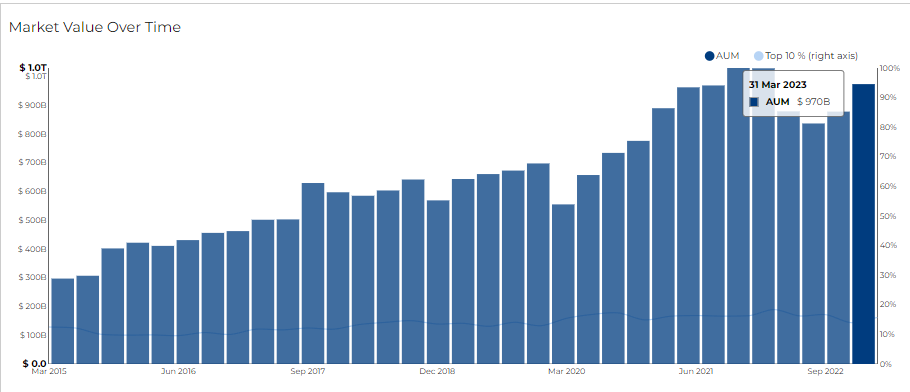

BANK OF AMERICA CORP filed its most recent 13F on 12 May 2023, for the quarter ended 31 Mar 2023.

Bank of America Capital Advisors LLC (BACA) is a subsidiary of NB Holdings Corporation and Bank of America Corporation. It serves as a managing member, general partner, and/or investment adviser to pooled investment vehicles sold to institutional and high-net-worth investors. The funds invest in portfolios of hedge funds or private equity/real estate funds operated by third-party investment managers.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for BANK OF AMERICA CORP, breaking down the 13F filings of its top buys and sells.

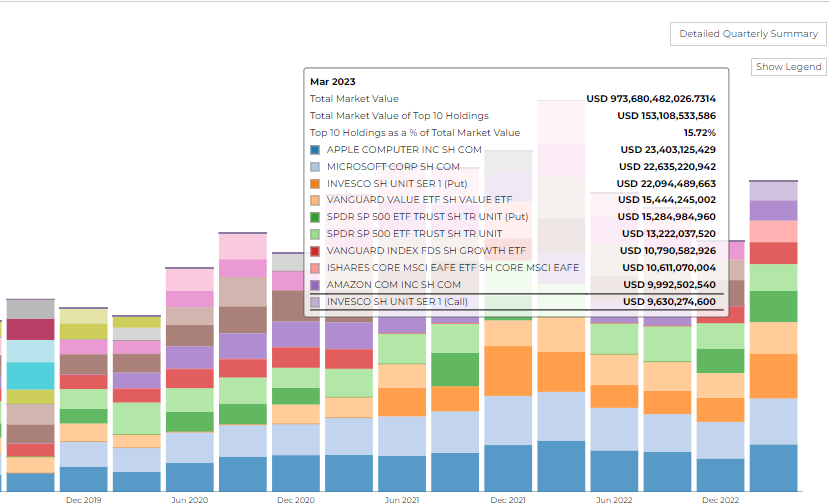

The firm disclosed 973.68 B in assets. It holds 7757 securities in its 13F portfolio, and the top 10 holdings account for 15.7% of the portfolio.

BANK OF AMERICA CORP /DE/'s top 3 holdings includes Apple Inc ($23.4B), Microsoft Corp ($22.6B), and Invesco Qqq Tr ($22B)

Top Buys by Bank of America

Bank of America has been making significant moves in the market, ramping up its holdings in various sectors. Here's a quick rundown of their top investments:

Technology Sector

- Invesco QQQ Trust (QQQ):

Bank of America has increased its stake by over 55%, buying around 68.8 million units. The current value of this investment stands at $22.1 billion. - Apple Inc. (AAPL):

The bank has upped its shares by 12%, acquiring approximately 141.9 million shares. The value of its Apple stake is $23.4 billion. - NVIDIA Corporation (NVDA):

It has increased its shares by nearly 40%, purchasing 27.9 million shares. The investment in NVIDIA is worth $7.7 billion. - Microsoft Corp. (MSFT):

Bank of America marginally increased its position by 4%, currently holding 78.5 million shares. The value of its Microsoft stake is $22.6 billion. - Amazon Inc. (AMZN):

The bank grew its stake by nearly 23%, buying 96.7 million shares. The Amazon investment now stands at $10 billion.

