Oppenheimer & Co's Q3 2023 13F insights

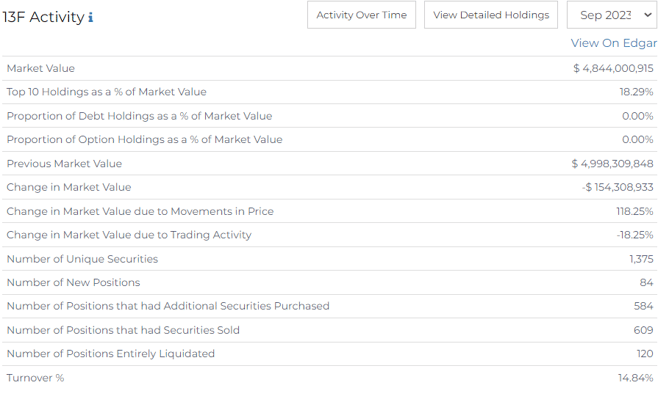

Market Value: $4.8B

Top 10 holdings as a % of market value: 18.29%

Number of new securities added: 84

No of securities entirely liquidated: 120

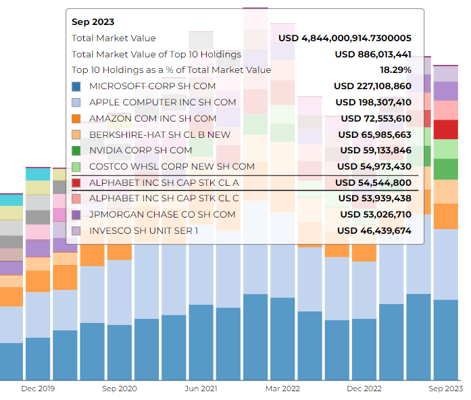

Top 5 securities held by the firm:

Microsoft ( Value $227M)

Apple (Value $198M)

Amazon (value $72.5M)

Berkshire Hathaway (Value $66M)

Nvidia Corp ($59M)

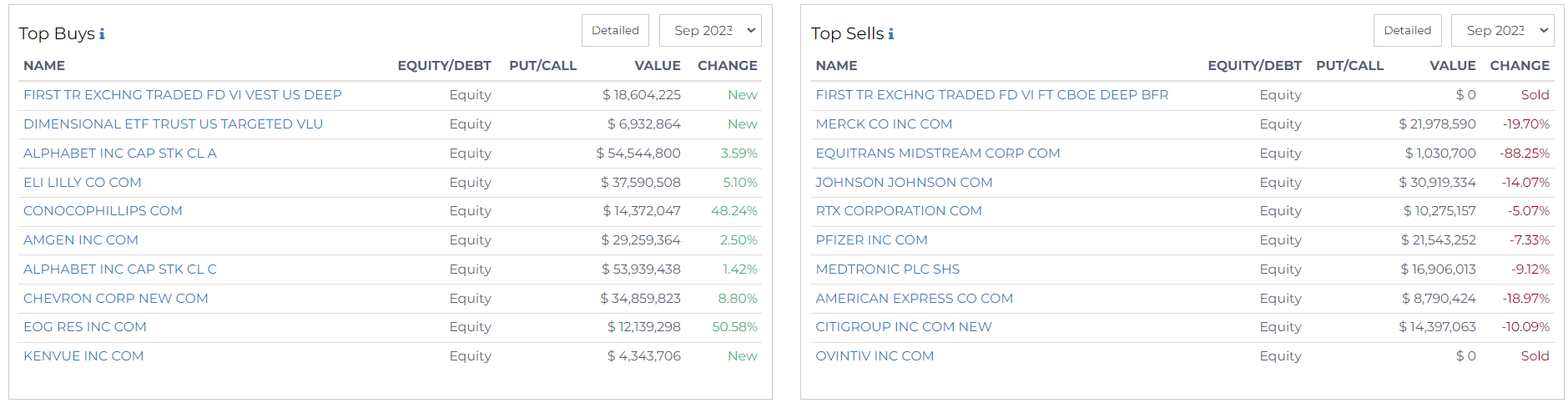

Top Buys of Q3 2023:

Dimensional ETF Trust (Value $6.9M)

Alphabet Inc (Value $54.5M)

Eli Lilly Co (Value $37.5M)

Chevron Corp ( Value $34.8M)

Top Sells of Q3 2023:

Ovintiv Inc

Pricesmart Inc

Wingstop Inc

The firm majorly holds securities from the financial and IT sectors.

See the filing, here.

More on Oppenheimer & Co

Oppenheimer & Co. Inc. is a registered investment adviser and broker-dealer that offers advisory services on a discretionary or non-discretionary basis, as well as investment consulting services. The company has been in business since 1881 and is owned by Viner Finance Inc., an indirect subsidiary of Oppenheimer Holdings Inc. Oppenheimer manages $8.4 billion of client assets on a discretionary basis and approximately $14.2 billion of client assets on a non-discretionary basis.