It’s been more than a month, and the Corona virus has continued spreading across the globe, wreaking havoc on financial markets. With oil demand predicted to fall, and no consensus with between Russia and OPEC on production cuts, oil prices plunged by almost 30% as the OPEC decided to initiate a global price war. This added to the already heightened volatility in financial markets.

On the 9th of March, bond yields across the world touched a record low as there was a safety flight of capital from equities to treasury bonds. Though earnings yields continue to fall, this year has seen high returns in 2 sectors.

In this blog we discover the 2 sectors which gave the best returns, the securities they contain and the reasons for their movement -

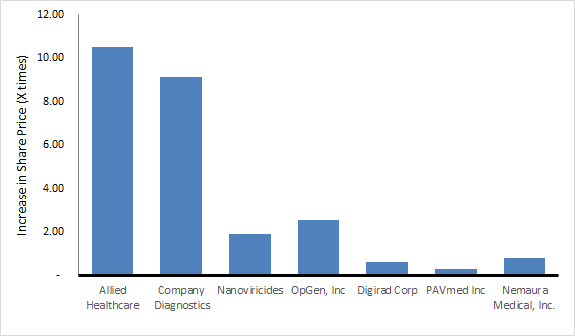

Diagnostics, Research and Medical Devices

In the wake of the spread of COVID 19 and subsequent increase in requirement of medical equipment throughout the world, diagnostic and medical devices stocks are in the green since Jan 2020. Some of the best performing stocks include

|

Stock |

Returns from 1st Jan 2020 (X times) |

Short Overview |

|

10.50 |

Makes respiratory therapy equipment, home healthcare products, emergency medical supplies |

|

|

9.15 |

Will collaborate in making molecular testing kits for the COVID 19 |

|

|

1.90 |

Completed the synthesis of a number of Nanoviricide drug candidates for testing of COVID 19 |

|

|

2.58 |

Will collaborate in making molecular testing kits for the COVID 19 |

|

|

0.64 |

Designs and makes diagnostic medical imaging products |

|

|

0.29 |

Submitted to the FDA groundbreaking technology which has the potential to have as great an impact on esophageal cancer |

|

|

0.81 |

Medical technology company focused on developing micro-systems-based wearable diagnostic devices |

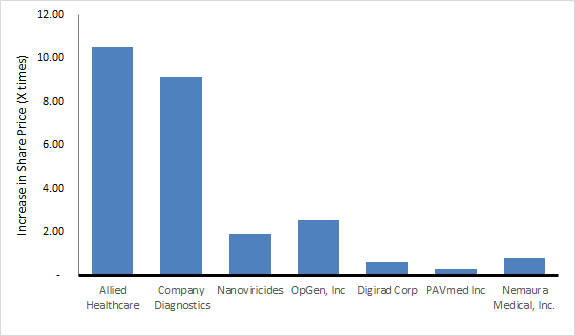

Biotechnology

Biotech is sure to remain one of the most volatile sectors this year, with share price increasing on the announcements of treatments and vaccines, and then declining on a fall in progress. However, successful companies are sure to see a massive earnings growth, even though we need to lookout for overvaluation due to initial reactions (e.g. in the case of Gilead). Some of the best performing stocks include

|

Stock |

Returns from 1st Jan 2020 (X times) |

Short Overview |

|

12.07 |

Experimental therapy to treat certain forms of pulmonary hypertension reported positive clinical data |

|

|

7.97 |

Clinical-stage biotechnology company focused on the discovery and development of direct lytic agents (DLAs) |

|

|

3.94 |

Clinical-stage gene therapy company, patented diabetes gene therapy technology this year |

|

|

3.90 |

iBio specializes in plant-based biologics manufacturing, plans to develop a plant-based vaccine to treat the coronavirus |

|

|

2.37 |

Program to develop oral tablet vaccine candidates based on 2019-nCoV |

|

|

1.85 |

Clinical stage immuno-oncology company developing therapies for the treatment of cancer |

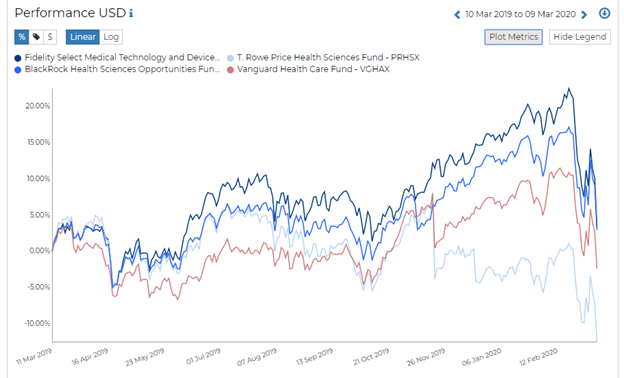

You can check out some of the largest healthcare funds such as FSMEX, PRHSX, BHSRX and VGHAX on RADiENT!

Hope you enjoyed our blog and stay tuned for more updates on funds!