Warren Buffet-led Berkshire Hathaway’s recent 13F filing disclosed 3 new stocks and 9 liquidated positions.

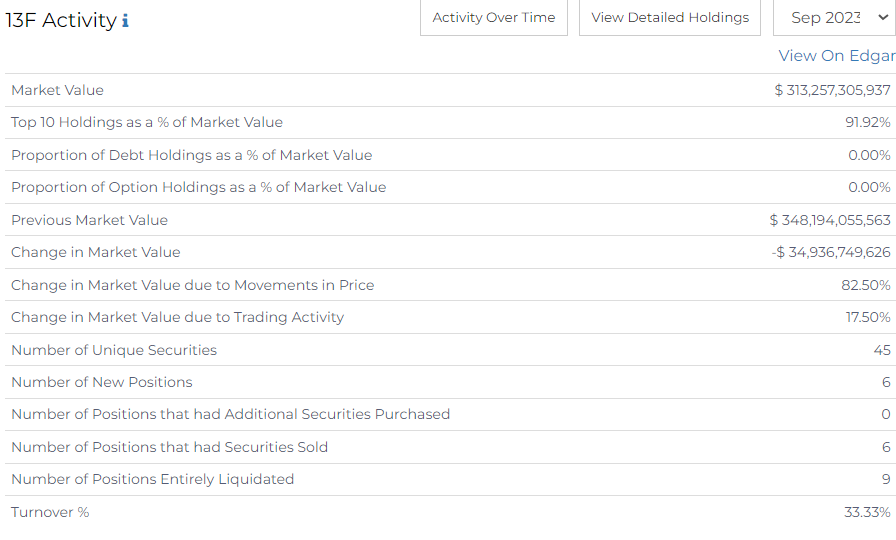

13F data on Radient discloses $313B in assets.

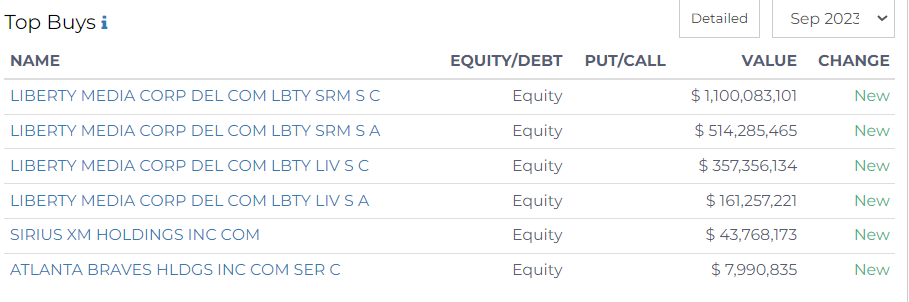

New stock additions include:

- Liberty Media Corp

Liberty Media Corporation owns interests in a broad range of media, communications, and entertainment businesses. - Sirius XM Holdings Inc

Berkshire now holds positions worth $43.7M in the satellite radio provider company. - Atlanta Braves Holdings

Berkshire holds shares $7.9M in this company.

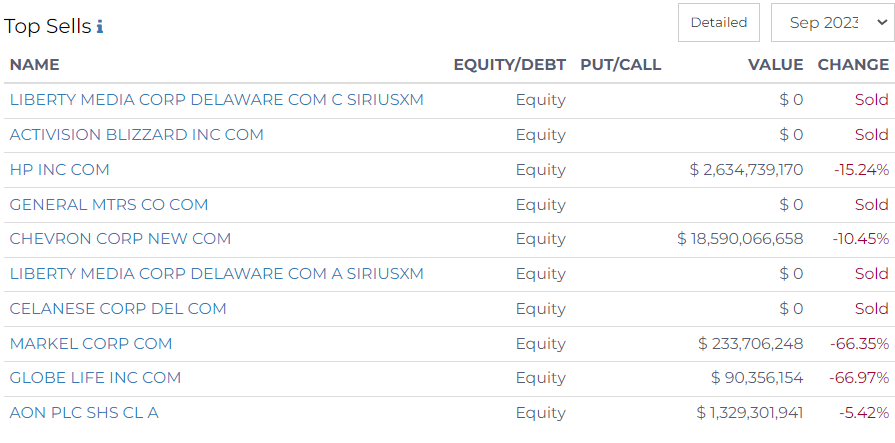

Positions completely liquidated in Q3 2023

- Activision Blizzard

Berkshire completely liquidated its $14.7M stake in video game maker. Berkshire held this security since Q4 of 2021. - General Motors

