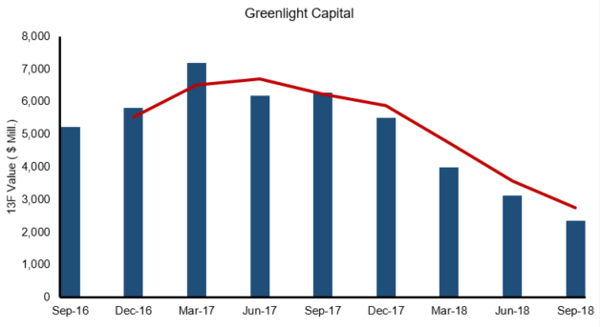

There’s no denying it – the last few years have been hard on David Einhorn. His Greenlight Capital's AUM (per Form ADV filings) was $12.2 billion at its height in 2015 falling 28% to $8.7 billion in 2017 and then a further 25% to $6.3 billion in 2018!

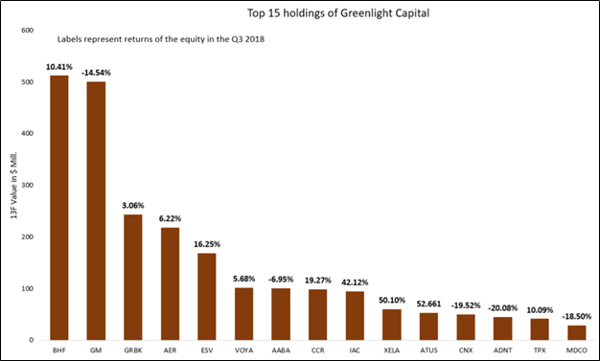

Einhorn’s 13F filings reveal the long side of his equity portfolio and this equity long AUM fell from $7.2 billion in March 2017 to $2.4 Billion according to Greenlight’s latest 13F filing as of September 2018.

However, he still manages over $6 billion and is one of the smartest investors we know. He did short Lehman right before the financial crisis after all so we track his investments carefully looking for that diamond in the rough!

What went wrong and where does Greenlight stand now?

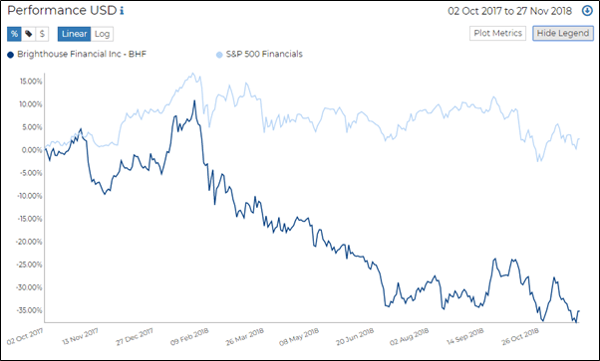

1. Brighthouse Financial Capital (NASDAQ : BHF)Greenlight first invested in Brighthouse in Q3 2017. Today, it is Greenlight’s largest holding (1/5th of its total portfolio value) and has returned over 10% in the last quarter. However, it has still lost more than 27% year-over-year (YoY) (from September 2017) since Einhorn first invested! A large chunk of the portfolio erosion of Greenlight can be attributed to Brighthouse alone.

Post 13F filings, Brighthouse shares have once again plummeted by more than 9%. A comparison of Brighthouse with S&P Financials from October 2017 reveals a gap of more than 35%.

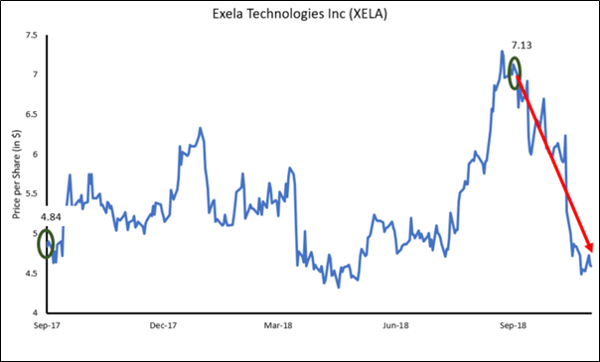

2. Exela Technologies Inc. (NASDAQ: XELA)

Exela Technologies is a global business process automation solution provider with a market capitalization of $696 million. Out of this, Greenlight holds more than 5% (i.e. 8 million shares).

