Form ADV filings are a goldmine for investment manager and private fund information - utilize it to identify prospects and drive sale.

We stumbled onto Form ADV's many uses while conducting research for a large allocator on investment firms that manage private funds i.e. hedge funds and private equity funds.

After having looked at several public sources including corporate websites, news reports, social media including LinkedIn and Twitter, we came up short. We knew that hedge fund and private equity managers share information cautiously, but were surprised by how little was publicly available.

Discovering Form ADV

This compelled us to turn our attention to regulatory filings and the first stop was the U.S. Securities and Exchange Commission (SEC).

Form ADV is the primary disclosure document advisers provide to their clients, and contains a significant amount of information regarding a manager's investment strategy and more specifically, assets under management (AUM), owners and key officers, managed private funds along with key service providers, and details on any regulatory and judicial actions.

However, what surprised us was how difficult it was to access this data on the IAPD website.

IAPD only allows search based on a firm or individual's name. Any other search, even something as simple as listing all managers in Massachusetts or those that have been charged with a felony, was impossible to do.

Mission Form ADV - Easy Search and Actionable Information

So we took on the challenge to build something better and bring together industry knowledge with skills in cloud computing, machine learning and artificial intelligence.

Our mission was to make this blob of IAPD data into information that is searchable and usable, to provide actionable insights.

We mined the SEC's Form ADV filings and created a map of the entire US investment management industry. We then made sure to update our data everyday. Now we had everything i.e. all Form ADV filings made either with the SEC or with state regulators – over 35,000 filers!

We then built the tools to make it easy to search and organised the content so that it was easy to understand. We can now report and aggregate across filers with ease. Lastly, we made it all available to the public online. Part self-interest and part public good.

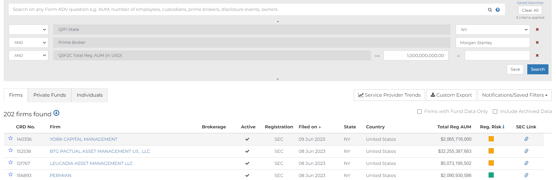

Now you can easily find all filers in Massachusetts, or start to create your own sophisticated searches, for example:

- Firms in NY with over $1 billion in AUM that use Morgan Stanley as their prime broker

- What is the gross asset value of all the private funds that HedgeServ administers?

- Firms in San Francisco that have been charged with a felony

- Firms with a direct owner named Ray Dalio

This data set is a map of the entire US investment management industry and literally a goldmine! One of the most compelling uses is to use Form ADV data to identify prospects and to drive sales. For instance:

- Prime brokerage identifying clients of Deutsche Bank with high AUM growth

- Big 4 accounting firm looking for funds that use Grant Thornton as auditor

- Investor relations team looking for wealth managers in Minnesota to build distribution

- Administrators competing with Citco for equity/long short hedge funds

- Broker dealer locating buy side firms that might be interested in specific securities

- Financial technology firms targeting investment managers with high employee growth

- Law firms looking to identify fund manager in Florida with reported regulatory actions

And the use cases are endless….

Now that exploring Form ADVs is a joy! Try it and share your thoughts. What else can this data be used for?