We’re all familiar with r/wallstreetbets and Gamestop(GME)- redditors traded an unbelievable short squeeze on a hedge fund, which resulted in GME rising 4.5X in 2 days. But while short-sellers Melvin Capital and Maplelane are in the news, regulatory filings such as the 13F are a reliable source to find hedge funds which hold the stocks that r/wallstreetbets is positive on.

Given below, we explore the 5 most popular stocks on r/wallstreetbets right now, and the hedge funds that hold them –

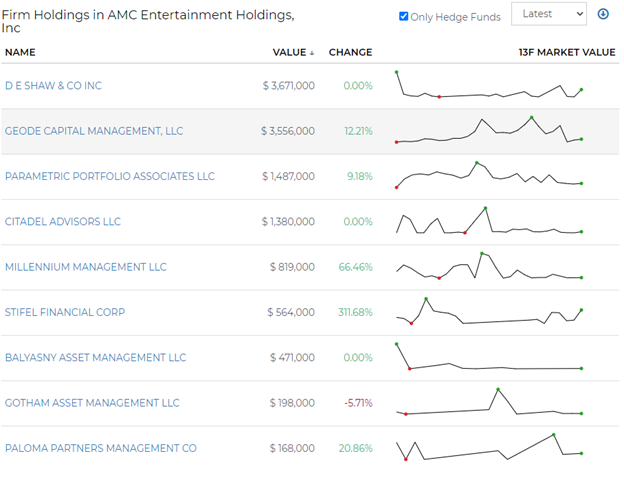

AMC is the largest theatre chain in the United States, and since the onset of COVID-19 in Feb 2020, the stock has taken a large beating. AMC’s earnings dropped 91% to $119 Mill from $1.3 Bill in Q3-2020 and the company is struggling with sizeable debt. The hedge funds that held this stock according to their last 13F filings are

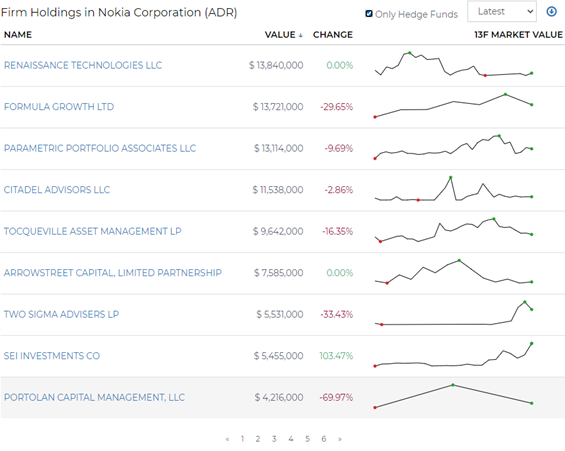

One of the the world’s largest telecom equipment manufacturers, this giant has found favour among redditors and jumped by 63% at its peak, before falling again! Nokia has however issued a statement saying that the company is “not aware of any material, undisclosed corporate developments or material change” that accounts for this recent boom. The hedge funds that hold Nokia include:

Sundial Growers Inc

SNDL is Wall Street’s cheapest marijuana company, and redditors are determined to change this. The cannabis producer has been introducing a number of new brands in the last 1 year and is a cultivation to extraction manufacturer.

The penny stock rose from 71 cents to $1.21 in lesser than a week, and is still garnering positive sentiments across reddit. The hedge funds that hold SNDL include SAF Jackson, Hudson Bay Capital, Hellard Edward Arthur, RenTech, Arrowgrass Capital and Caprock Group.

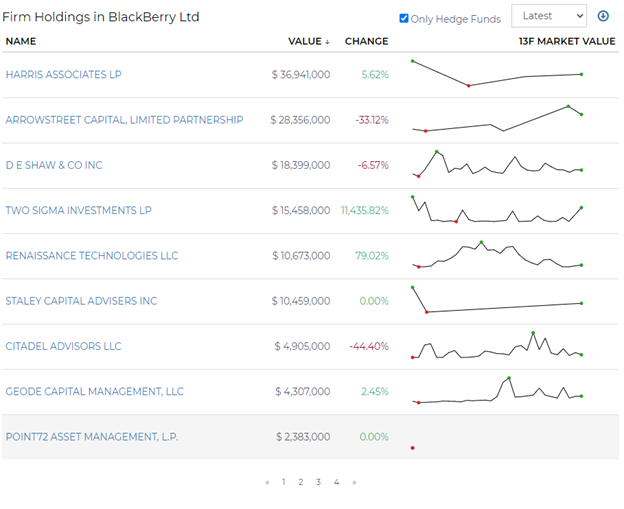

All the new stocks championed by redditors have induced some sort of nostalgia, and Blackberry is no different. BB faded out of public eye by 2016 because of Android and IOS platforms – but before this, it was one of the most prominent office smartphones in the world with revenues closed to $11 Bill in 2013.

Since the stock was mentioned on reddit, its price skyrocketed from $7.44 to a peak of $25 in 2 weeks. The hedge funds that already held Blackberry include:

Cassava is a clinical-stage biopharmaceutical company focused on neuroscience. Their primary mission is to detect and treat Alzheimer's disease. The stock doubled in value in the last one month and is now approaching its 10 year high. Trading volume in a single day exceeded 40 million shares compared with a previous daily average of ~3 million shares.

Cassava is considered by many in reddit as a deep value stock because of its addressable market. It just announced positive results and is moving forward with its Phase 3 clinical trials.

Summary

The 13F and NPORT can be used to find the owners of any listed security, and hence provide valuable market insights. Visit RADiENT to access these filings now!