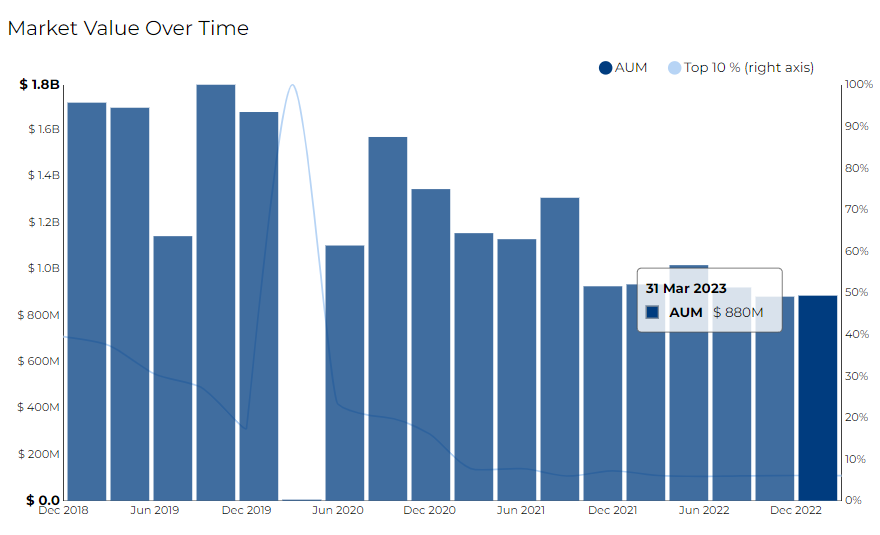

DUALITY ADVISERS, LP filed its most recent 13F on 27 Jun 2023, for the quarter ended 31 Mar 2023.

Drawing on the data and insights gathered via Radient, the focus now turns to significant highlights, equity transactions, and sales at DUALITY ADVISERS, LP. for Q1 2023, as reported in their most recent 13F filing.

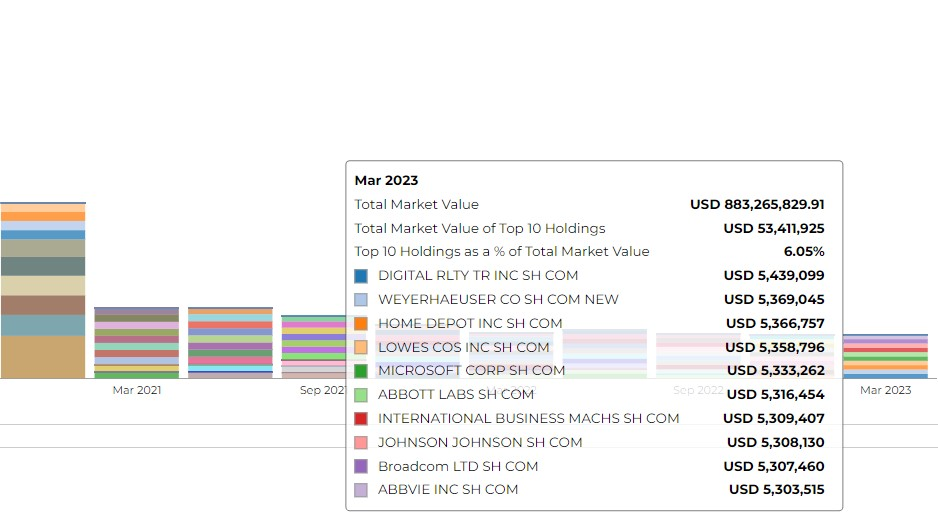

The firm disclosed 883.27 M in assets. It holds 528 securities in its 13F portfolio, and the top 10 holdings account for 6.0% of the portfolio.

DUALITY ADVISERS, LP's top purchases include Digital Rlty Tr Inc ($5.4M), Weyerhaeuser Co Mtn Be ($5.3B), and Home Depot Inc ($5.3B).

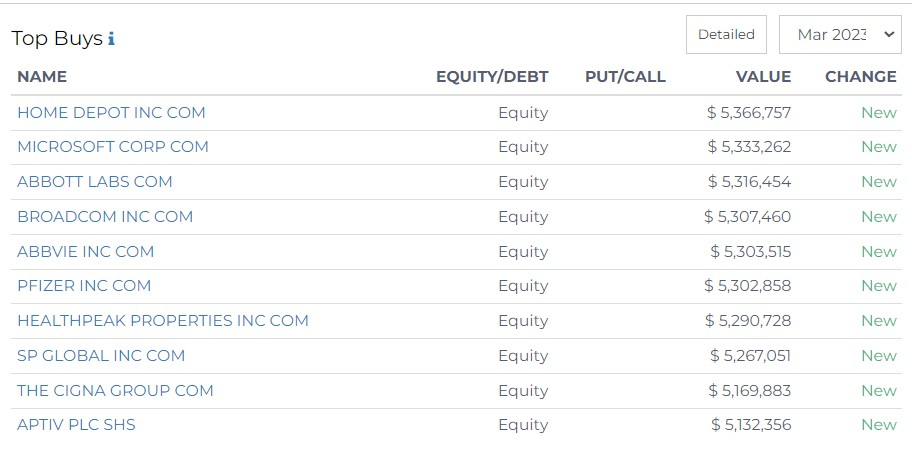

Duality Advisers' Recent Investment Increases Across Various Sectors

Investment firm Duality recently made significant purchases in a number of sectors, with each investment exceeding $5M in value. These investments were spread across the Home & Construction, Technology, Healthcare & Pharmaceuticals, and Financial Services sectors.

