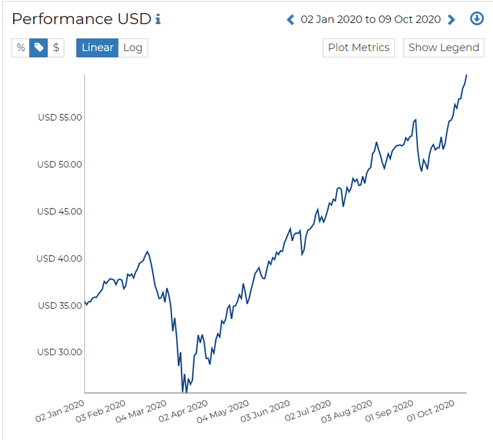

Delaware Smid Growth Fund (DFDIX) has been one the best performing mutual funds in this tricky year given the uncertainty of the COVID pandemic and the upcoming US elections. A quick glance at the fund using the RADiENT security analyzer shows that its price almost doubled from $35.43 at the start of the year to $59.60 by the first week of October. Despite large drawdowns of upto 37% in the lead up to the pandemic from Feb to March, this is quite an achievement. The style analysis of DFDIX returns shows strong correlation with consumer discretionary that was largely affect by Covid and IT sector . An analysis of the fund’s N-PORT filing on RADiENT can provide key insights into the drivers of return and risk for the fund enabling the asset managers to better manage the portfolios and intermediaries to identify more sell-to opportunities.

N-Port Overview

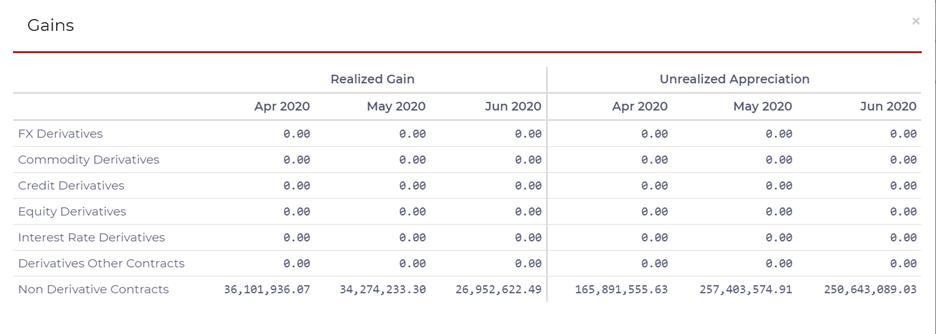

The N-Port breaks down the quarterly returns for each of the different classes of the fund each of which can be viewed in detail in the RADiENT platform. The realized gain and unrealized appreciation across the different asset classes each month show more selling activity in the first half of the quarter as Covid hit, and larger unrealized appreciation as market conditions improved over April to June.

Tracking this information along with turnover of the fund gives an indication on the buying and selling activity of the manager. The fund outflows also show a similar trend with decreasing trend in redemption from $56M in April to $40M in June and sales going from $228M to $111M.

The form N-Port also gives the risk measures of each of the asset classes held in the fund. As an all equity fund, the measure tracked for Delaware Smid Growth Fund (DFDIX) is the proportion of securities that experience greater than 10% fall in value. Given the April-June market conditions, having just 34% of securities experience steep fall in value is justifiable.

Portfolio Transactions

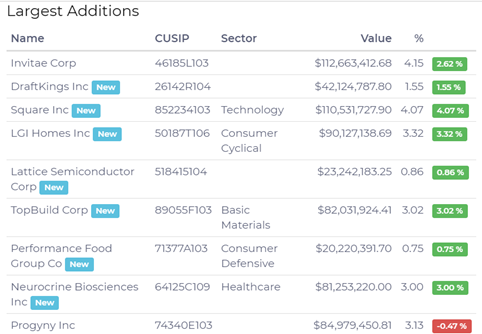

Holding analysis of the fund show several large bets in new portfolio additions with $30M investments into DraftKings Inc, Square, LGI Homes, Lattice semiconductor, TopBuild Corp, Performance food group, Neurocrine Biosciences and Planet Fitness. While some investments are in the technology and consumer sectors, the inclusion of LGI Homes, Top Build and Neurocrine imply significant commitment in real estate and Pharma stocks.

The key portfolio deletions show a significant sale of Yeti Holdings to the tune of $127M since the company, which designs and distributes products for recreation and outdoor activities, could likely face longer road to recovery

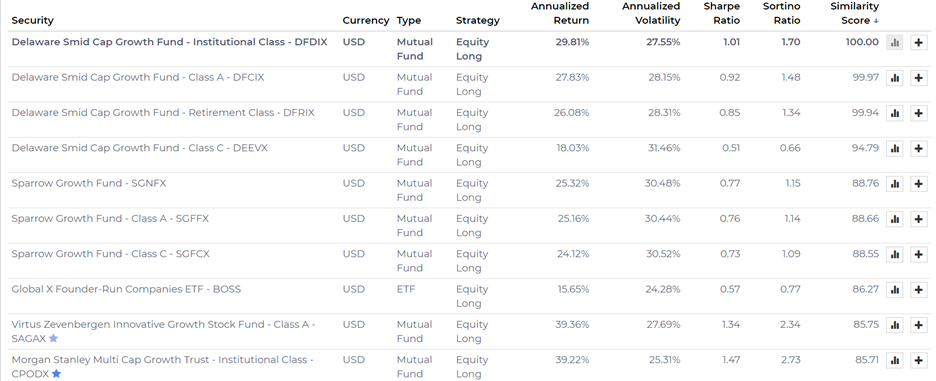

The full list of holdings with ~45 securities is also provided and used as input in our proprietary similar fund’s analysis. Basis the holdings and the proportion in the portfolio, the algorithm suggests Sparrow Growth fund, Global X and Morgan Stanley Multi Cap Growth as nearest to the current year top performing Delaware Smid Growth Fund

For more information on N-PORT filings of major funds check RADiENT!