ExxonMobil, a prominent multinational energy corporation, stands as a global leader in the oil and gas industry. The company operates across a diverse range of energy-related sectors.

Exxon Mobil Q2 2023 Insights

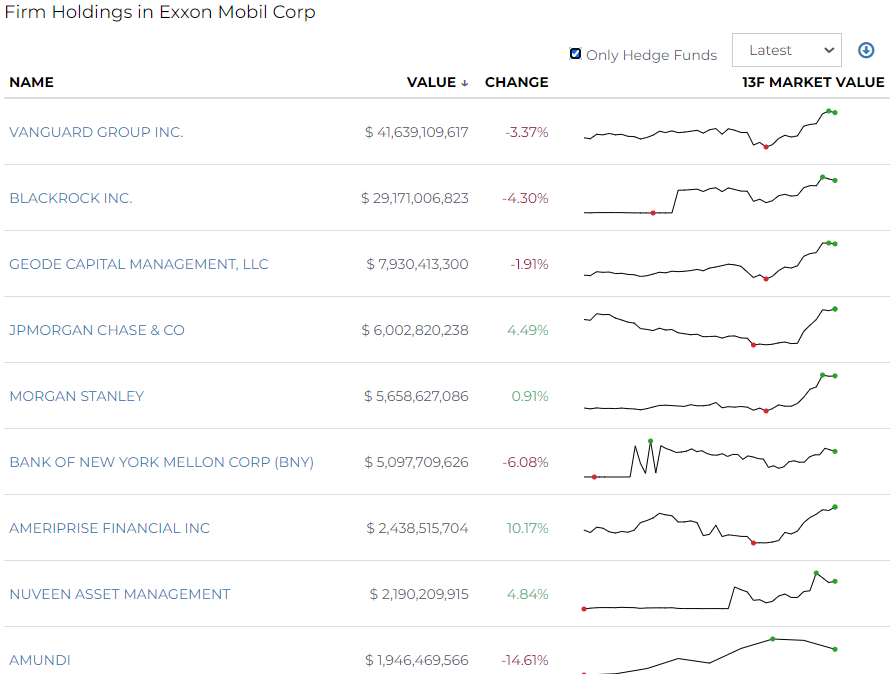

- Exxon Mobil's 13F security is held by 819 hedge funds, contributing a 38% to the total 13F market value for XOM.

- Notable Q2 2023 buyers: JP Morgan, Ameriprise Financial, Hudson Bay Capital, Nuveen Asset Management.

- Top hedge fund buyer of XOM's 13F security: Strid Group LLC

- Top hedge fund seller of XOM's 13f security: Aurum Wealth Management Group LLC

- During this period, 2,414 filers reduced their holdings, including Atria Wealth, Veritable L.P., Roberts Wealth Advisors

- Interestingly, First Republic Investment Management and Renaissance Technologies emerged as top sellers of Exxon Mobil's 13F security.

- First Republic completely liquidated its holdings in Exxon Mobil, Chevron, and Devon Energy Corp while significantly reducing its Shell holdings by 55%. The firm adjusted its energy sector holdings from 5.2% to 2.7% of the total portfolio value in Q2 2023.

Track the full filing, here.