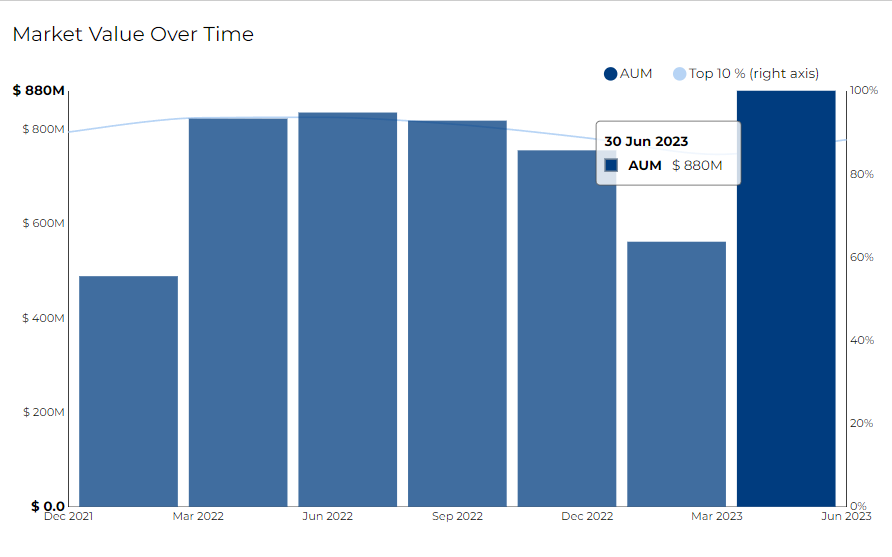

Advance Capital Management, Inc. filed its most recent 13F on 03 Jul 2023, for the quarter ended 30 Jun 2023. The firm disclosed 881.74 M in assets.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for Advance Capital Management, Inc breaking down the 13F filings of its top buys and sells.

