Kaydan Wealth Management, Inc. filed its most recent 13F on 10 Apr 2023, for the quarter ended 31 Mar 2023.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at Kaydan Wealth Management, Inc. for Q1 2023, as reported in their most recent 13F filing.

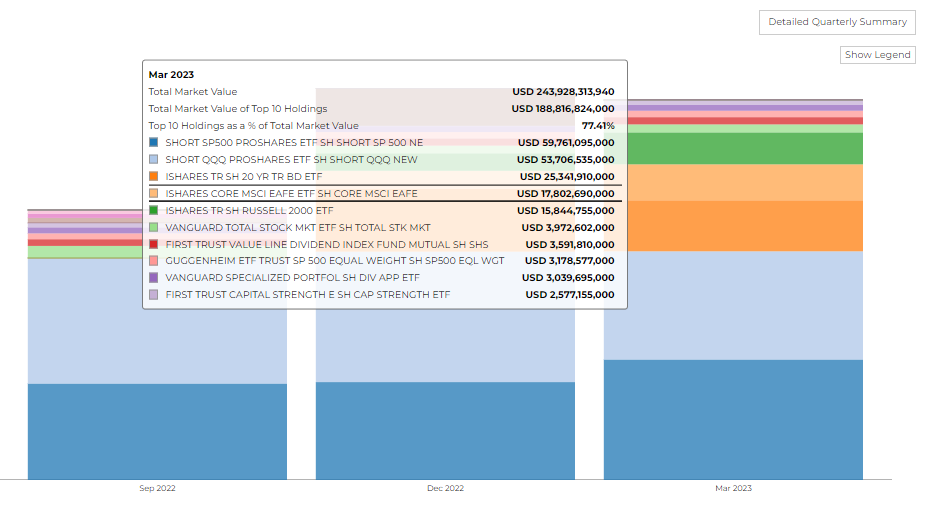

The firm disclosed 243.93 B in assets. It holds 88 securities in its 13F portfolio, and the top 10 holdings account for 77.4% of the portfolio.

Kaydan Wealth Management, Inc.'s top holdings include Proshares Tr, Ishares Tr, and Vanguard Total Stock MKT.

Top Buys by Kaydan Wealth Management

Based on recent transactions, Kaydan Wealth Management has made strategic purchases across various sectors. Here's a breakdown of the top buys made by the wealth management firm, categorized by sector:

In the Financial Sector:

- Proshares TR Short SP 500 NE has experienced an increase in shares by 31.46%, now holding 3.98M shares with a current value of $59.76 billion.

- iShares TR Core MSCI EAFE has witnessed an increase in shares by 83.63%, now possessing 266.3K shares, worth $17.8 billion in the current market.

- Invesco Exch Trd Slf Indx Fd Bulshs 2027 CB, a new addition to the portfolio, currently holds 10.79K shares with a total value of $208.33 million.

- Vanguard Index Fds Growth ETF has experienced an increase in shares by 5.07%, with current holdings of 4.33K shares valued at $1.08 billion.

- iShares TR Core SP MCP ETF has seen an increase in shares by 6.59%, now possessing 7.8K shares that are worth $1.95 billion.

In the Information Technology Sector:

- TriNet Group Inc has been newly acquired, currently holding 4.28K shares valued at $345.09 million.

In the Consumer Discretionary Sector:

- Disney Walt Co is a new addition to the portfolio, holding 2.37K shares with a current market value of $238.01 million.

In the Industrials Sector:

- Raytheon Technologies Corp is a new acquisition, currently holding 2.36K shares valued at $231.51 million.

In the Communication Services Sector:

- Comcast Corp New Cl A has seen a substantial increase in shares by 36.81%, now holding 8.36K shares with a total value of $316.99 million.

Top Sells by Kayden Wealth Management

Here is a breakdown of the top sells made by the wealth management firm, categorized by sector:

In the Financial sector, Kaydan Wealth Management has reduced its holdings in several entities.

- The firm decreased its shares in First TR Lrg CP VL AlphaDEX by 97.75% to 6.42K, resulting in a current value of $426.53M.

- It also scaled back on iShares TR U S Equity Factr, with a 60.24% decrease to 17.63K shares, now worth $730.5M. A reduction of 14.42% was seen in First TR Mid Cap Core Alphad, lowering the shares to 16.75K and the value to $1.51B.

- Similarly, shares in First TR Lrge CP Core Alpha were decreased by 8.81% to 14.83K, resulting in a current value of $1.19B.

- A minor decrease was also seen in Vanguard Specialized Funds Div App ETF, where shares decreased by 3.75% to 19.73K with a current value of $3.04B.

The Healthcare sector also experienced sell-offs.

- Kaydan divested completely from Cigna Corp.

- Pfizer Inc saw a minor decrease of 1.58% to 17.59K shares, now valued at $717.82M.

- Additionally, shares in UnitedHealth Group Inc were reduced by 4.22% to 954, giving a current value of $450.85M.

- Lastly, there was an 8.13% reduction in Abbott Labs to 2.23K shares, now worth $225.36M.

In the Consumer Discretionary sector, Kaydan decreased its holdings in Home Depot Inc by 8.95% to 1.36K shares, bringing the current value to $402.25M.

-png.png)

-png.png)

-png.png)