Adobe Systems Inc. is a software company offering various software and services to a wide array of clients, ranging from professionals and marketers to developers, enterprises, and consumers.

Its products facilitate the creation, management, delivery, measurement, and engagement with content across different operating systems, devices, and media.

Adobe markets its software directly to enterprises and end-users, as well as through a network of distributors, value-added resellers, systems integrators, and more.

The acquisitions of Ideacodes LLC and Neolane in 2013 broadened Adobe's offerings. As of May 31, 2023, Adobe's one-year annualized return stood at 0.31%, with an annualized volatility of 47.98%, and a maximum one-year drawdown of 32.90%.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Adobe Systems Inc, breaking down the 13F filings of its top buys and sells.

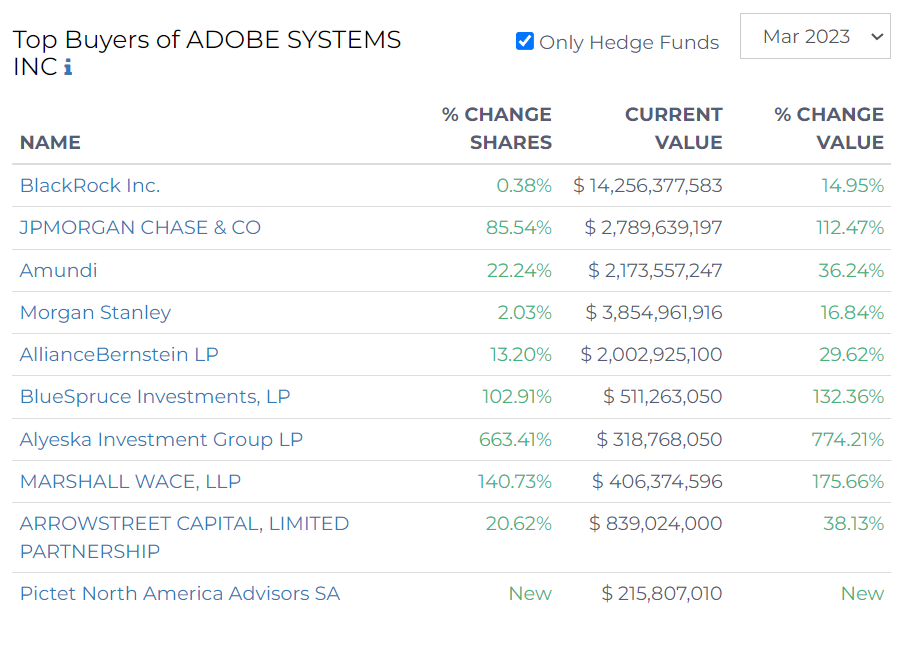

Top Buyers of Adobe

Leading asset management and investment companies have been shifting their holdings in Adobe Systems Inc., with significant changes noted across a number of firms. The data from March 2023 provides a detailed glimpse into these financial moves.

Asset management giant, BlackRock Inc., slightly increased its shares by 0.38%, raising the value of their Adobe stake to $14.26 billion, marking a growth of 14.95%.

JPMorgan Chase & Co saw a significant rise in their Adobe holdings, with an 85.54% surge in shares, pushing the current value to $2.79 billion. This indicates a 112.47% uptick in the value of their holdings.

French asset management company, Amundi, also adjusted its holdings, raising its shares by 22.24%. The firm's current investment in Adobe is now worth $2.17 billion, a 36.24% increase in value.

Morgan Stanley demonstrated a more conservative increase, raising its shares by 2.03%. Despite the marginal rise, the value of their holdings has seen a 16.84% growth, taking the current value to $3.85 billion.

- Meanwhile, AllianceBernstein LP expanded its stake by 13.2%, increasing the value to $2 billion, a 29.62% growth.

- Chicago-based BlueSpruce Investments LP more than doubled its shares by 102.91%, with the current value of its stake skyrocketing by 132.36% to $511 million.

- Alyeska Investment Group LP upped its shares by 663.41%, bringing the value to $318.77 million, a 774.21% increase in value.