Berkshire Hathaway liquidated its $848M investment in General Motors. - Celanese Corp.

Following reductions in Q1 and Q2, Berkshire completely divested its position in Celanese during Q3. The initial stake was established in the Q1 of 2022.

Stakes reduced in Q3

- HP

Berkshire Hathaway pared its ownership in HP by 15.2%. The company's current holding in HP is worth over $2.6B. - Aon

Berkshire Hathaway reduced its holdings in Aon, a professional services firm, by 5.4%. - Amazon

Berkshire also scaled back its position in the online retail giant Amazon by 5.2%. - Markel

Berkshire significantly decreased its investment in the insurance company Markel, cutting it by over 66% in Q3.

- Globe Life

Berkshire trimmed its stake in insurance company Globe Life by approximately 67%, the newly adjusted position is worth $90M.

- Chevron

Berkshire pared its stake in Chevron by about 10.5%. Chevron remains one of Berkshire's five largest holdings. - Procter & Gamble, United Parcel Services, Mondelez International and Johnson & Johnson

Berkshire closed out relatively small positions in these household names during the quarter.

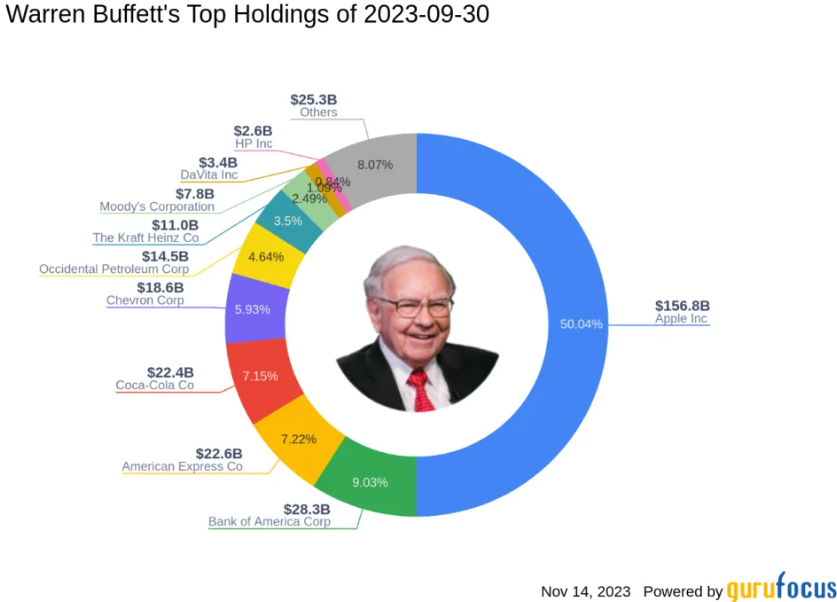

Top holdings

The top 10 holdings account for 91.9% of the portfolio

- Apple ($156.8 B)

- Bank of America ($28.3 B)

- American Express ($22.6 B)

- Coca-Cola ($22.4 B)

- Chevron ($18.6 B)

(Source: Yahoo Finance, here)

(Source: Yahoo Finance, here)

In a recent filing, Berkshire Hathaway the company has opted for confidential treatment with the SEC, indicating its decision to withhold specific details about the new stock or stocks for the time being. Berkshire last used this confidentiality treatment rule in 2020. At that time, the fund was confidentially accumulating stock in Chevron and Verizon.