Home & Construction

Duality newly secured 18.2k shares in the home improvement retail giant, Home Depot Inc. The current value of the investment stands at $5.37M.

Technology

In the Technology sector, Duality acquired a substantial 18.5k shares in Microsoft Corp. This is a new stake and the investment is valued at $5.33M.

- Duality also bought 8.27k shares in Broadcom Inc, representing another new stake. This investment is valued at $5.31M.

Healthcare & Pharmaceuticals

Venturing significantly into the Healthcare and Pharmaceuticals sector, Duality purchased 52.5k shares in Abbott Labs. This is a new stake with a current value of $5.32M.

- Duality acquired 33.3k shares in AbbVie Inc. This new stake is valued at $5.3M.

- Investing heavily in Pfizer Inc, Duality bought 130k shares. The current value of this new stake is $5.3M.

- The firm also secured 240.8k shares in Healthpeak Properties Inc. This investment, another new stake, is currently valued at $5.29M.

- Finally, Duality bought 20.2k shares in The Cigna Group. This new stake is valued at $5.17M.

Financial Services

In the Financial Services sector, Duality increased its portfolio with a 15.3k share investment in SP Global Inc. The current value of this new stake is $5.27M.

- Additionally, Duality added 45.7k shares of Aptiv PLC to its portfolio. This new stake is currently valued at $5.13M.

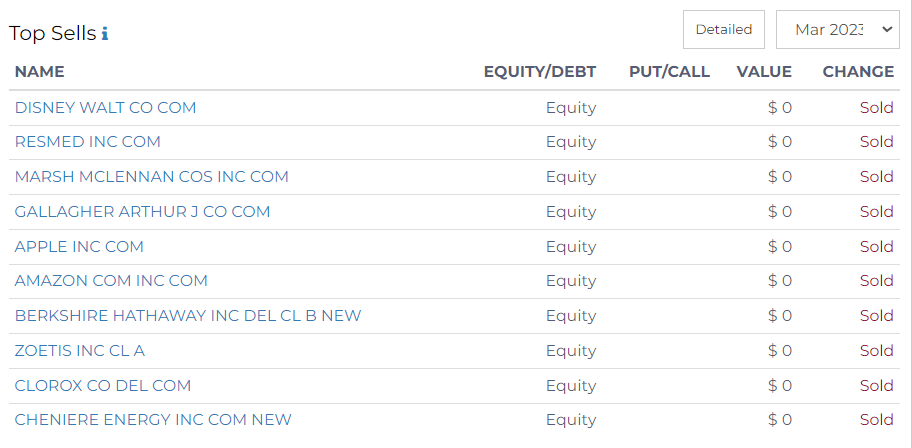

Duality's Recent Divestments

Investment firm Duality recently divested from several significant positions across various sectors. The divestments occurred in the Entertainment, Healthcare, Financial Services, Technology, Retail, Insurance, Animal Health, Consumer Goods, and Energy sectors.

Entertainment

Duality completely divested its stake in Disney Walt Co.

- The firm previously owned 62k shares valued at $5.39M, but these shares have now been fully sold off.

Healthcare

The firm also fully sold its holdings in ResMed Inc.

- Duality previously owned 25.8k shares in this company, which were valued at $5.36M.

Financial Services

In the financial services sector, Duality completely divested from Marsh McLennan Cos Inc, previously owning 32.1k shares valued at $5.32M.

- The company also completely divested from Gallagher Arthur J Co, where it previously owned 28.2k shares valued at $5.31M.

Technology

Duality sold all its shares in the tech firms, Apple Inc and Amazon Com Inc.

- The firm previously owned 40.4k shares in Apple Inc, valued at $5.25M, and 62.5k shares in Amazon Com Inc, valued at $5.25M.

Insurance

The firm completely divested its holdings in Berkshire Hathaway Inc Del. Duality previously owned 17k shares in this company, which were valued at $5.25M.

Animal Health

In the animal health sector, Duality fully sold its stake in Zoetis Inc.

- The company previously owned 35.7k shares, which were valued at $5.23M.

Consumer Goods

Duality also sold off all its shares in Clorox Co Del.

- The firm previously owned 36.5k shares in this company, which were valued at $5.12M.

Energy

In the energy sector, Duality divested from Cheniere Energy Inc.

- The company previously owned 33.4k shares valued at $5.01M.