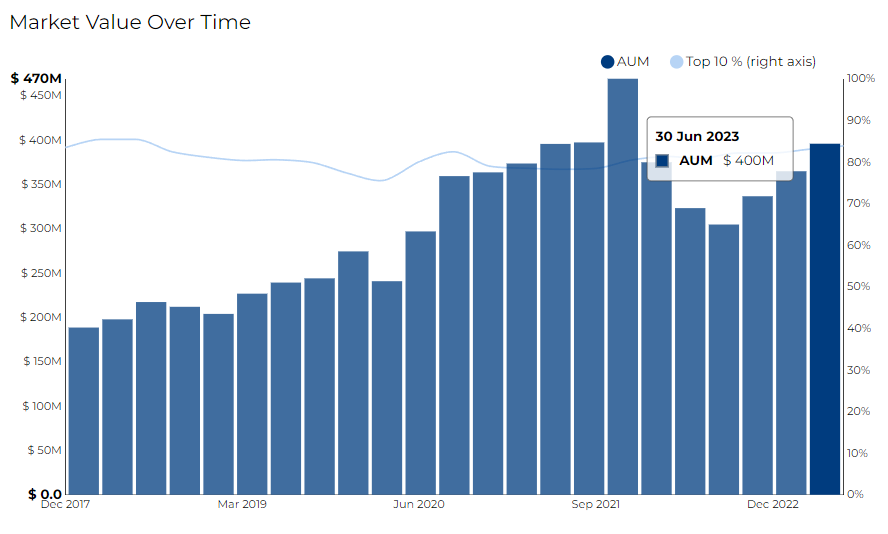

Brickley Wealth Management filed its most recent 13F on 11 Jul 2023, for the quarter ended 30 Jun 2023.

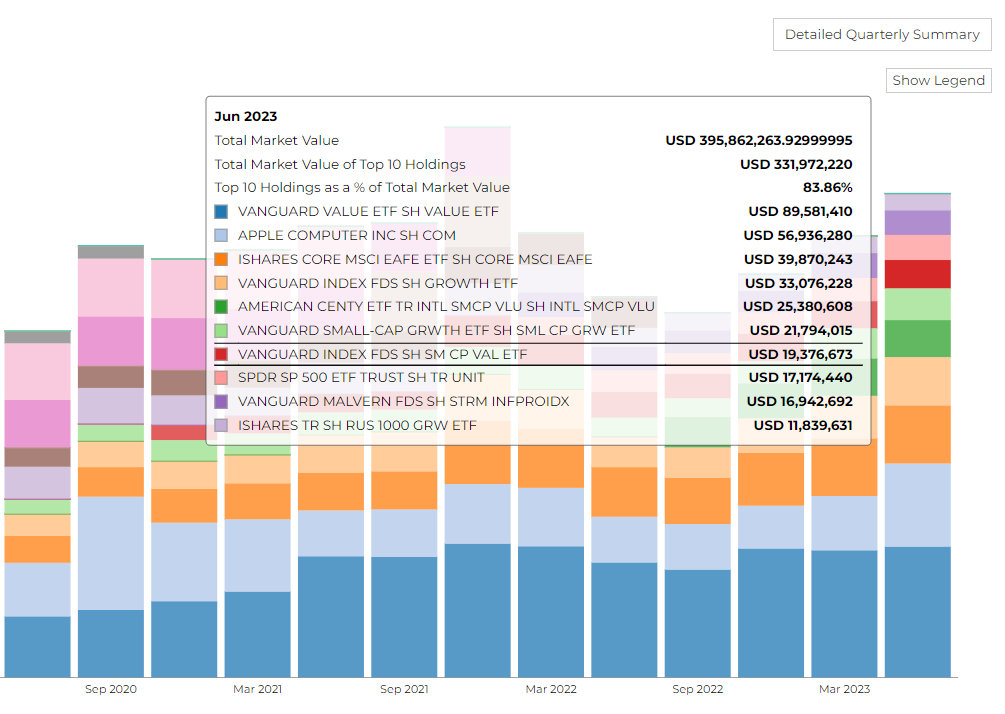

The firm disclosed 395.86 M in assets. It holds 41 securities in its 13F portfolio, and the top 10 holdings account for 83.9% of the portfolio.