ETFs and Other Sectors

- SPDR S&P 500 ETF Trust (SPY):

The bank increased its stake by 19%, purchasing 37.3 million units. The current value of this investment is $15.3 billion. - AbbVie Inc. (ABBV):

A new addition to the portfolio, Bank of America acquired 20.7 million shares. The stake in AbbVie is worth $3.3 billion. - Vanguard Index Funds, Value ETF (VTV):

The bank increased its stake by 28%, buying 111.8 million shares. The value of the Vanguard investment is $15.4 billion. - iShares Russell 2000 ETF (IWM):

The bank boosted its stake by an impressive 77%, purchasing 37.3 million shares. The investment in iShares Russell is worth $6.6 billion.

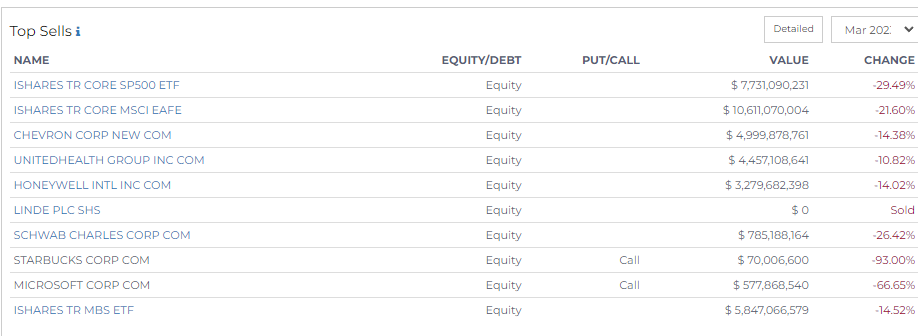

Top Sells by Bank of America

Exchange Traded Funds (ETFs)

Bank of America has reduced holdings in various ETFs. Specifically:

- iShares Core S&P500 ETF (IVV):

Bank of America reduced its stake by about 29.5%, selling 18.8 million shares. The value of this investment now stands at $7.7 billion. - iShares Core MSCI EAFE (IEFA):

The bank decreased its stake by around 21.6%, selling 158.7 million shares. This investment is now valued at $10.6 billion. - iShares MBS ETF (MBB):

The bank cut its stake by about 14.5%, selling 61.7 million shares. The value of this investment is $5.8 billion. - Vanguard Specialized Funds, Dividend Appreciation ETF (VIG):

The bank reduced its stake by 21%, selling 22 million shares. The value of this investment is $3.4 billion.

Energy Sector

- Chevron Corp (CVX):

The bank reduced its stake by 14.4%, selling 30.6 million shares. The current value of this investment is $5 billion.

Healthcare Sector

- UnitedHealth Group Inc (UNH):

The bank cut its stake by 10.8%, selling about 9.4 million shares. The value of this investment stands at $4.5 billion.

Industrial Sector

- Honeywell International Inc (HON):

The bank decreased its stake by 14%, selling 17.2 million shares. The current value of this investment is $3.3 billion.

Financial Services Sector

- Charles Schwab Corp (SCHW):

The bank reduced its stake by 26.4%, selling 15 million shares. The value of this investment is $785.2 million.

Consumer Discretionary Sector

- Starbucks Corp (SBUX):

Bank of America drastically reduced its stake by about 93%, selling 672.3 thousand shares. The value of this investment is $70 million.

Technology Sector

- Microsoft Corp (MSFT):

The bank cut its stake by 66.7%, selling 2 million shares. The value of this investment stands at $577.9 million.

-png.png)