Kopernik Global Investors: A Deep Dive into their Latest 13F Filing.

Kopernik Global Investors, LLC recently made its 13F filing public on May 12, 2023, providing insights into its investment portfolio for the first quarter of 2023.

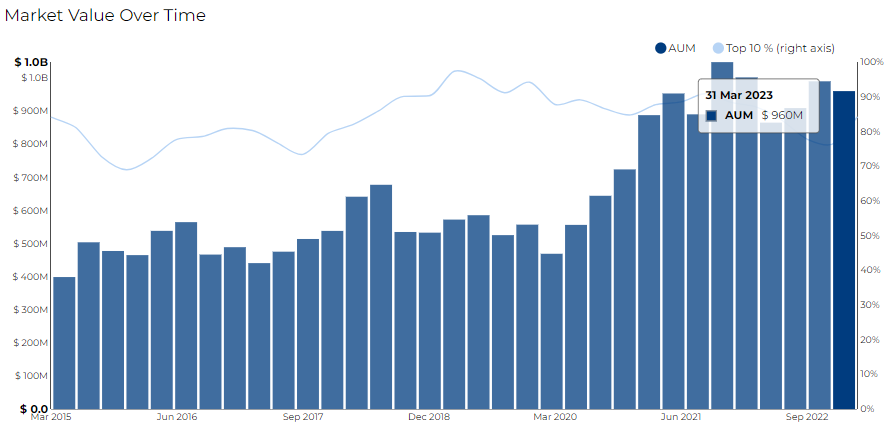

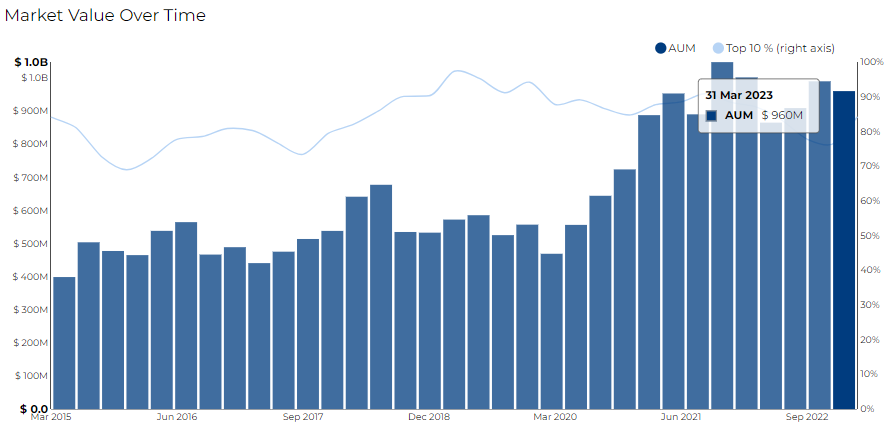

The firm disclosed $961.18 million in assets, spread across 33 different securities. The firm's 13F market value as of March 2023 stood at $961.18 million with a turnover of 24%.

