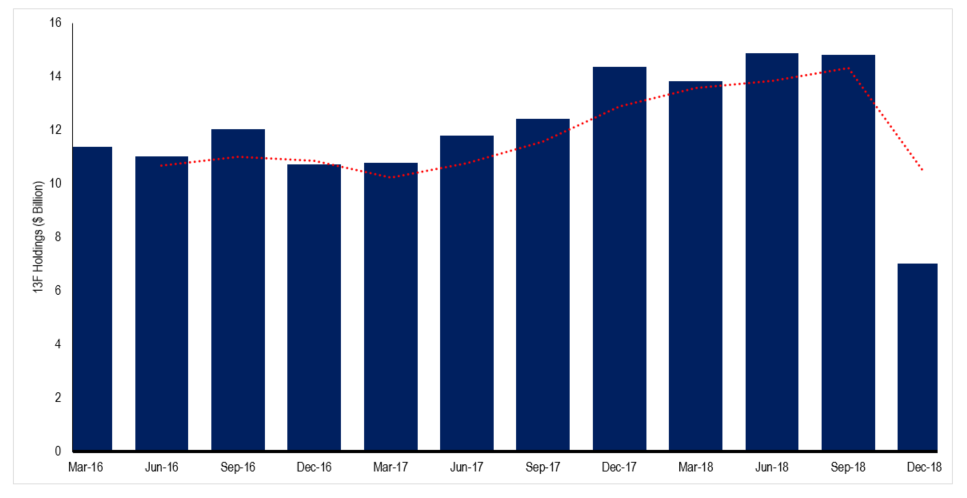

Activist investor Daniel Loeb’s hedge fund had a very active year-end quarter – 10 positions completely liquidated, 12 positions reduced and just 1 new addition to their portfolio! The market value of the firm's holdings reduced by more than half to just $6.5 billion from over $14 billion in the previous quarter.

Third Point's 13F portfolio value over the last 3 years

This bizarre liquidation of numerous stocks has led to a very concentrated portfolio for Third Point - 28% of their holdings are now in Baxter (BAX) and another 25% are between Campbell (CPB), DowDuPont (DWDP) and Paypal (PYPL).

In this blog we review the activity and holdings of Third Point for the 4th quarter of 2018.

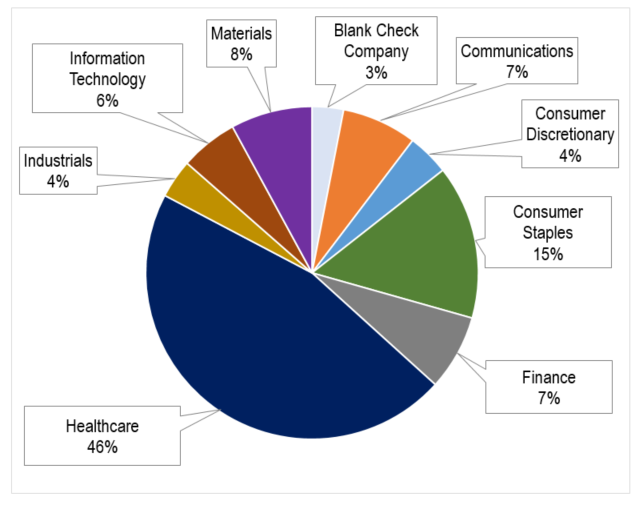

Sector Focus

A consolidation of Third Point’s different holdings reveals that the firm now has a 46% stake riding on the healthcare sector alone. This is despite Third Point liquidating over 22% of its holdings in Baxter during the quarter. Third Point exited Baxter at a sizable gain of almost $30 per share!

The firm’s other holdings in the healthcare sector include Cigna Corp(CI), Danaher (DHR), Shire Plc (SHPG), Merck (MRK), IQVIA(IQV) and Kadmon (KDMN).

Besides healthcare, Third Point is also heavily invested in Consumer Staples – the two primary stocks in this sector being Campbell Soup and Constellation Brands (STZ), both of which under performed the S&P 500 Consumer Staples index in the last year.

