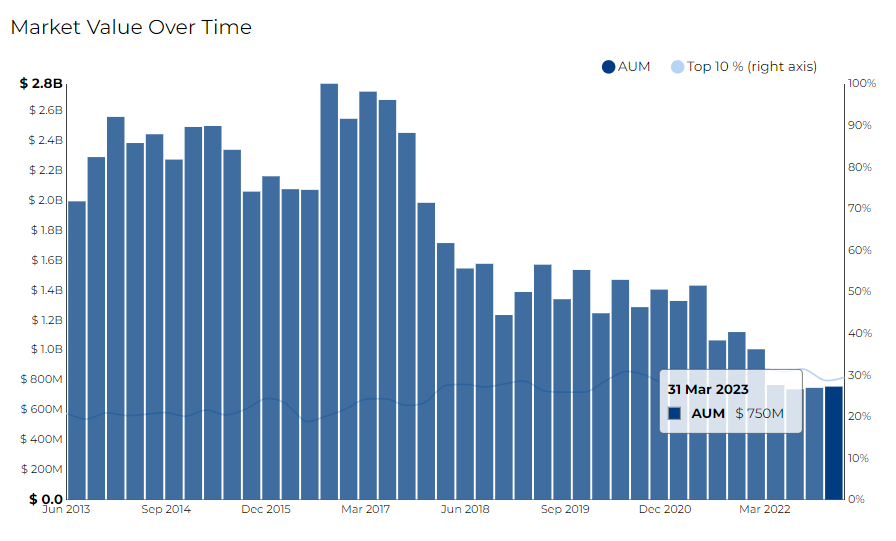

McKinley Capital Management LLC filed its most recent 13F on 25 Jul 2023, for the quarter ended 31 Mar 2023.

The firm disclosed $754.92 M in assets with a turnover of 23.12%.

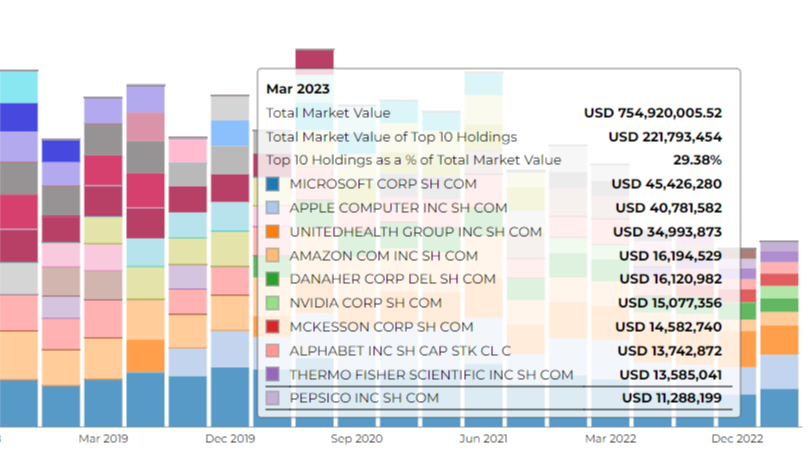

It holds 160 securities in its 13F portfolio, and the top 10 holdings account for 29.4% of the portfolio.

McKinley Capital Management LLC's top purchases include Microsoft Corp ($45.42M), Apple Inc ($40.78M), and Unitedhealth Group Inc ($34.99M).

Top Buys

McKinley Capital has significantly diversified its portfolio across various sectors.

In the tech sector, the firm took a new position in Meta Platforms Inc, buying 47.3K shares worth $10.03M.

- It increased its stake in Nvidia Corporation by 41.49%, now holding 54.3K shares valued at $15.08M.

- The firm also expanded its Tesla Inc stake by 64.39% to 38.3K shares, worth $7.94M, and boosted its Hims & Hers Health Inc stake by 87.13% to 709K shares, valued at $7.03M.

In finance, McKinley Capital invested in Blackstone Secured Lending Fund, acquiring 335.5K shares valued at $8.36M.

- The company also bought 172.8K shares of Oaktree Specialty Lending Co, worth $3.24M.

In the energy sector, bought 55K shares in Exxon Mobil Corp, valued at $6.03M.

In the beverages industry, the firm took a new position in Fomento Economico Mexicano S, buying 45.7K shares worth $4.35M.

Lastly, in the IT sector, the firm increased its stake in ServiceNow Inc by 233.19%, now holding 12.9K shares valued at about $5.98M.

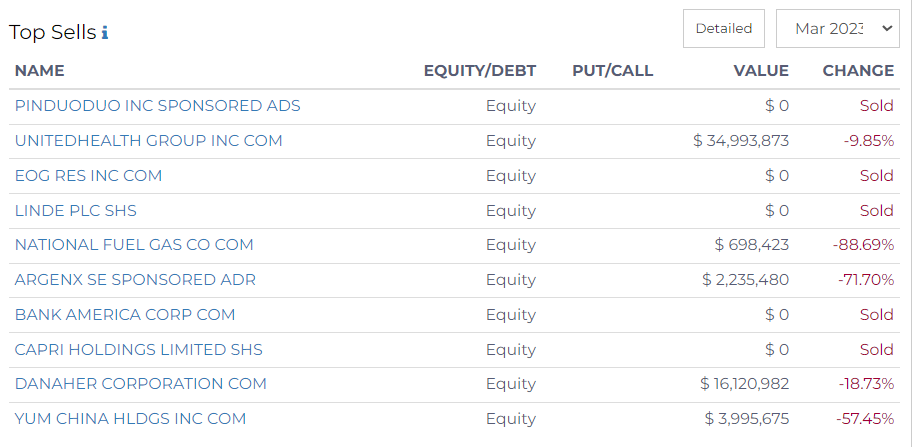

Top Sells

McKinley Capital has made substantial shifts in its investment portfolio, divesting from several companies across a range of sectors.

In the technology sector, McKinley Capital completely sold off its shares in Pinduoduo Inc, letting go of 127.3K shares previously valued at $10.38M.

- The firm also exited its investment in Yum China Holdings Inc, selling 85.8K shares, thereby reducing its holdings by 57.45% to 63.5K shares now valued at $3.99M.

Within the healthcare sector, McKinley Capital trimmed its stake in UnitedHealth Group Inc by 9.85%, now owning 74K shares worth $34.99M.

- It also significantly reduced its position in Argenx SE by 71.7%, now holding only 6K shares valued at $2.24M.

In the energy sector, McKinley Capital entirely exited its investment in EOG Resources Inc, selling all 50K shares previously worth $6.48M.

In the utilities sector, the firm reduced its stake in National Fuel Gas Co by 88.69%, now owning 12.1K shares with a total value of $698.4K.

In finance, the firm sold all its 170.6K shares in Bank of America Corp previously valued at $5.65M.

It also exited its investment in Capri Holdings Limited in the consumer discretionary sector, selling all 93.3K shares previously worth $5.35M.

Lastly, in the industrial sector, the company cut its position in Danaher Corporation by 18.73%, now owning 64K shares valued at $16.12M.