Activist investors are often in the news given their public tussles with management of the companies they invest in. Being long term by nature and aiming to maximize shareholder value, does it make sense to buy securities when they invest?

Elliott Management is one such successful activist and among the largest hedge funds in the world, managing over USD 74 billion. We analyzed the RADiENT 13D database to see how the market reacted to acquisitions made by Elliott Management over 2017-2018. 13Ds are filed with the Securities and Exchange Commission within 10 days of an entity attaining a position greater than 5% in any class of a company’s securities.

Elliott took a significant position in these 10 companies over 2017-18, primarily in the Services and Technology sectors

| Nielsen Holdings | Services - Business Services | August 13, 2018 |

| TIM Spa | Services - Communications | April 9, 2018 |

| Commvault Systems | Services - Software | April 2, 2018 |

| Travelport | Services - Logistics | March 26, 2018 |

| Akamai Technologies | Services - Business Services | December 15, 2017 |

| Mednax | Services - Hospitals | November 16, 2017 |

| NXP Semiconductors | Semiconductors | August 4, 2017 |

| Athenahealth | Services - Business Services | May 18, 2017 |

| Roadrunner Transportation | Services - Logistics | April 3, 2017 |

| NRG Energy | Services - Electric | January 17, 2017 |

*excludes companies that were taken private

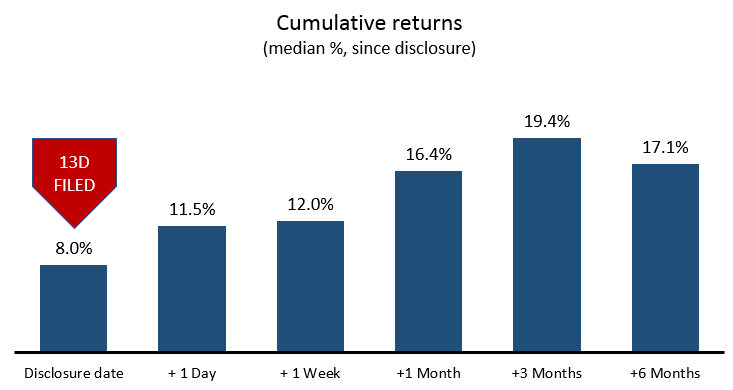

As expected, on the day Elliott discloses its holdings in a company, the share price goes up by 8% due to increased interest and consequent upward pressure on price. What's more interesting is that even if you miss the D-day boat, the general performance of these securities is strong, returning 16.4% cumulative over the next month.

On the day of disclosure, the median return on the securities was a staggering 8% in a day! This increased to 19.4% in 3 months.

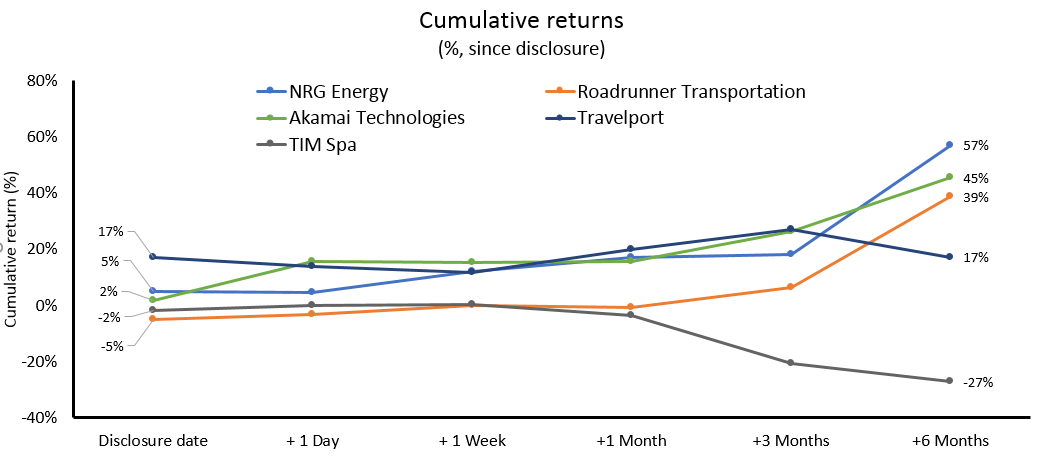

The market reacted positively in most cases to the news of Elliott's involvement except for Roadrunner Transportation and TIM Spa. The upward trend for all other investments persisted over the next 6 months.

9 out of 10 securities were in the green within 3 months of Elliott's disclosure

This kind of investment thesis can be extended to over 65,000+ 13D and 13G filers on RADiENT. Or evaluate manager alpha by analyzing how securities have performed after they have acquired or sold large positions.

Schedule 13D and 13G provide deep and timely insight into investor activity, visit RADiENT to know more.