13F Disclosures Reveal StoneX Group Inc.'s (SNEX) Top Buyers and Sellers

StoneX Group Inc., formerly known as INTL FCStone Inc., is a global financial services company, backed by a team of over 3,000 employees, and offers a wide range of transaction and advisory services.

Recently, StoneX has experienced considerable investment activities from institutional investors, mainly hedge funds. These activities have brought about significant changes in share ownership.

This report presents an overview of the leading institutional buyers and sellers of StoneX Group Inc. shares for March 2023. The data, insights, and tables presented herein have been sourced and analyzed on Radient, documenting key shifts and trends in investment activities among these institutional entities.

Top Buyers of StoneX Group Inc

In Q1 2023, StoneX Group Inc. observed a mix of investments from both new entrants and existing stakeholders.

Bares Capital Management, Inc. led the pack by significantly raising its stake by 130.83%. The value of their investment to a final sum of $11.80M.

They were followed by Assenagon Asset Management S.A., which also increased its holdings by 110.16%, pushing their investment's worth to $24.26M, a surge of 128.31%.

Other notable buyers include:

- Goldman Sachs Group Inc.: The group expanded its investment by 87.87%, increasing investment value by 104.10% to $11.82M.

- Robeco Investment Management, Inc.: Robeco increased its stake by 46.25%, resulting in an increase in investment value by 59.67%, totaling $21.76M.

- Nuveen Asset Management: Nuveen increased their stake by 50.16%, with investment value rising by 63.13% to $15.35M.

- Vanguard Group Inc.: This group increased their holdings by 11.32%, with the value of their investment at $133.92M, representing a value gain of 20.94%.

- Private Capital Management, LLC: This fund increased its stake by 5.70%, leading to a rise in the investment value of 14.83%, to a total of $37.74M.

- BlackRock Inc.: BlackRock Inc. slightly increased its holdings by 0.37%. The value of their stake stood at $289.90M, an increase in value of 9.03%.

Notably, two hedge funds have made their debut investments in the security:

- Nine Ten Capital Management LLC: As a new entrant, this hedge fund's investment is valued at $78.93M.

- Ashford Capital Management Inc.: Another new entrant, Ashford Capital Management Inc. started their investment in StoneX Group at $18.19M.

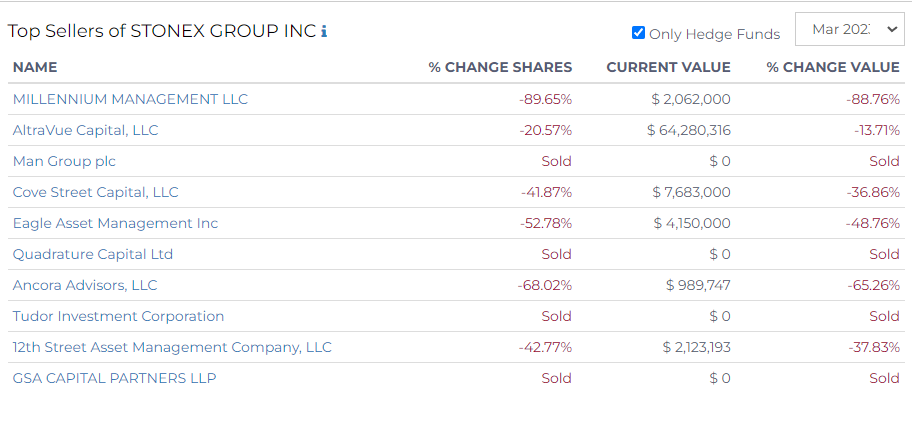

Top Sellers of StoneX Group Inc

Several hedge funds scaled down their holdings or entirely liquidated their stake in StoneX Group Inc. This report highlights the top sellers, outlining the shift in shares and the current value of the shares held, along with the change in value.

The following hedge funds have completely divested their shares in StoneX Group Inc:

- Man Group plc

- Tudor Investment Corporation

- GSA Capital Partners

- Quadrature Capital Ltd

Millennium Management LLC substantially reduced its shares by 89.65%, bringing the current value of its holding to $2.06M, representing a decrease in value of 88.76%.

AltraVue Capital, LLC decreased its shares by 20.57%, with the current value of its stake standing at $64.28M. This indicates a decrease in value by 13.71%.Cove Street Capital, LLC reduced its shares by 41.87%, resulting in a current value of $7.68M, a decrease in value of 36.86%.

Other notable sellers include:

- Eagle Asset Management decreased its stake by 52.78%. The current value of their investment stood at $4.15M, a decrease in value of 48.76%.

- Ancora Advisors, LLC slashed their shares by 68.02%, leading to a current holding value of $989,747, reflecting a decrease in value by 65.26%.

- 12th Street Asset Management Company, LLC reduced its shares by 42.77%, leading to a current value of $2.12M, which is a decrease in value of 37.83%.