Which Hedge Funds Are Up-Sizing and Taking Out McDonald's Equity? Q1 2023 13F review

McDonald's Corporation, for the period from January 1, 2023, to June 1, 2023, reported a 13F Value of $67.13 billion for the last held period, which ended on March 31, 2023.

McDonald's Corporation, a key player in the global restaurant industry, franchises and operates McDonald's restaurants in 119 countries worldwide. It provides diverse menus at different price points. The restaurants are either company-operated or managed by franchisees under conventional franchise arrangements, developmental licensees, or foreign affiliated markets under license agreements.

Franchisees contribute capital initially for equipment, signs, seating, and decor, and reinvest over time.

The corporation is listed on the NYSE and falls under the Consumer Cyclical sector.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for McDonald's Corporation, breaking down the 13F filings of its top buyers and sellers.

Who's Been UpSizing or Taking out their McDonald's Equity? Q1 2023 13F Review

Top Hedge Fund Buyers of McDonald's Corp (MCD)

McDonald's Corp saw major activity in its equity.

The lineup of top buyers was led by Pictet North America Advisors SA, which boosted its holdings by 16.58%, pushing its current value to $6.3 billion — a 23.70% increase in value. Vanguard Group Inc expanded its holdings by 0.04%, nudging its current value to $19.1 billion and marking a 6.15% change in value.

Geode Capital Management, LLC and Marshall Wace, LLP also made their mark, the former increasing its holdings by 1.51% to reach a current value of $3.9 billion (7.66% change in value), and the latter amplifying its holdings by 108.61%, translating into a current value of $459.2 million (a 121.34% change in value).

New buyers on the scene included Holocene Advisors, LP with a current value of $192 million, Samlyn Capital, LLC at $78.2 million, and Junto Capital Management LP with a current value of $71.5 million.

HSBC Holdings PLC and Balyasny Asset Management LLC also increased their stakes by 22.35% ($450 million, 29.93% change in value) and 195.19% ($113.3 million, 213.20% change in value), respectively.

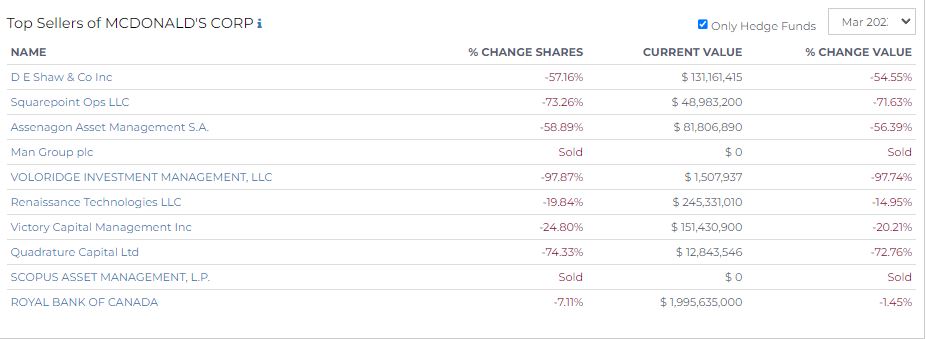

Top Hedge Fund Sellers of McDo Corp

Meanwhile, the top sellers of McDonald's Corp equity in March 2023 were also predominantly hedge funds.

D E Shaw & Co Inc headed the sellers, decreasing its holdings by 57.16%, which dropped its current value to $131.2 million, marking a -54.55% change in value.

Squarepoint Ops LLC and Assenagon Asset Management S.A. followed suit, reducing their holdings by 73.26% ($49 million, -71.63% change in value) and 58.89% ($81.8 million, -56.39% change in value), respectively.

Scopus Asset Management, L.P. went all in, selling all of its holdings.

Voloridge Investment Management, LLC significantly scaled down its stake by about 97.87%, leaving them with a value of $1.5 million. This reduction totaling to 97.74%.

Renaissance Technologies LLC also trimmed its holdings but to a lesser extent. They reduced their position by 19.84%, resulting in a value of $245.3 million, a decrease in value of 14.95%. Despite the cutback, Renaissance still retains a substantial investment in McDonald's Corp.

Victory Capital Management Inc similarly lessened its McDonald's Corp stake by 24.80%. Consequently, the value of their holdings fell to $151.4 million, marking a decrease of about 20.21%.

Royal Bank of Canada followed a more moderate path, decreasing its holdings by 7.11% to a current value of about $2 billion, signifying a -1.45% change in value.