Form ADV is a treasure trove of information on investment management companies because of the data it contains about their clients, assets and activities.

Section 7B of the form details information on private funds that an investment adviser manages such as fund type, Gross Asset Value (GAV), and the service providers that the adviser engages with - prime brokers, administrators, custodians, marketers and auditors.

The RADiENT Service Provider Trends tool facilitates insights such as rising new prime brokers, the new funds they acquire, and the assets they manage.

Prime Brokers Snapshot - Dec 2018

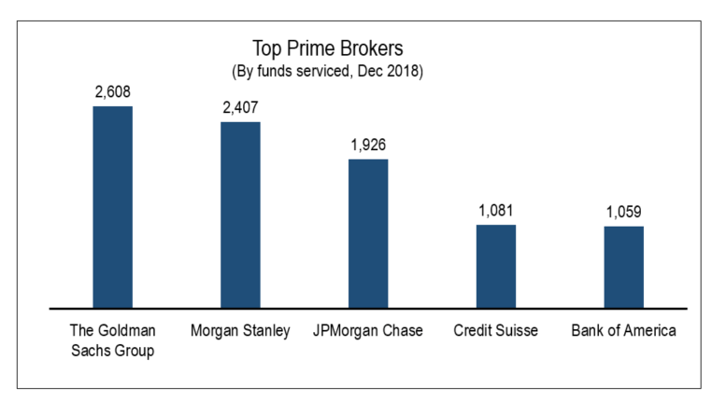

To begin with, we look at the top Prime Brokers (servicing the largest number of funds) as of Dec 2018

Goldman Sachs is at the top of this list, currently servicing over 2,600 funds, with Morgan Stanley at a close second. These five prime brokers alone account for more than 50% of all registered adviser funds!

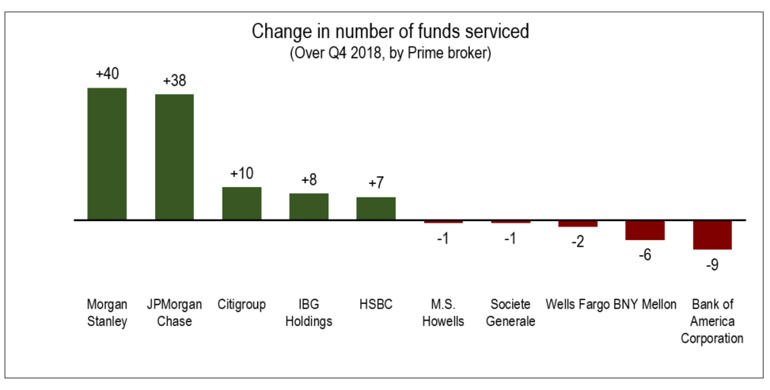

RADiENT also allows us to track developments in the entire Prime Broker space over time, and even isolate activity at an individual firm level.

A Deeper Dive

Another lens to analyse the growth of a broker’s business is through the increase or decrease in total GAV of funds serviced, in addition to the absolute number of funds itself.

For example, HSBC shows a decrease in the total gross asset value (GAV) of its funds by 3.5%, but reports an increase in the number of funds. On digging deeper, in the last quarter of 2018, even though the total GAV serviced went down, HSBC added several funds managed by Global Macro Advisor LLC to its list of clients.

HSBC Prime Statistics

|

Funds serviced as of Oct 1st 2018 |

93 |

|

Funds serviced as of Dec 31st 2018 |

100 |

|

Change in funds serviced (#) |

7 |

|

Gross asset value as of Oct 1st 2018 ($ B) |

479.1 |

|

Gross asset value as of Dec 31st 2018 ($ B) |

462.1 |

|

Change in gross asset value ($ B) |

-17.0 |

|

Change(%) gross asset value |

-3.5% |

Visit RADiENT Form ADV to get a better look at the different service provider trends now!