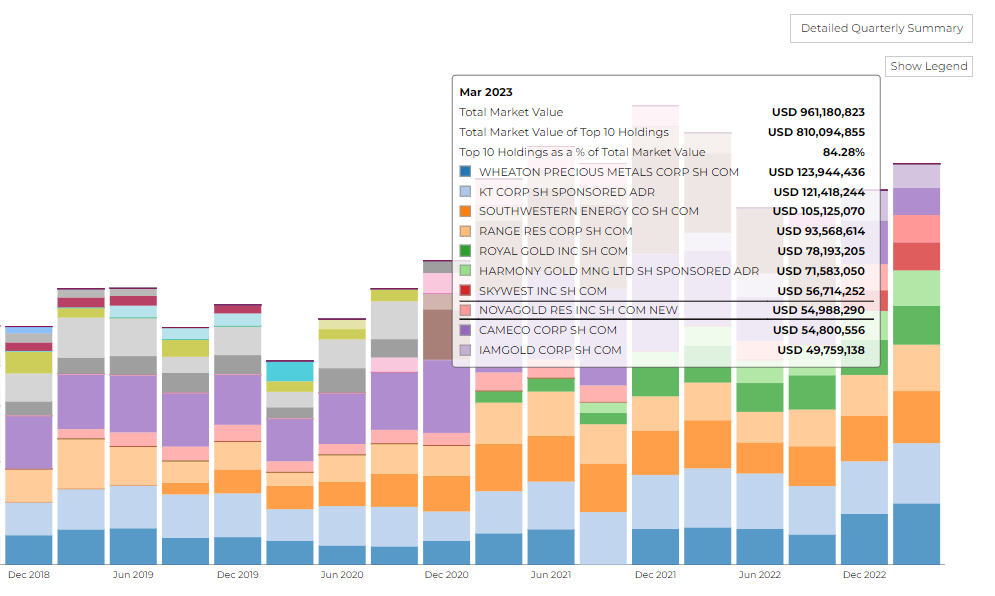

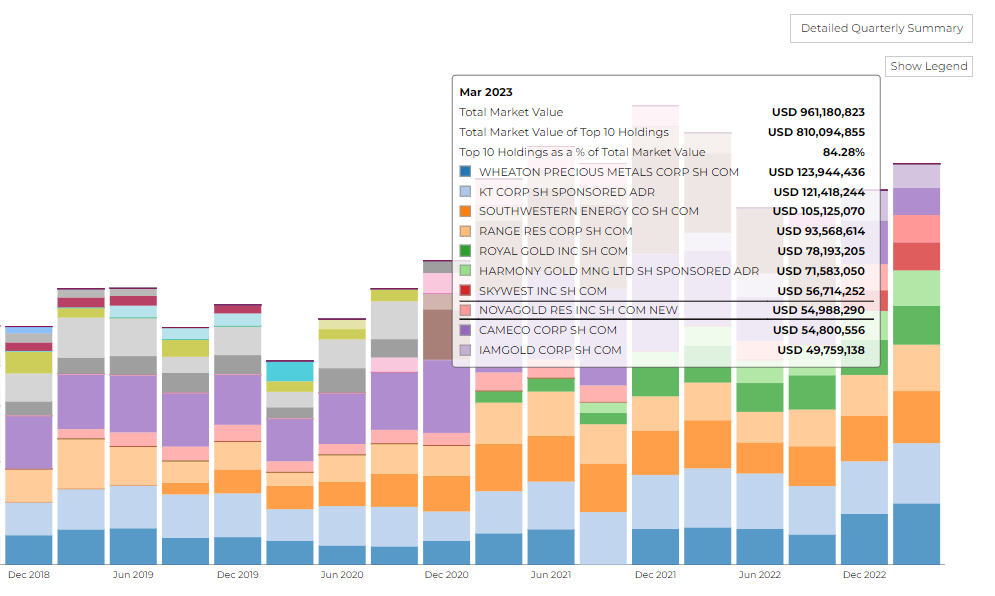

Interestingly, their top 10 holdings account for 84.3% of the entire portfolio. The top 3 holdings were Wheaton Precious Metals Corp SH COM valued at $123.94 million, KT Corp SH Sponsored ADR valued at $121.41 million, and Southwestern Energy Co SH COM valued at $105.12 million.

This blog post explores some of the critical moves made by Kopernik over the previous quarter, focusing on their prominent purchases and sales.

The firm disclosed $961.18 million in assets, spread across 33 different securities. The firm's 13F market value as of March 2023 stood at $961.18 million with a turnover of 24%.

Interestingly, their top 10 holdings account for 84.3% of the entire portfolio. The top 3 holdings were Wheaton Precious Metals Corp SH COM valued at $123.94 million, KT Corp SH Sponsored ADR valued at $121.41 million, and Southwestern Energy Co SH COM valued at $105.12 million.

This blog post explores some of the critical moves made by Kopernik over the previous quarter, focusing on their prominent purchases and sales.

