Hillhouse Investment Management, a Singapore-based investment firm started with backing from Yale University’s endowment, is preparing to pitch a new Asia-focused private credit fund to international investors as the asset class continues to grow in the region.

Fund Size: Estimated to be between $900M and $1.1B (Source: Bloomberg)

The new fund will focus on so-called performing credit investments in well-established companies posting profit before interest, taxes, depreciation and amortization. The average size of its investments will be between $50 million and $75 million. (Source: Bloomberg)

Recent Form ADV Insights on Hillhouse Investment Management:

- Total Regulatory Assets Under Management (Reg AUM): $62B

- Client Type Managed: The firm manages capital on behalf of global institutions such as non-profit foundations and pensions.

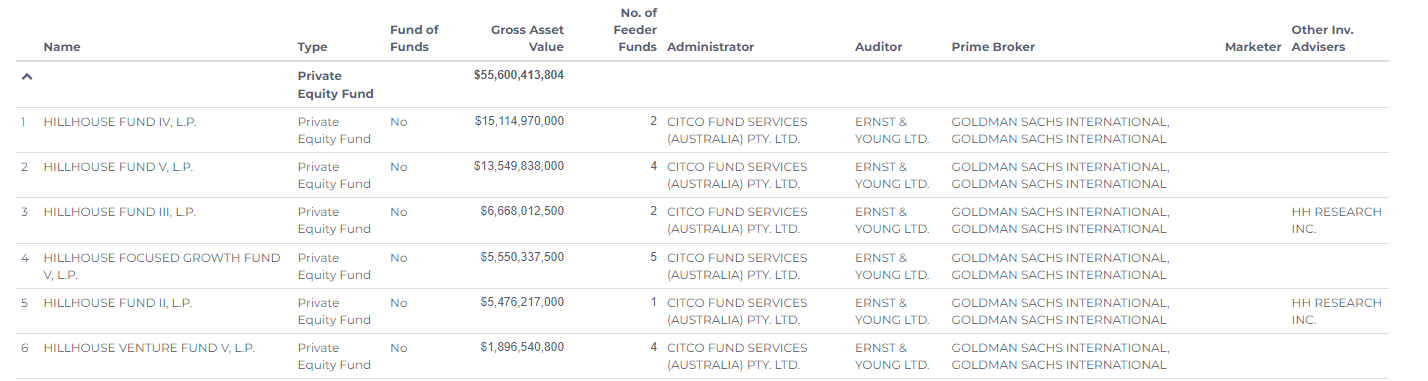

- 17 Private Equity Funds with a total Gross Asset Value of $55.6B

- Current Auditor for all the funds: EY

- Current Administrator for all the funds: Citco Services

- Hillhouse also discloses: HH Research Inc as the other investment advisor to its funds -Hillhouse Fund III, LP ($6.6B) and Hillhouse Fund II, LP ($5.4B)

Historical Form ADV Data Insights from Radient:

- The firm removed 2 of its direct owners in 2023

- The firm also removed the previous custodians for 10 of its private funds and disclosed CITCO Services as the new custodian in 2023

- The firm's Hillhouse Healthcare Fund added Goldman Sachs as its prime broker in 2023

To view more such filings and compare historical Form ADV data, visit Radient.

To know more, write to us at support@radientanalytics.com