One of the primary considerations while building a long-term portfolio should be diversification across securities, asset classes and domiciles. Portfolio diversification ensures drawdowns are limited and reduces return volatility.

Amidst a scenario where annualized market volatility over the last one month was over 30%, we outline the benefits a diversified equity, debt and gold portfolio would have over a concentrated portfolio. This portfolio was built on RADiENT, and all risk tools used in this blog are available for FREE on RADiENT.

Step 1: Screening and selecting funds

After filtering dozens of funds by criteria such as returns, sector correlation, drawdown, fund house etc on Screener, we build a simple portfolio on Portfolios with weights assigned to the following ETFs :

|

ETF |

Ticker |

Weight |

|

Vanguard Information Technology ETF |

15% |

|

|

Health Care Select Sector SPDR Fund |

15% |

|

|

Vanguard Financials ETF |

15% |

|

|

Consumer Staples Select Sector SPDR |

10% |

|

|

Vanguard Consumer Discretionary ETF |

15% |

|

|

iShares MSCI Emerging Index Fund |

10% |

|

|

iShares Core U.S. Aggregate Bond ETF |

12% |

|

|

SPDR Gold Trust |

8% |

Step 2: Monitoring different risk measures

Once we build this sample portfolio, we verify certain risk measures on RADiENT such as

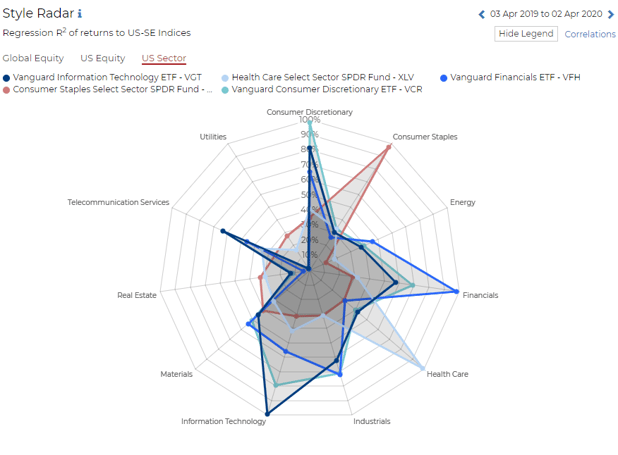

- Correlation of securities with different sectors:

From the image below we can see that while each ETF is highly correlated with the sector it tracks, its correlation with other sectors is relatively low. There is now adequate diversification among the equity securities

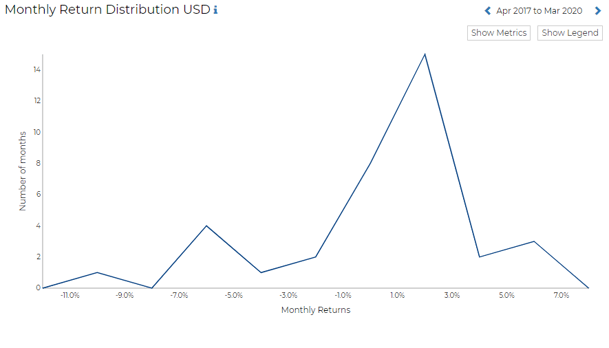

- VAR for the portfolio:

The return distribution graph on the Portfolios tab shows that despite a highly volatile environment the highest negative monthly returns in the last one year were -10% vs S&P 500 index returns of -12.5%.

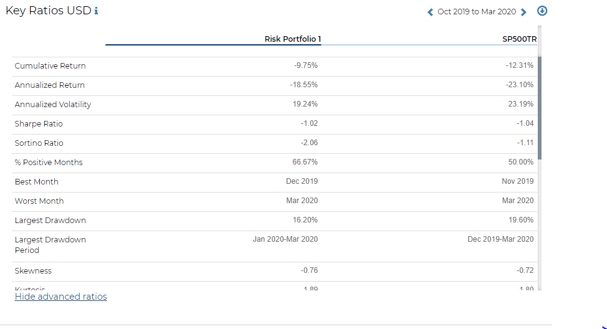

- Key Metrics:

Step 3: Set notifications for events

Monitoring your portfolio regularly to rebalance it when weights change drastically is a boring and tedious task. RADiENT will simplify this part by sending you notifications on fixed set dates. Asset values are calculated daily so you can log into the platform anytime to see your portfolio value.

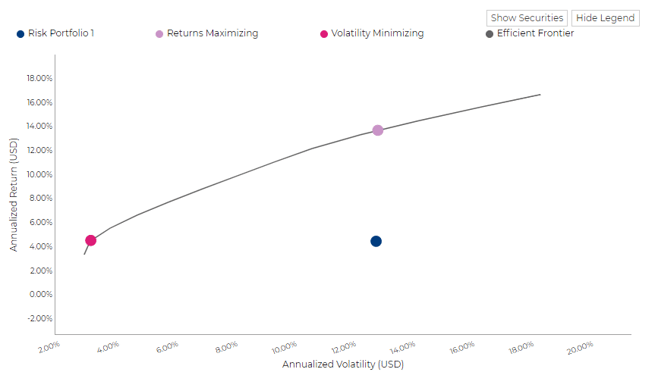

Step 4: Optimize your portfolio for maximum returns

Portfolios contains an optimization feature which lets you rebalance your portfolio for maximum returns / minimum volatility based on modern portfolio theory. Mean-variance optimization and Scenario (Black Litterman) optimization can be executed at the click of a button.

The resulting portfolios after executing optimization are plotted on the efficient frontier as displayed below, and the option to adjust portfolio weights is also given.

We hope you found this blog useful and informative. Click here to build portfolios and use these risk tools on RADiENT.