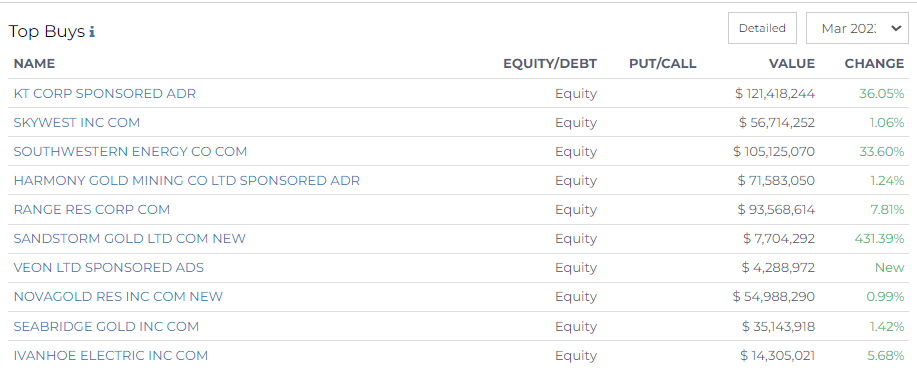

Kopernik's Top Buys

The top buy for Kopernik was KT Corp Sponsored ADR, a leading South Korean telecommunications company. This purchase amounted to $121.4 million, representing a 36.05% change.

It was followed by Skywest Inc COM, a North American regional airline, with a 1.06% change in equity amounting to $56.7 million. Another significant purchase was Southwestern Energy Co COM, with a 33.60% change and an investment sum of $105.1 million.

It was followed by Skywest Inc COM, a North American regional airline, with a 1.06% change in equity amounting to $56.7 million. Another significant purchase was Southwestern Energy Co COM, with a 33.60% change and an investment sum of $105.1 million.

Further down the line, is Harmony Gold Mining Co Ltd Sponsored ADR, with a 1.24% change and an investment total of $71.5 million. Lastly, Range Resources Corp COM saw a 7.81% change, with an investment amount of $93.5 million.

These purchases, among others, reflect a keen interest in the mining and energy sectors.

These purchases, among others, reflect a keen interest in the mining and energy sectors.

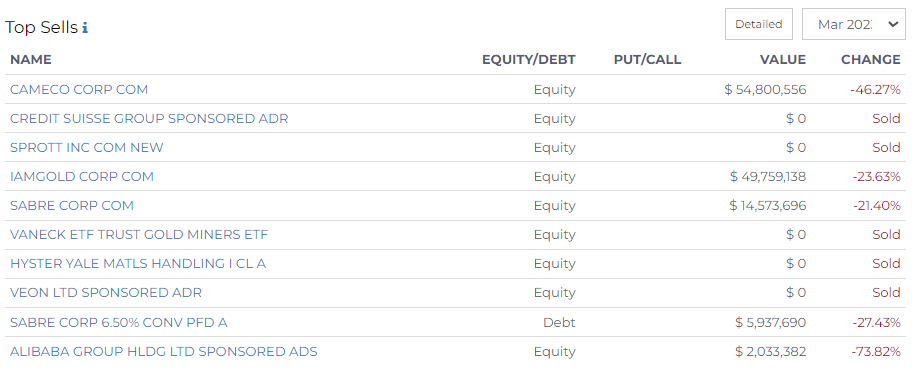

Kopernik's Top Sells

On the other hand, Kopernik Global Investors also made several notable sales during this quarter. They reduced their stake in Cameco Corp COM by 46.27%, resulting in a remaining equity of $54.8 million.

This was followed by the complete sale of their holdings in Credit Suisse Group Sponsored ADR and Sprott Inc COM New, both of which now stand at zero.

Other significant sales include IAMGold Corp COM, where they reduced their stake by 23.63%, leaving them with $49.7 million. Sabre Corp COM also experienced a reduction of 21.40%, with the remaining equity standing at $14.5 million.

Explore more insights on the latest 13F filings via Radient.

Explore more insights on the latest 13F filings via Radient.