BNP Paribas is on the path to becoming one of the top prime service providers in the industry. The bank’s growth is bolstered by the implementation of its prime brokerage agreements with Deutsche Bank AG and Credit Suisse.

BNP’s master agreement with Deutsche Bank

In 2019, BNP Paribas signed a master transaction agreement to provide continuity of service to Deutsche Bank’s Global Prime Finance and Electronic Equities clients. The German institution had confirmed that it would exit equities sales and trading and prime finance in a major restructure.

BNP Paribas reported plans to launch an expanded prime services division this year, as the banks have completed the transfer of clients, technology and key staff from Deutsche Bank’s Global Prime Finance and Electronic Equities businesses to BNP Paribas. Over the past two years, BNP Paribas has transferred approximately 900 staff globally from Deutsche Bank.

- According to the Form ADV data on RADiENT in the year 2021, 153 firms worldwide disclosed Deutsche Bank as their prime broker.

- Data shows that BlackRock and AQR are the largest firms by AUM to be serviced by Deutsche Bank’s prime services.

Private Funds Serviced by Deutsche Bank

According to the data on RADiENT, in the year 2021, 443 global funds and 317 US private funds reported Deutsche Bank as their Prime Broker. The following table shows the categories of private funds serviced by Deutsche Bank for the year 2021. This table reports only aggregated US private fund data as disclosed in their Form ADVs

|

Type of Fund |

No of Funds |

|

Hedge Funds |

288 |

|

Private Equity Funds |

17 |

|

Real Estate Funds |

2 |

|

Venture Capital Funds |

1 |

|

Securitised Asset Funds |

0 |

|

Liquidity Funds |

0 |

|

Other Private Funds |

9 |

The largest funds serviced are- hedge fund managed by Citadel Advisors with a gross asset value of $117B and a private equity fund managed by Softbank Vision Fund LP with a gross asset value of $70B.

Credit Suisse

The blow-up of Archegos in early 2021 severely affected the global banking sector. Nomura reported a $2.9 B hit and suspended its head of prime brokerage, and UBS revealed a $861M loss from the debacle. This fiasco cost the Swiss-Bank $5.5B.

Following Archegos’ downfall, in November 2021, Credit Suisse decided to exit most of its Prime Service Operations from January of this year, cutting the investment bank division’s capital by some $3 B or 25 per cent, with approximately $3.3M redeployed to its wealth management operations. The bank has decided to focus on reorganising the group into four divisions with a “simplified model” – wealth management, investment bank, the Swiss bank, and asset management.

In addition, Credit Suisse is set to reduce its long duration structured derivatives book, while exiting approximately 10 non-core Global Trading Solutions markets. The only factions of the prime services that the bank will retain are – Index Access and APAC Delta One.

For their existing clients, Credit Suisse has signed a referral agreement with BNP Paribas for the latter’s prime and derivatives clearing services. This agreement is a major win for BNP Paribas in its efforts to continue to grow the business which has undergone significant changes over 2020 and 2021.

- RADiENT data shows that a total of 271 firms globally disclosed Credit Suisse as a prime broker in 2021. Pacific Investment Management Company and Alliance Bernstein are some of the largest firms serviced by the prime brokerage wing of Credit Suisse.

- Pacific Investment Management Company LLC’s (regulatory AUM of $2.9T) form N-CEN data on RADiENT that 16 PIMCO Funds pay $723,000 in brokerage to Credit Suisse. The largest amount of brokerage is paid by the PIMCO Trends Managed Futures Strategy Fund, - $ 531,000.

- Alliance Bernstein’s latest Form NCEN discloses that 6 funds of its Bernstein Sanford C Fund Inc, 15 funds of its Financial Investors Trust and 13 of its AB Cap Fund Inc are serviced by Credit Suisse.

Private Funds Serviced by Credit Suisse

Data also shows that for the year 2021 a total of 640 US private funds across different categories was serviced by Credit Suisse. The following table shows the categories of private funds serviced by Credit Suisse for the year 2021. This table reports only aggregated US private fund data as disclosed in their Form ADVs

|

Type of Fund |

No of Funds |

|

Hedge Funds |

620 |

|

Private Equity Funds |

8 |

|

Real Estate Funds |

4 |

|

Venture Capital Funds |

2 |

|

Securitised Asset Funds |

0 |

|

Liquidity Funds |

0 |

|

Other Private Funds |

6 |

The largest fund serviced was a hedge fund managed by Millenium Partners LP with a GAV of $289B.

