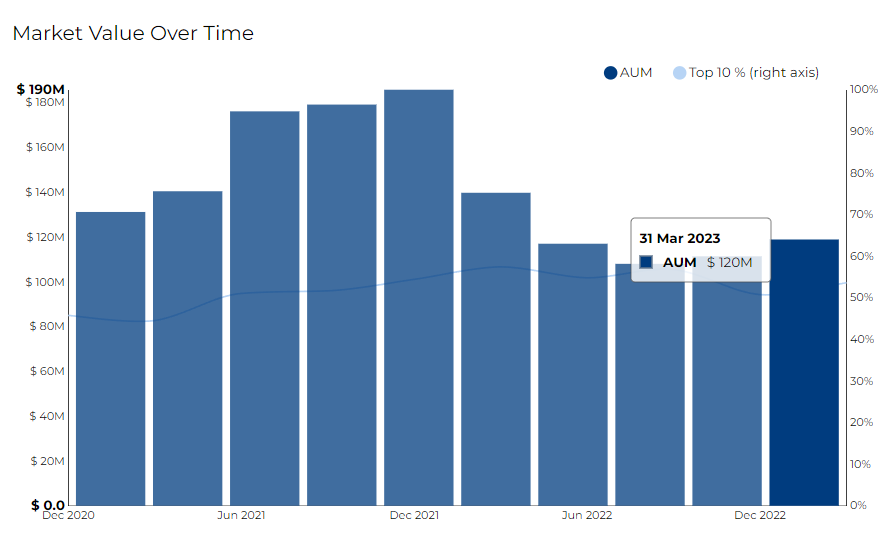

EMC Capital Management filed its most recent 13F on 22 May 2023, for the quarter ended 31 Mar 2023.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Advance Capital Management, Inc breaking down the 13F filings of its top buys and sells.

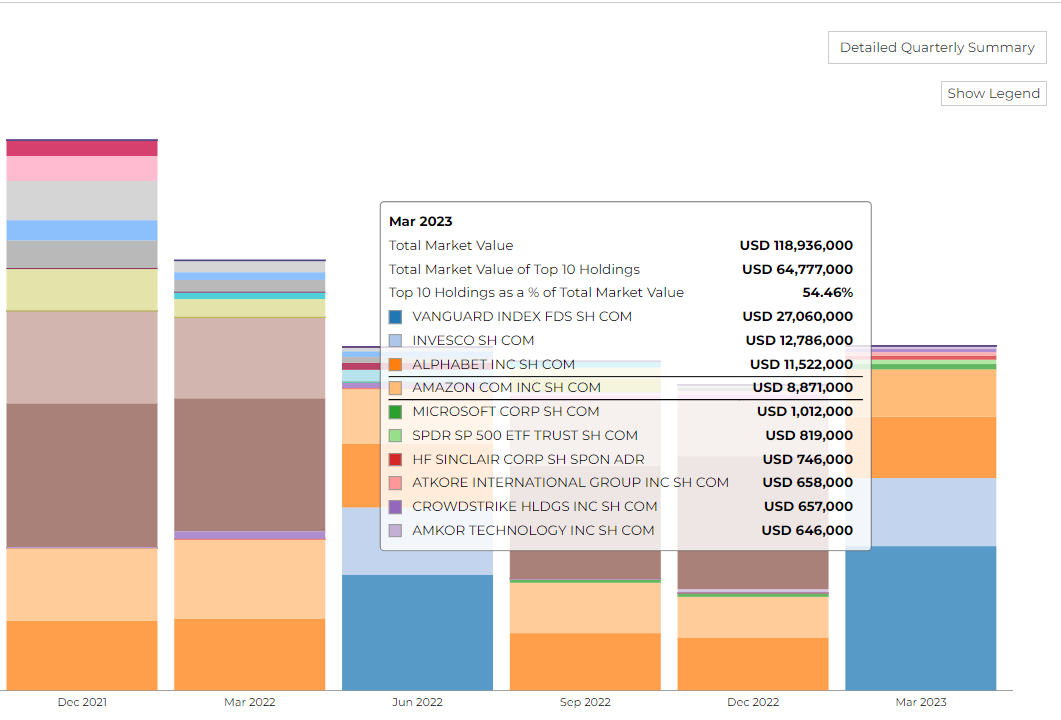

The firm disclosed 118.94 M in assets. It holds 292 securities in its 13F portfolio, and the top 10 holdings account for 53.6% of the portfolio.

EMC Capital Management's top holdings include Vanguard Sp 500, Invesco Qqq Trus, Alphabet Inc-C, Amazon.Com Inc, Vanguard Grw Etf.