Sector-wise bifurcation of Third Point's portfolio for the quarter ended Dec-2018

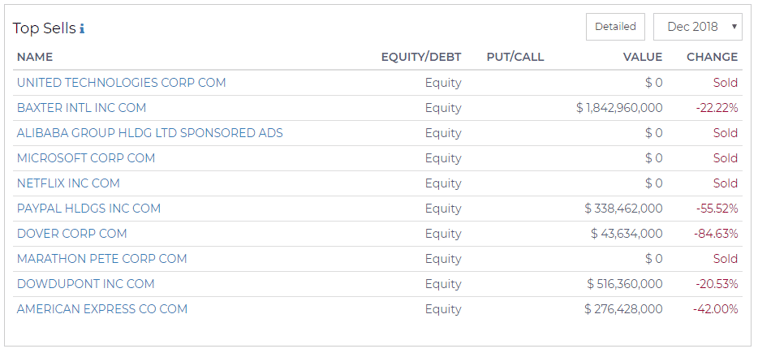

Buys and Sells

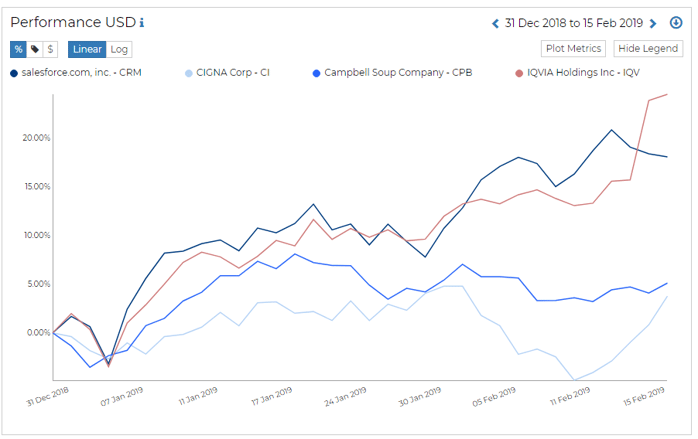

Third Point’s only new position was also its largest purchase – Cigna Corp (CI), a healthcare insurance services provider. The firm increased its holdings in SalesForce (CRM), Campbell Soup, Shire PLC and IQVIA.

Performance of latest buys post Dec 2018

You can take a look at the financial ratios and risk factors of this equities on RADiENT.

Third Point’s sells were the major talking point in its latest 13F – The firm sold out of 12 of its holdings, and completely liquidated 10. The largest stakes reduced include large names such as Baxter, Paypal, Netflix, Microsoft (MSFT), Alibaba (BABA) and United Tech (UTX).

Top sells of Third Point for the quarter ended Dec 2018

Exploring Similar Firms

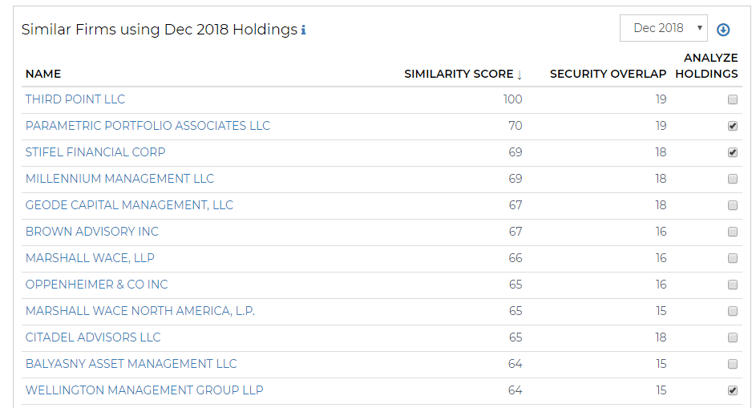

The Similar Firms feature allows you to find other firms which have similar security holdings and portfolio allocation as the selected firm.

Firms similar to Third Point

To evaluate the holdings of these firms, we selected Parametric Portfolio Associates, Stifel Financial Group and Wellington Management for further analysis. From the Analyze Holdings feature at the bottom of the page, the following inferences can be made -

1. Third Point has sold Baxter, while the other 3 firms have bought more. All firms hold Baxter in their portfolio.

2. Together, these 4 firms hold 15.51% of Baxter’s market value.

3. Baxter makes up almost 30% of their aggregated 13F portfolio value.

We hope you enjoyed our blog on Third Point’s activities in the last quarter. Follow us on twitter for regular updates on 13F filings, and stay tuned for our next blog! You can read other articles from our blog here.