- Marshall Wace LLP also had a notable surge in their holdings, increasing their shares by 140.73%. Their current Adobe investment now stands at $406.37 million, a growth of 175.66%.

- Boston-based Arrowstreet Capital Limited Partnership enhanced its holdings by 20.62%, translating to a 38.13% increase in the value of its stake, which is now valued at $839.02 million.

Lastly, Swiss firm Pictet North America Advisors SA made a new entry into the Adobe investment scene, with an initial Adobe stake valued at $215.81 million.

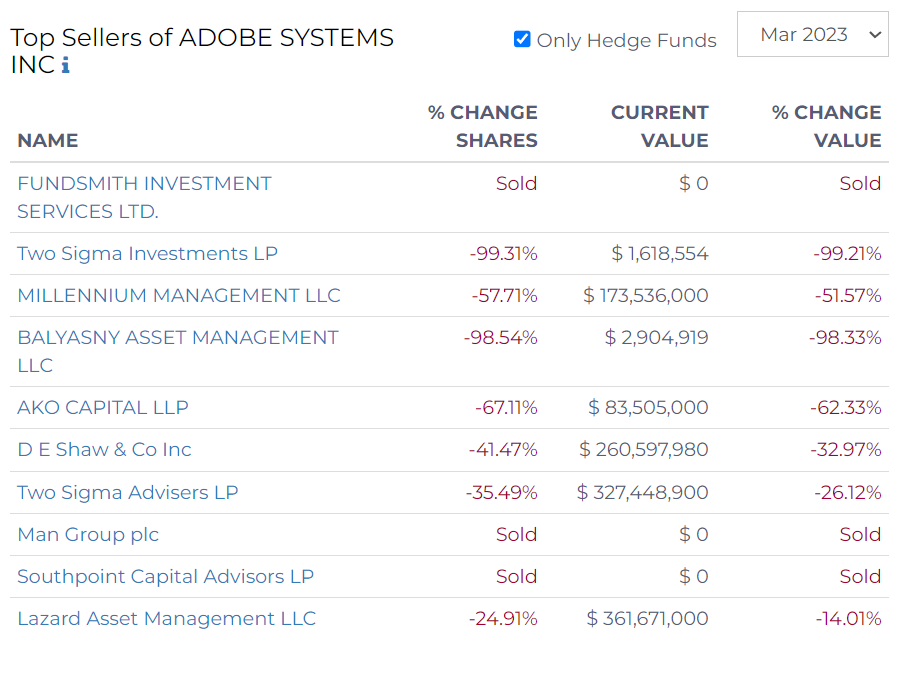

Top Sellers of Adobe Systems

Adobe Systems Inc has seen significant changes among its top hedge fund shareholders in March 2023.

Fundsmith Investment Services Ltd and Southpoint Capital Advisors LP have completely exited their positions in Adobe, selling off all their shares in the company.

Two Sigma Investments LP reduced its holdings dramatically by 99.31%, leaving the firm with a remaining investment of $1.62 million in Adobe. The value of their investment similarly saw a sharp decrease of 99.21%.

Millennium Management LLC trimmed its position in Adobe by 57.71%, leaving them with a $173.54 million worth of shares. Their investment value has decreased by 51.57%.

Balyasny Asset Management LLC slashed its stake in Adobe by 98.54%, ending up with $2.90 million worth of shares. Its investment value dipped 98.33%.

AKO Capital LLP, another prominent hedge fund, reduced its position by 67.11%, leaving it with an investment of $83.51 million, which represents a decrease in value of 62.33%.

D E Shaw & Co Inc scaled back its Adobe position by 41.47%, with a remaining holding worth $260.60 million. This represents a value decline of 32.97%.

Two Sigma Advisers LP, despite trimming its position by 35.49% to $327.45 million, witnessed a lesser decrease in the investment value by 26.12%.

Lastly, Lazard Asset Management LLC reduced its stake by 24.91% leaving a significant $361.67 million investment in Adobe. This move corresponds to a value drop of 14.01%.