Radient looks at some of the famous hedge fund managers that have delivered high returns in Q4 2023.

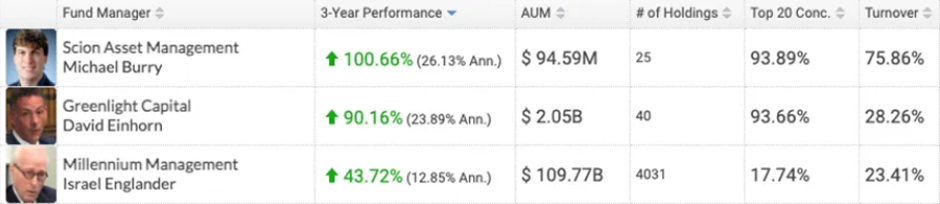

Scion Asset Management

![]()

Manager: Michael Bury

The firm disclosed $94.59 M in assets. It holds 25 securities in its 13F portfolio, and the top 10 holdings account for 54.7% of the portfolio.

Trading Insights:

- Number of new positions added: 18

- Number of securities entirely liquidated: 6

- Turnover: 96%

- Sectoral Focus: consumer cyclical, communication services and healthcare

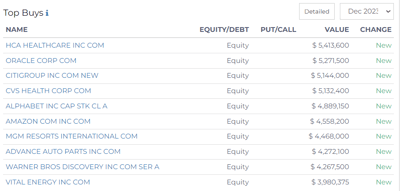

Notable New securities added:

- HCA Healthcare Inc makes 5.72% of the portfolio with 20K shares

- Oracle Group accounts for 5.57% of the portfolio with shares worth $5.27M

- Citigroup represents 5.44% of the portfolio with shares worth $5.14M.

Increase in Stakes

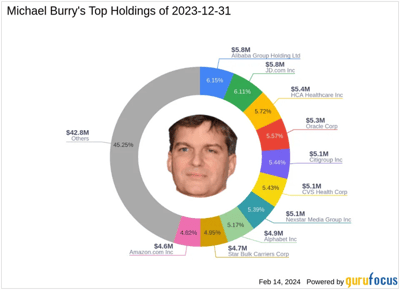

Burry increased investments in Chinese tech giants Alibaba and JD.com

- Alibaba: Scion Asset Management’s largest stock with 75K shares worth $5.81M.

- JD.com: In Q3 2023, 75K of JD.com were added bringing the total to 200,000 shares.

Alibaba and JD.com emerged as the largest holdings in the portfolio by the end of 2023, representing 6.15% and 6.11% of the investments, respectively.

Scion Asset Management completely divested from Stellanti, Euronav, Crescent Energy, and Hudson Pacific Properties.

Additionally, Burry reduced his holdings in Nexstar Media, Booking, TheRealReal, and Star Bulk Carriers.

Greenlight Capital

Manager: David Einhorn

Greenlight invests primarily in publicly traded North American corporate debt offerings and equities. The hedge fund disclosed $2.05 B in assets. It holds 40 securities in its 13F portfolio, and the top 10 holdings account for 77.0% of the portfolio.

Trading Insights:

- Number of new positions added: 7

- Number of securities entirely liquidated: 6

- Turnover: 32.5%

- Sectoral Focus: real estate, basic materials and financial services.

New Securities added:

- Alight Inc with shares worth $78.8M

- Viatris Inc with shares worth $36M

- Aercap Holdings with shares worth 18.5M

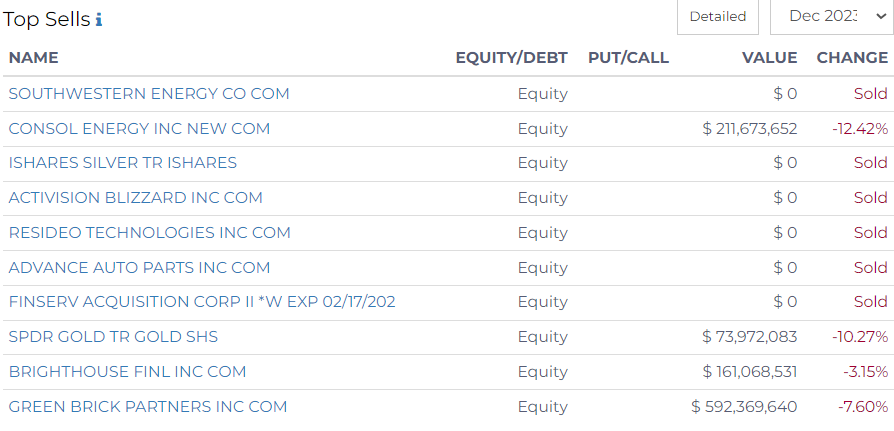

Top Sold securities:

Green Brick Partners Inc is the largest holding in Greenlight Capital’s portfolio worth $592M. This security has been in Greenlight’s portfolio since June 2015.

Millennium Management

Manager: Israel Englander

The recent 13F filing disclosed $231B in assets. It holds 6,007 securities in its 13F portfolio, and the top 10 holdings account for 20.5% of the portfolio.

Trading Insights:

- Number of new positions added: 887

- Number of securities entirely liquidated: 937

- Turnover: 30.36%

- Sectoral Focus: technology, consumer cyclical and healthcare.

New securities added:

Top Securities Sold

The top holdings of Millennium include:

To track more 13F filings, visit Radient!