Brickley Wealth Management's top purchases include Vanguard Index Fds, Apple Inc, Ishares Tr, Vanguard Index Fds, American Centy Etf Tr.

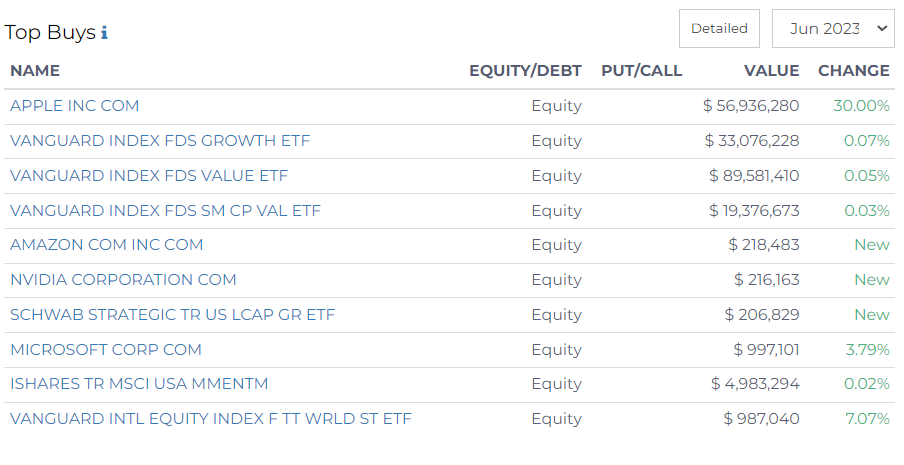

Top Buys

Brickley Wealth Management shared its latest investment updates, revealing strategic decisions across sectors:

- Apple Inc.: Shares rose by 30.00%, from 225.79K to 293.53K, with the investment value increasing to $56.9 million.

- Microsoft Corp.: Shares increased by 3.79% from 2.82K to 2.93K, valuing at $997,101.

- Nvidia Corporation: A new addition, with 511 shares acquired for $216,163.

Consumer Goods

- Amazon Inc.: New to the portfolio, with 1.68K shares purchased, totaling $218,483.

ETFs

- Vanguard Growth ETF: Shares slightly increased from 116.81K to 116.89K. Investment value now stands at $33.1 million.

- Vanguard Value ETF: Shares increased marginally by 0.05%, from 630.11K to 630.41K, with the total value at $89.6 million.

- Vanguard Small Cap Value ETF: Slight increase from 117.12K to 117.15K shares, with an investment value of $19.4 million.

- Schwab US Large-Cap Growth ETF: New addition, with 2.76K shares bought for a total of $206,829.

- iShares MSCI USA Momentum ETF: Shares slightly increased from 34.54K to 34.55K, reaching a value of $4.98 million.

- Vanguard Total World Stock ETF: Shares increased by 7.07%, from 9.51K to 10.18K. The investment value is $987,040.

Top Sells

Heritage Wealth Management, Inc. (HWM) recently released its top sales in their latest filings.

Exchange-Traded Funds (ETFs)

- iShares Russell 1000 Growth ETF:

Shares decreased by 13.73% from 49.88K to 43.03K. The investment value now stands at $11.84 million. - Vanguard Short-Term Treasury ETF:

A substantial 43.43% reduction in shares from 7.26K to 4.11K, now valuing $237,213. - iShares 7-10 Year Treasury Bond ETF:

Shares decreased by 4.82% from 11.62K to 11.06K. The total investment value is $1.07 million. - Vanguard ESG International Stock ETF:

A slight decrease in shares from 7.81K to 7.64K (-2.18%), with a total value of $405,707. - Vanguard Total Stock Market ETF:

Share reduction of 2.14%, from 1.03K to 1.01K. The investment value stands at $221,846. - Vanguard Small Cap ETF:

Shares decreased slightly from 11.34K to 11.07K (-2.42%). The investment value reached $2.2 million. - iShares MSCI USA Min Vol Factor ETF:

Minimal share decrease from 114.40K to 114.37K (-0.03%). The total value is $8.5 million. - iShares Core MSCI EAFE ETF:

Slight decrease in shares from 591.10K to 590.67K (-0.07%), with the total value at $39.87 million. - Vanguard Small Cap Growth ETF:

Share count decreased from 95.40K to 94.86K (-0.56%), with the investment value at $21.79 million.