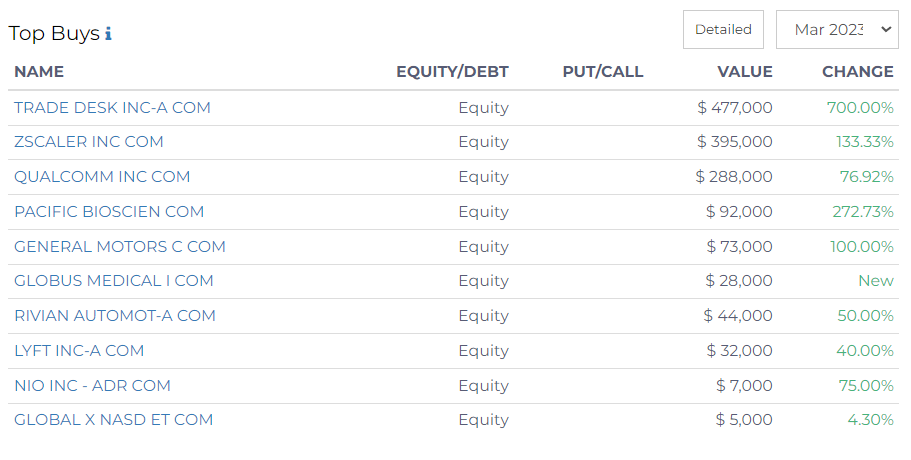

Top Buys made by EMC Capital

EMC Capital Management made significant additions to its portfolio, acquiring shares across various sectors, with a particular focus on the equity market.

In the technology sector, EMC Capital significantly ramped up its investment.

- The firm purchased 8,000 shares in the digital advertising technology company, Trade Desk Inc., marking a significant 700% increase from their previous holding. The investment is now valued at $477,000, up from the earlier $45,000.

- EMC also bolstered its investment in Zscaler Inc., a cloud-based information security company, acquiring an additional 2,000 shares, a 133.33% increase, resulting in a $395,000 stake.

The communications sector also saw EMC Capital's interest.

- Qualcomm Inc., the wireless technology company, now counts EMC Capital as an owner of 2,300 of its shares, up by 76.92%, and valued at $288,000.

In the healthcare industry, the firm took on 500 shares of Globus Medical Inc., valued at $28,000, marking their first investment in the company.

- They also slightly increased their stake in pharmaceutical giant Pfizer Inc., now holding 1,071 shares, up by 1.04%.

EMC Capital also showed interest in the automotive and transport sectors.

- They added 2,000 shares of General Motors, doubling their previous stake to a current value of $73,000.

- The firm's stake in electric vehicle maker Rivian Automotive also rose by 50%, with 3,000 shares now valued at $44,000.

- In addition, EMC increased its investment in ride-hailing service Lyft Inc. by 40%, bringing its total shares to 3,500, valued at $32,000.

In the consumer sector, EMC Capital expanded its stake in Pacific Biosciences by 272.73%, now holding 8,200 shares valued at $92,000.

- It also increased its shares in NIO Inc., the Chinese automobile manufacturer, by 75%, with the current stake valued at $7,000.

Finally, in the financial sector, EMC modestly increased its stake in Global X NASD ET by 4.3%, holding 291 shares valued at $5,000.

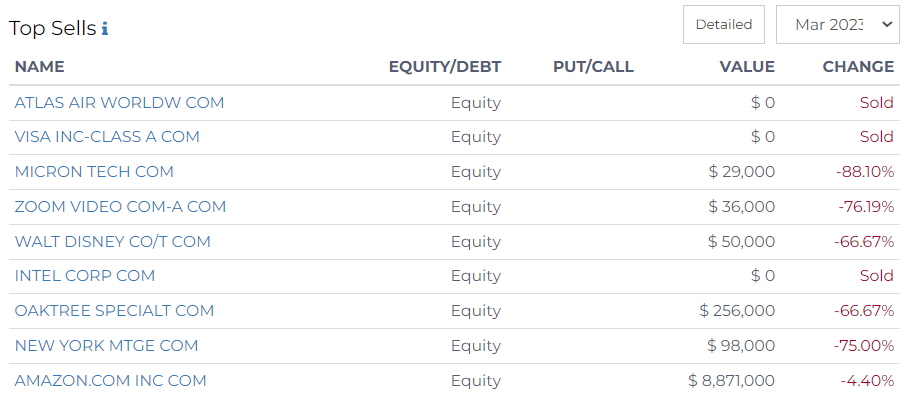

Top Sells made by EMC Capital

In a recent investment shift, EMC Capital Management trimmed holdings across various sectors in its portfolio.

In the technology sector, the firm fully exited its position in Visa Inc., selling all 1,000 shares previously valued at $208,000.

- EMC Capital also substantially reduced its stake in Micron Technology by 88.1%, selling off 3,700 shares. The current stake now stands at 500 shares, valued at $29,000.

- Similarly, the firm sold 1,600 shares of Zoom Video Communications, a 76.19% decrease, leaving them with 500 shares worth $36,000.

- They also entirely divested from Intel Corp, selling all 2,500 shares, previously valued at $66,000.

- EMC Capital Management slightly decreased their Amazon shares by 4.4% from about 91k to 87k. Despite this, the value of EMC's stake in Amazon increased from $7.6m to $8.9m due to Amazon's share price increase.

In the transportation sector, the company fully divested from Atlas Air Worldwide, selling all 4,503 shares previously worth $454,000.

In the entertainment sector, EMC Capital decreased its stake in Walt Disney Co. by 66.67%, selling 1,000 shares. The firm now holds 500 shares valued at $50,000.

In the financial sector, EMC Capital decreased its stake in Oaktree Specialty Lending Corp by 66.67%, selling off 27,298 shares. The current stake now stands at 13,648 shares, valued at $256,000.