While the US stock market has bounced back since the initial bear during the onset of the pandemic, the focus is now largely on when everyday life returns to normal. Naturally, pharma companies at the forefront are fighting a multi-billion-dollar race to develop the fastest vaccine. To stop transmission by 2021, the development process has been compressed with pre-clinical and clinical trials phases combined. In this post we look at the securities in the race for the vaccine and hedge funds that have bet big on these stocks

Stocks under the lens

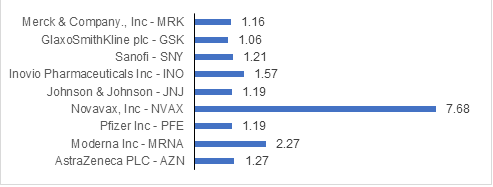

While the following stocks have all started the testing process, AstraZeneca with Oxford university, Moderna and Pfizer with BioNTech and Fosun pharma have got approvals for emergency / limited use cases. The data also shows GSK whose drug is still in preclinical phase having subdued growth compared to the rivals. Novavax climb is attributed to the success of NanoFlu drug coupled with its announcement of development of the COVID-19 vaccine

Superimposing with RADiENT 13F data shows increased interest in these stocks with more firms accumulating holdings on these stocks. Hedge funds such as Two Sigma entered into positions of AZN stock with $41M investment, increased its position in Pfizer by 75% and Sanofi by 50%. Point 72 on the other hand increased its stake in AZN by 30% but sold Pfizer. Similarly, AQR sold 10% in PFI and took a new position in Inovio with $1.7M investment.

| Drug | Buys | Sells | # HF's |

| AstraZeneca PLC - AZN | 455 | 66 | 77 |

| Pfizer Inc - PFE | 1174 | 926 | 171 |

| Sanofi - SNY | 369 | 81 | 51 |

| Inovio Pharmaceuticals Inc - INO | 107 | 6 | 20 |

| GlaxoSmithKline plc - GSK | 532 | 171 | 69 |

| Merck & Company., Inc - MRK | 1400 | 787 | 184 |

| Johnson & Johnson - JNJ | 2209 | 484 | 213 |

As the pandemic starts to stabilize it will be interesting to see the firms that stand to gain big from the pandemic.

For more healthcare fund information you can check out FSMEX, PRHSX, BHSRX and VGHAX on RADiENT!