Home Depot, Inc., a leading player in the Consumer Cyclical sector, operates full-service warehouse-style home improvement retail stores. These stores offer an array of building materials, home improvement items, and lawn and garden products, along with various services. The average store provides approximately 104,000 square feet of enclosed space and an additional 24,000 square feet for the outside garden area.

The company caters to three main customer groups: do-it-yourself (DIY), do-it-for-me (DIFM), and professional customers. As of February 3, 2013, it operates 2,256 stores across the U.S., Puerto Rico, U.S. Virgin Islands, Guam, Canada, and Mexico. In February 2013, the company expanded its operations by acquiring Measurecomp LLC and HD Components LLC. The company employs approximately 413,000 people.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Home Depot, Inc., breaking down the 13F filings of its top buyers and sellers.

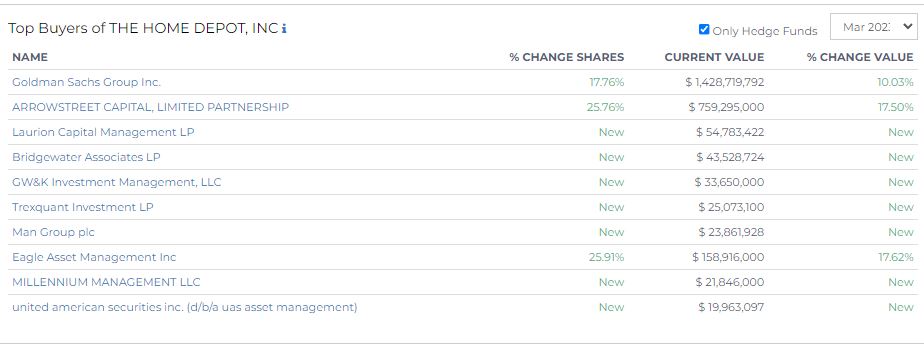

Top Buyers of Home Depot, Inc.

Several hedge funds increased their stakes in The Home Depot, Inc., a leading home improvement retailer, in March 2023, according to recent data.

Leading the pack, Goldman Sachs Group Inc. raised its stake by 17.76%, bringing its current value to $1.43 billion, a 10.03% increase in value.

Arrowstreet Capital, Limited Partnership also displayed notable interest in the retail giant. The fund increased its stake by 25.76%, translating to a current value of $759.3 million. This marks a 17.50% uptick in value.

The third-largest investment came from Laurion Capital Management LP, a new entrant in the shareholders list, which started a position in Home Depot with a value of $54.78 million.

Similarly, Bridgewater Associates LP, another new player, initiated a stake worth $43.53 million.

New positions were also started by GW&K Investment Management, LLC ($33.65 million), Trexquant Investment LP ($25.07 million), Man Group plc ($23.86 million), and Millennium Management LLC ($21.85 million).

Eagle Asset Management Inc also bolstered its holdings in Home Depot, increasing its stake by 25.91% to a current value of $158.9 million, a 17.62% increase in value.

Lastly, United American Securities Inc., also known as UAS Asset Management, newly acquired shares in Home Depot, with the current value of their investment standing at $19.96 million.

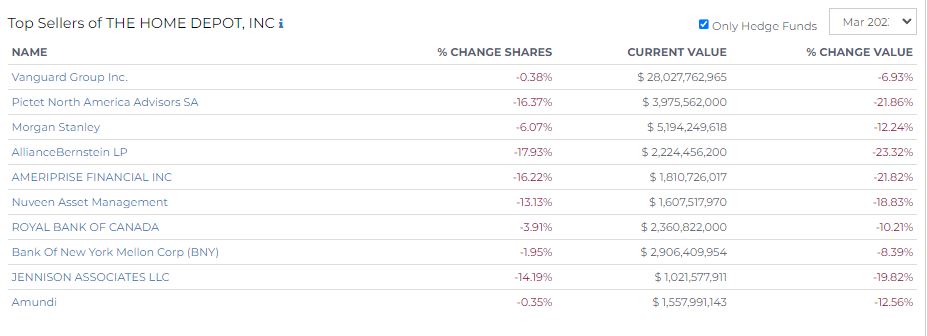

Top Sellers of Home Depot, Inc.

Vanguard Group Inc., one of the world's largest investment management companies, slightly reduced its stake by 0.38%, corresponding to a decrease in the current value of its holdings by 6.93%, down to $28.03 billion. Despite this reduction, Vanguard maintains a substantial position in Home Depot.

Pictet North America Advisors SA, another significant holder, lowered its stake by 16.37%, leading to a 21.86% decrease in the current value of its holdings to $3.98 billion.

Morgan Stanley also trimmed its holdings by 6.07%, resulting in a 12.24% decrease in the current value of its stake, which now stands at $5.19 billion.

AllianceBernstein LP and Ameriprise Financial Inc. both decreased their stakes notably, by 17.93% and 16.22%, respectively, leading to a decline in their current value of holdings by 23.32% (down to $2.22 billion) and 21.82% (down to $1.81 billion), respectively.

Other notable decreases in holdings were executed by Nuveen Asset Management (down 13.13% to $1.61 billion), Royal Bank of Canada (down 3.91% to $2.36 billion), Bank Of New York Mellon Corp (down 1.95% to $2.91 billion), and Jennison Associates LLC (down 14.19% to $1.02 billion).

Amundi slightly trimmed its stake by 0.35%, leading to a 12.56% decrease in the current value of its holdings, now at $1.56 billion.