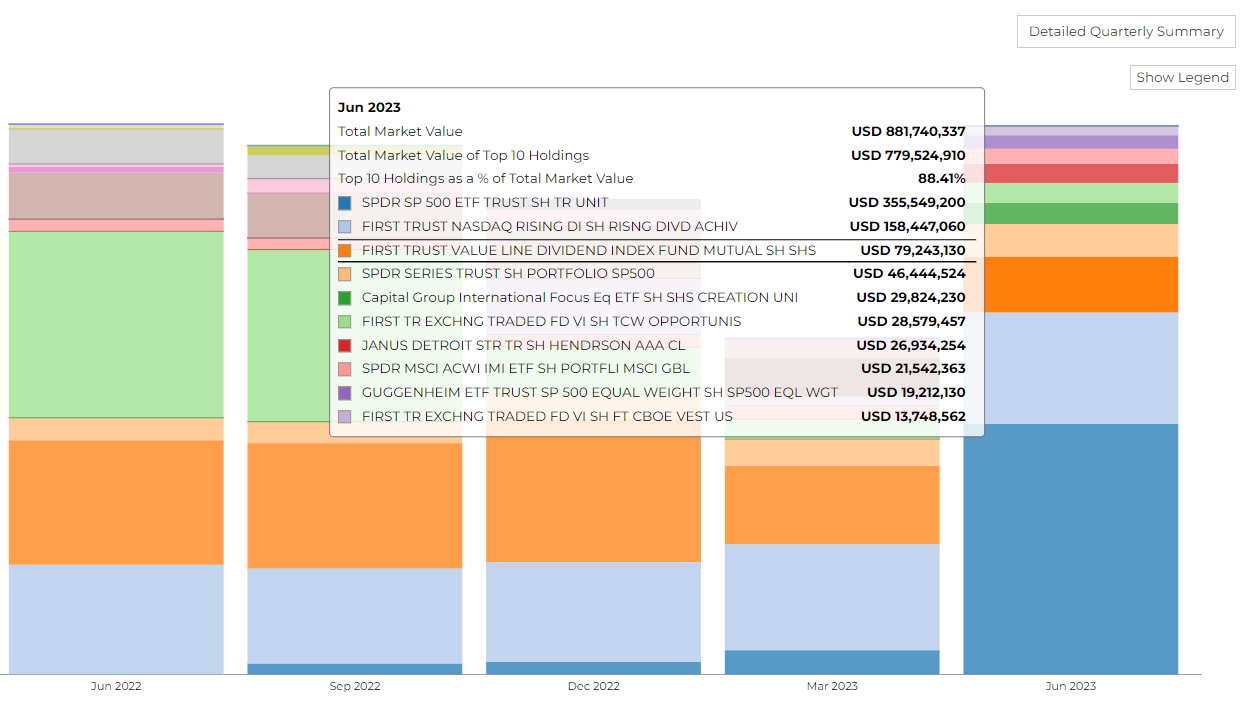

It holds 121 securities in its 13F portfolio, and the top 10 holdings account for 88.2% of the portfolio.

Advance Capital Management, Inc.'s top 3 holdings include Spdr Sp 500 Etf Tr ($355.54M), First Tr Exchange-Traded Fd ($158.44M), and First Tr Value Line Divid In ($79.24M).

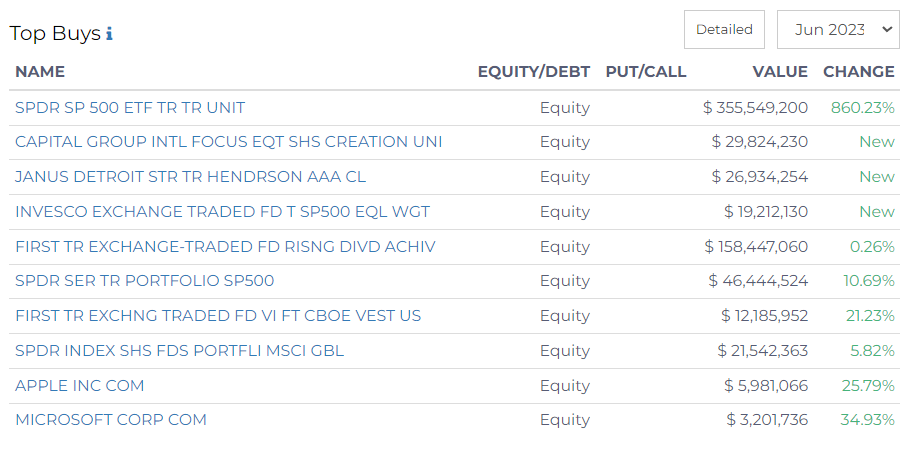

Top Buys

In summary, ACM has focused on ETFs, particularly those tracking the S&P 500, while also making substantial investments in leading technology companies, Apple and Microsoft.

The top purchases made by Advanced Capital Management (ACM) organized by sector:

Technology:

ACM increased its stake in Apple Inc (AAPL), buying an additional 30.8K shares, representing a 25.79% increase in its position.

- This brought their total investment in Apple to $5.98M, up from $4.04M in the previous period.

Microsoft: They also bought 9.4K shares, a 34.93% increase from their previous position.

- Their total investment in Microsoft is now valued at $3.2M, up from $2.01M.

Exchange Traded Funds (ETFs):

ACM significantly increased its holding in the SPDR S&P 500 ETF Trust (SPY), buying an additional 802.1K shares - a 860.23% increase.

- The current value of their SPY holdings is $355.55M.

They invested in the Capital Group International Focus Equity, purchasing 1.27M shares to bring their total investment to $29.82M.

ACM also initiated new positions in the Janus Detroit Street Trust Henderson AAA Class and Invesco Exchange Traded Fund Trust S&P500 Equal Weight.

- Buying 540.3K and 128.4K shares respectively, resulting in a total investment of $26.93M and $19.21M for each ETF.

