Latest 13F Review: Atika Capital Management's Top Buys and Sells.

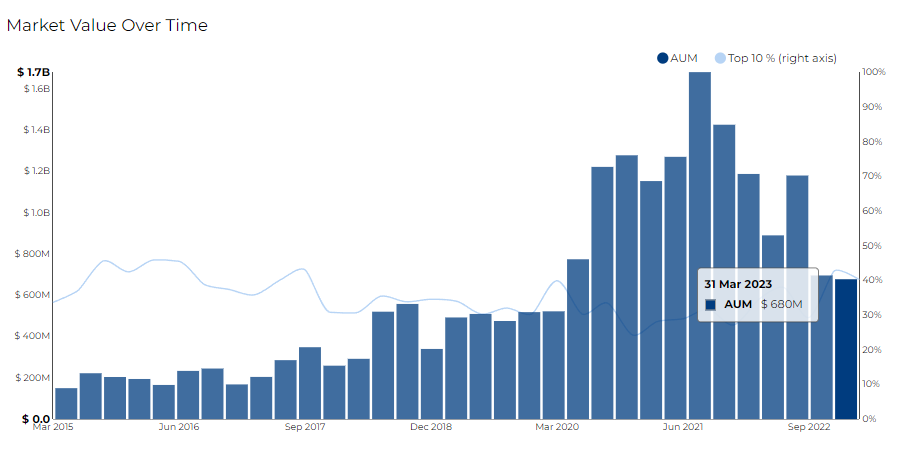

Atika Capital Management LLC filed its most recent 13F on 12 May 2023, for the quarter ended 31 Mar 2023.

Based on data and analytics gathered on Radient, let's delve into Atika Capital Management's significant key highlights, equity purchases, and sales for March 2023, as documented in their recent 13F filing.

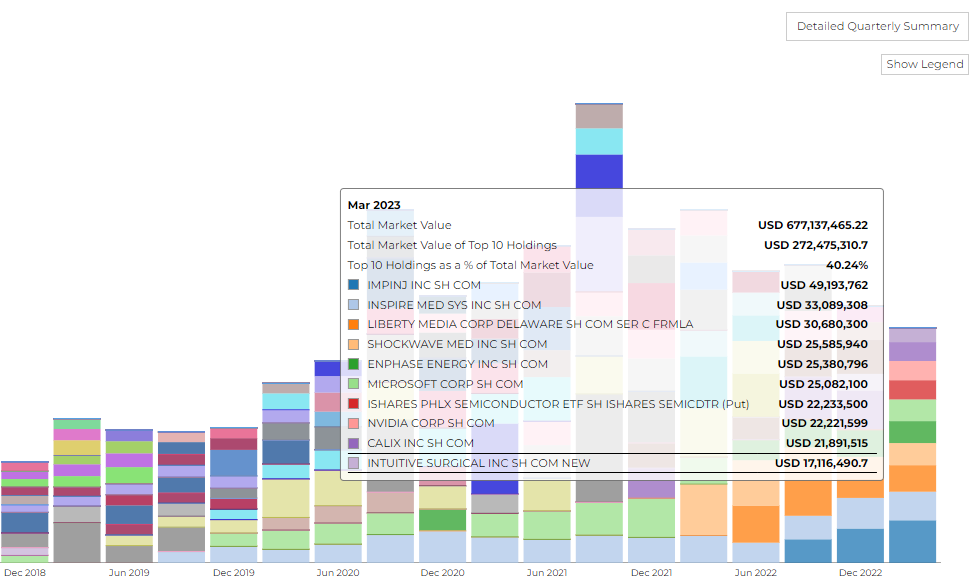

Atika Capital Management is an investment adviser based in New York, founded in February 2013 by Bradley Farber. The firm's market value stood at $677.14 M with a turnover rate of 67.53% and holds 77 securities in its 13F portfolio.

The top 10 holdings account for 40.2% of the firm's portfolio. Among the top 3 are Impinj Inc SH COM, valued at $49.19 million, Inspire Med Sys Inc SH COM valued at $33.08 million, and Liberty Media Corp Delaware SH Com Ser C FRMLA valued at $30.68 million.

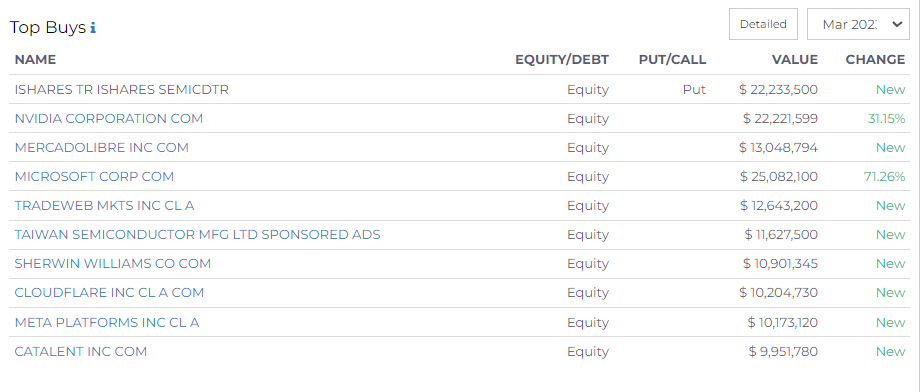

Atika Capital Management made a series of top equity purchases that underline the firm's focus on the tech and semiconductor sectors.

- Taiwan Semiconductor Mfg Ltd Sponsored ADS to their portfolio with a new equity investment of $11.63 million.

- An allocation of $10.90 million was made for Sherwin Williams Co, marking its inclusion in the portfolio.

- Cloudflare Inc was also added to their investments with a fresh equity input of $10.20 million.

- Meta Platforms Inc became a part of the portfolio with an initial equity investment of $10.17 million.

- Catalent Inc received a new equity investment of $9.95 million.

Top Sells of Atika Capital Management:

A series of significant reductions and complete sell-offs in several equity holdings have been made by the firm.

Atika Capital decreased its stake in Clearfield Inc by 89%, with the value dropping to $2.12 million. Similarly, the firm slashed its holding in Calix Inc by 37.75%, reducing the value to $21.89 million.

T-Mobile US Inc, United Therapeutics Corp, Select Sector SPDR TR SBI INT-INDS, Commscope Hldg Co Inc, and Mastercard Incorporated Class A have all been entirely liquidated from Atika Capital's portfolio, marking a complete sell-off in these equities.

Other notable sales include:

- Jazz Pharmaceuticals PLC, the company's stake plummeted by 70.36%, leaving the value at $3.88 million.

- Acadia Healthcare Company also faced a sizeable cut of 38.75% in its holding, bringing the investment value down to $10.04 million.

- Lastly, Axsome Therapeutics Inc experienced a 31.58% decline in Atika Capital's stake, with the current value standing at $9.56 million.