Exela rose by 45% (YoY) since Einhorn first invested in it, in September 2017. It has gained more than 50% on a quarter-over-quarter (QoQ) basis from July 2018 till September 2018!

However, similar to Brighthouse Financial, it has dropped spectacularly from September 2018 by more than 50% till date, erasing all previous gains.

Ensco is a global provider of offshore drilling services to the petroleum industry. Einhorn invested in Ensco in the last quarter of 2017 and acquired 20 million shares by March 2018.

Ensco has proved to be a reliable bet, increasing in value every quarter. By September 2018, Greenlight’s holdings in Ensco appreciated by more than 45% (from December 2017).

However, after September 2018, Ensco has tanked by more than 25%, twice the amount of the S&P 500 Energy index.

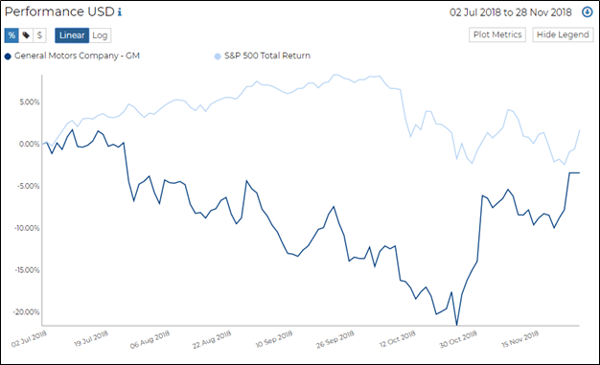

4. General Motors (NASDAQ: GM)

GM was one of the worst performers on the S&P 500 index for the year ending September 2018, amidst global restructuring efforts. Greenlight has been slashing its positions in GM since March 2017, when it held more than 72 million shares. Since then Greenlight has liquidated more than 75% of its holdings in GM. However, GM remains its second largest holding at the end of Sep 2018.

GM has lost over 15% in the last quarter alone. However, post announcements of plant closures and layoffs in the United States at the end of Oct, GM shares have gained more than 15%, which is good news for Einhorn.

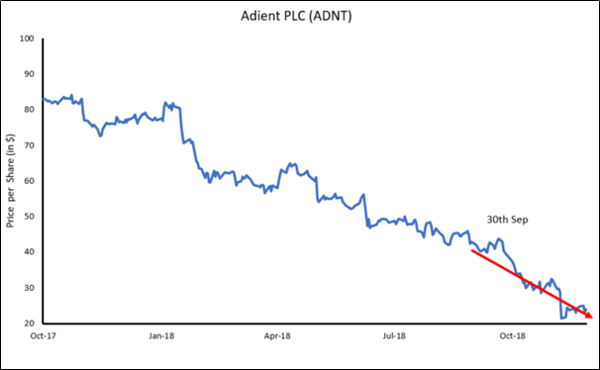

Adient plc is an automotive parts manufacturer focused on automotive seating. Greenlight Capital holds more than 1 million shares of Adient, which is its 13th largest holding. Adient lost more than half of its market value between September 2017 and September 2018.

While Greenlight aggressively dumped half of its holdings in Adient from December 2017 to June 2018, it went bullish on the share in the 3rd quarter of 2018 and purchased half a million units. As of today, it has lost more than 70% of its market value of 30th September 2018!

Summary of Greenlight's latest 13F filing

Though Greenlight Capital’s 13F market value reduced this quarter, they did record positive returns in 11 of out of their 15 largest holdings. Greenlight also made their portfolio more concentrated, and now invests in only 20 equities. They hold almost half of their portfolio value in Brighthouse Financial and General Motors alone.

Since a lot of their positive positions have deteriorated since September 2018, it will be interesting to see if they stay invested. I can't wait to see what their December 2018 13F filing reveals!