Minor additions were made to their holdings in the First Trust Exchange-Traded Fund Rising Dividend Achievers, buying an extra 8.6K shares, a 0.26% increase.

- Their total position is now valued at $158.45M.

ACM expanded its stake in the SPDR Series Trust Portfolio S&P500 by 10.69% by buying an additional 86.1K shares.

- Their total investment in this ETF is now valued at $46.44M.

They also increased their stake in the First Trust Exchange Traded Fund VI FT CBOE Vest US by 21.23%, adding 62.4K shares.

- The total value of their holdings in this ETF is $12.19M.

Lastly, their investment in the SPDR Index Shares Fund Portfolio MSCI Global increased by 5.82% with the purchase of 22.6K shares.

- Bringing the total value of their holdings to $21.54M.

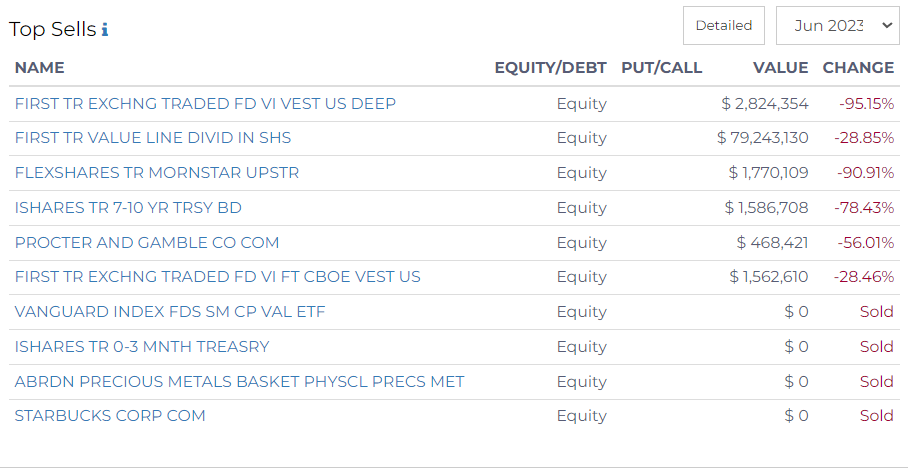

Top Sells

Consumer Goods:

ACM sold off a significant portion of their stake in Procter and Gamble Co (PG).

- They reduced their holdings by 3.1K shares, marking a 56.01% decrease in their position. This leaves their remaining investment in Procter and Gamble at $468.4K.

Exchange Traded Funds (ETFs):

A major sale was made in the First Trust Exchange Traded Fund VI Vest US Deep.

- ACM sold 82.99K shares, which led to a 95.15% reduction in their holdings. Their remaining position in this fund is valued at $2.82M.

ACM reduced their position in the First Trust Value Line Dividend Index Fund.

- By selling 1.98M shares, they decreased their holdings by 28.85%. The value of their remaining shares in this fund is $79.24M.

The firm sold 44.2K shares of the FlexShares Trust Morningstar Upstream Natural Resources Index Fund.

- This sale represents a 90.91% decrease in their holdings, leaving their current investment in this ETF at $1.77M.

ACM significantly reduced their investment in the iShares 7-10 Year Treasury Bond ETF.

- They sold 16.4K shares, marking a 78.43% decrease in their stake. The firm's remaining position in this ETF is valued at $1.59M.

The firm also sold a chunk of their shares in the First Trust Exchange Traded Fund VI FT CBOE Vest US.

- By selling 48.4K shares, they reduced their holdings by 28.46%. The value of their remaining shares in this ETF is approximately $1.56M.

Finally, ACM sold out their entire positions in the Vanguard Small-Cap Value ETF, the iShares 0-3 Month Treasury Bond ETF, and the Aberdeen Standard Physical Precious Metals Basket Shares ETF.

- These positions were previously valued at $245.2K, $227.1K, and $216.2K, respectively.