Way ahead for BNP Paribas

“BNP Paribas SA plans to unseat Barclays PLC as Europe's top global prime broker to hedge funds, leveraging on its acquired business from Deutsche Bank AG”, Olivier Osty, head of global markets, BNP Paribas. The integration of Deutsche Bank’s prime services with BNP reportedly brings up to $200B in assets.

BNP Paribas’s equity and prime services revenues reached $ 952M in the third quarter of 2021, up 79.3% from $532 M a year before. For the first nine months of the year, the business made up about 20.9% of revenue in the corporate and institutional banking division.

Market Share of BNP Paribas, Credit Suisse and Deutsche Bank

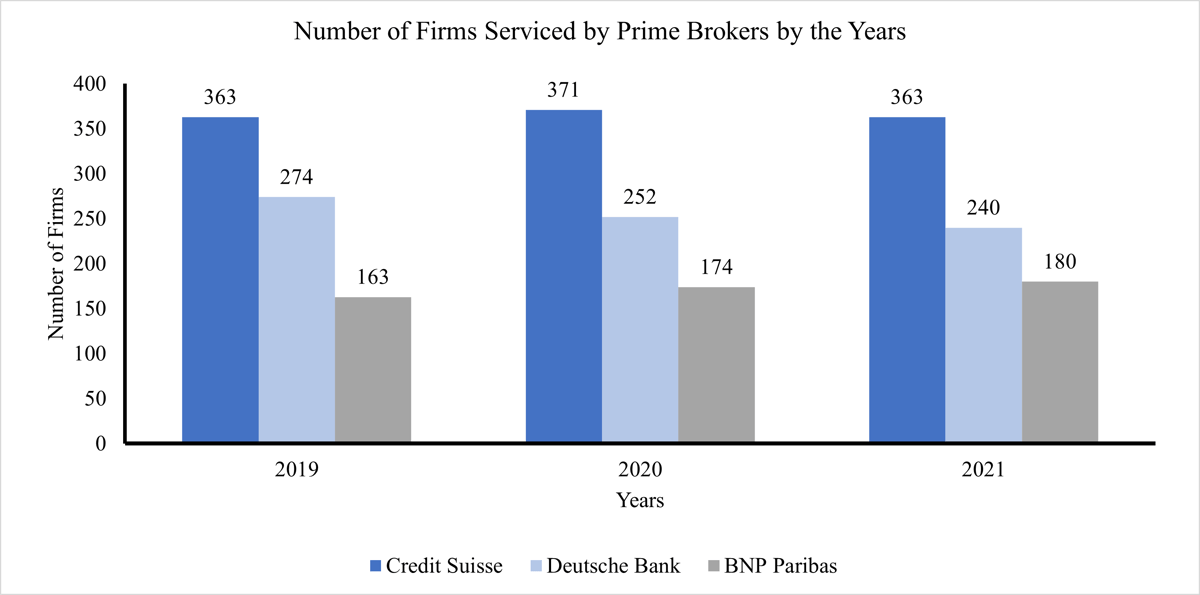

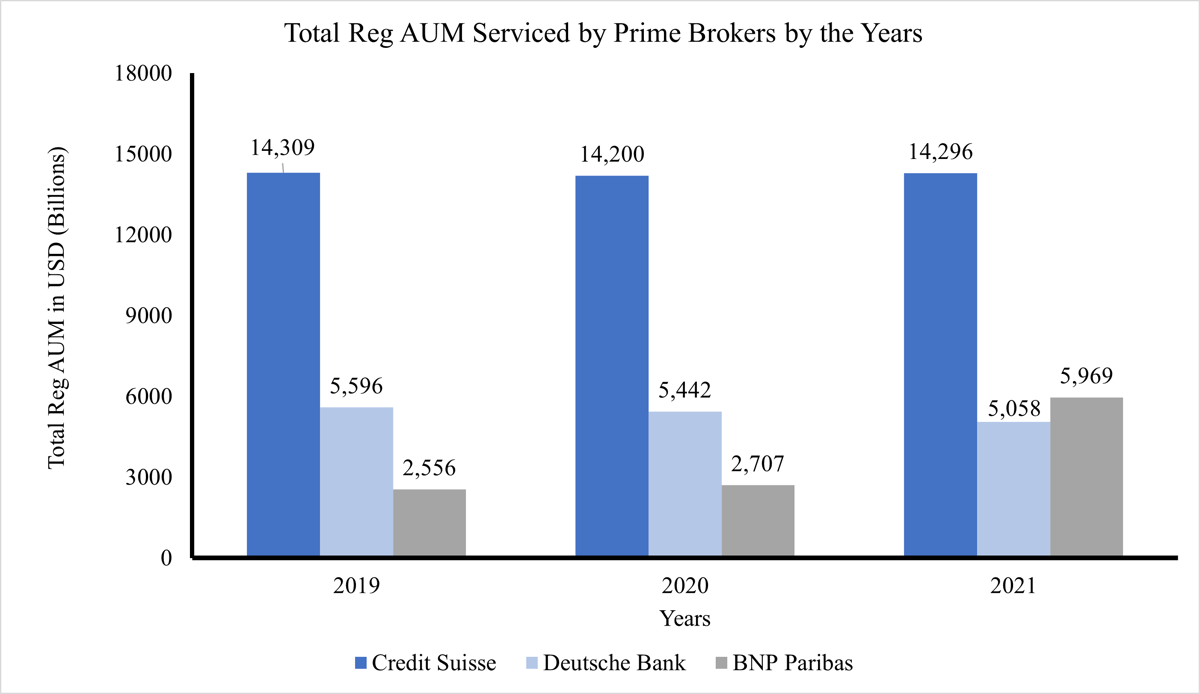

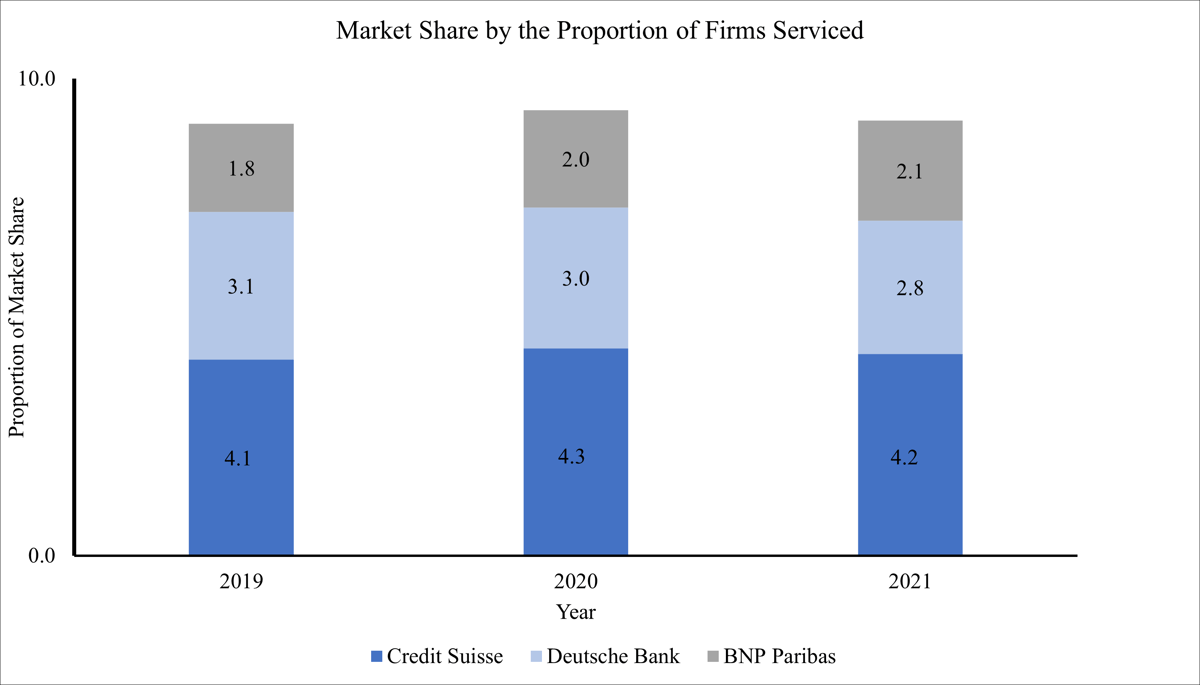

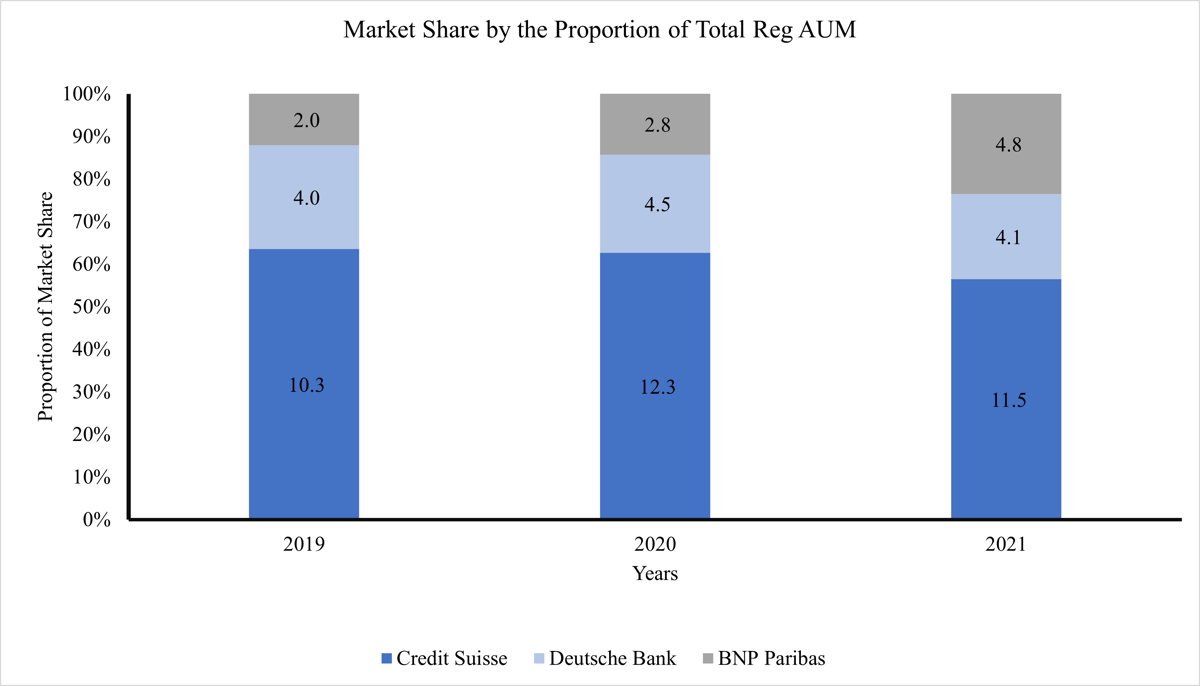

The graph above shows that the market share of BNP Paribas both by the number of firms serviced and total reg AUM has increased yearly from 2019. BNP Paribas can get a significant boost from the agreements that it has signed with Deutsche Bank and Credit Suisse.

As of 2018, the global ranks ( by the number of hedge funds serviced) of Credit Suisse and Deutsche Bank’s prime brokerage services stood at 3rd and 6th respectively, while BNP Paribas stood at the 29th position ( Prequin).

RADiENT data shows that the number of firms and the total reg AUM under BNP Paribas has increased every year since 2019. Whereas, the number of firms serviced by Credit Suisse and Deutsche Bank has reduced in 2021. Deutsche Bank’s fall in the number of firms serviced and total reg AUM and BNP Paribas subsequent increase in both these metrics aligns with the 2019 agreement that the banks signed. According to the data, BNP Paribas should benefit from Credit Suisse’s referrals, as this should increase the former’s prime services market share.