Argonne Capital Group is a private equity firm based in Atlanta, Georgia.

Since its founding in 2003, Argonne has invested over $2 billion of equity capital in a variety of small-to-medium-sized companies across a diverse range of industries, including restaurants, fitness, automotive services, commercial landscaping and equipment dealerships.

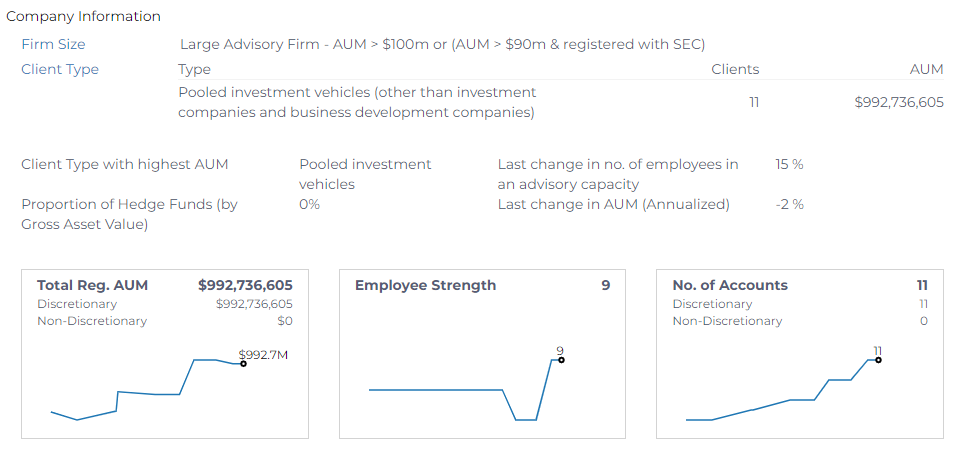

- Total Regulatory Assets Under Management (Reg AUM): $992M with 11 pooled investment vehicles as clients.

- Manages 11 private equity funds.

- Administrators disclosed for private funds: Alter Domus (US) LLC.

- Auditors disclosed: EY, Smith and Howard PC, Grant Thornton LLP, PwC.

- Largest Private Equity Fund held: SRP Continuation Partners LP ($290M).

Historical data for Argonne Capital Management shows that the firm in 2023:

- Changed the custodian for its private funds- Argonne Capital Partners Parallel, K-Square Restaurant Partners, Keystone Partners, and Border partners from Suntrust Bank Truist Bank.

- Disclosed EY as a new auditor for its private fund- Argonne Capital Partners Parallel, LP

- Disclosed 2 new private funds:

a) SRP Continuation Partners Parallel

b) SRP Continuation Partners LP

See the complete filing, here.