With the onset of COVID-19, cloud based solutions have enabled working from home by making collaboration simpler. At RADiENT, we are making it easier to collaborate on fund research, due diligence, and portfolio construction.

RADiENT is a cloud-first fund analytics system, and can be accessed through any mobile device. It allows you to :

Build and share portfolios online

Using Portfolios, you can build portfolios which contain equities, funds and ETFs and track their performance across time. You can also import and export these portfolios to excel, attribute performance to sectors and optimize weights using mean-variance and scenario-based optimizers.

Receive notifications on filings and funds

RADiENT's built-in functionality let's you set notifications for when a certain firm files a form, when a fund moves beyond a specified range and any other set event.

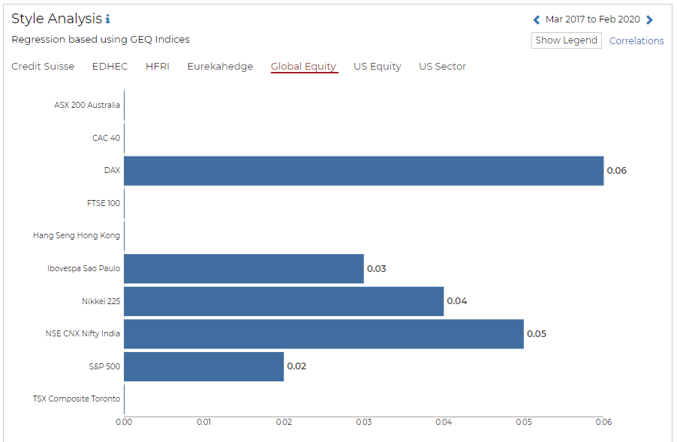

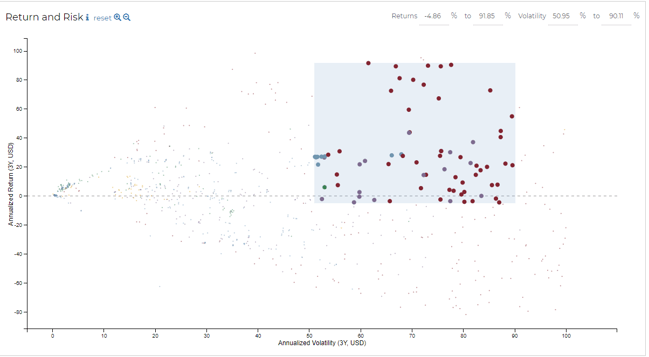

Filter and select funds, ETFs and equities across the world

Screener lets you filter public funds based on multiple criteria such as

- Fund strategy and Fund house,

- Returns, Sharpe ratios and Drawdowns and

- Correlation with various indices

Our interface is simple, interactive and intuitive so you can select and evaluate funds in the shortest possible time. Visit Screener to try now!

Filtering funds on the basis of returns and volatility

Subscribe to RADiENT to access hedge fund data and analyze with various tools.

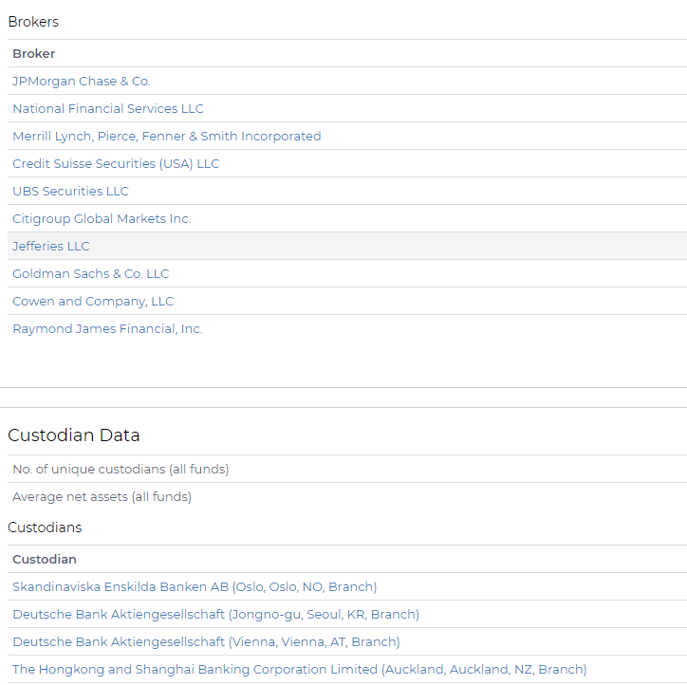

Aggregate Service Provider Data from millions of SEC Filings

Data from different SEC filings such as Form ADV, N-CEN and N-PORT is consolidated so you can look at institutional level data for private and public funds such as

- Broker details and commissions

- Security lending data

- Prime broker and custodian information

Brokers and custodians of a firm which filed Form NCEN

The data is accurate and updated regularly. It can be used to generate business insights and develop sales’ strategies for institutional players. It gives a bird’s eye view of the largest and fastest growing service providers.

Visit the Advisers and SEC Filings explorers to try it out now!

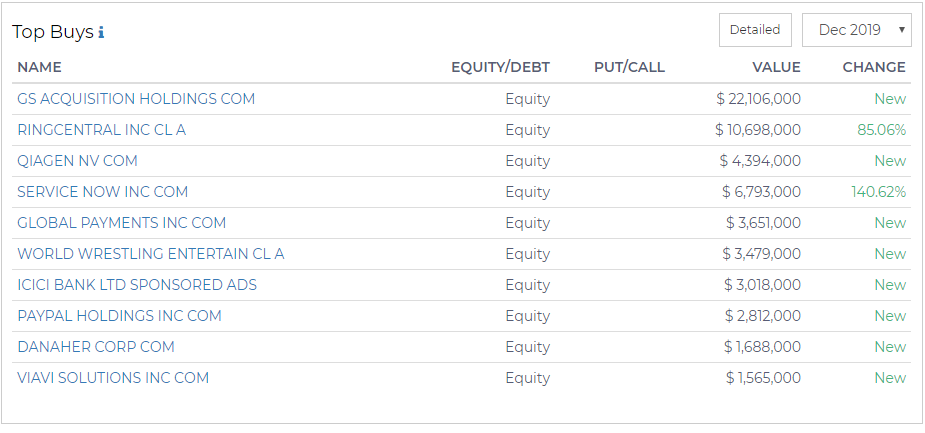

Portfolio details of private and public funds

Regulatory filings such as 13F and NPORT are parsed to generate insights about the portfolios of private and public funds. Find and compare interesting and useful information such as securities held, increase in AUM across time periods and the overall performance of different funds.

Unearthing useful information from the 13F filed by a firm