In this blog article, we will take a closer look at the hedge fund industry and analyze some of the major hedge fund’s recent 13F filings. Specifically, we will focus on ClearBridge Investments LLC, Fisher Asset Management and Dimensional Fund Advisors and examine their investment portfolios, top holdings, and recent trading activity.

ClearBridge Investments

Clearbridge Investments is a hedge fund based out of New York with 110K+ clients and 13F market value of $120B. Recent 13F filing shows that the fund holds 744 securities, and the top 10 holdings account for 22.3% of the portfolio.

The firm's largest allocation is in Technology, Healthcare, Financial Services sectors.

More 13F activities

- Turnover: 15.73%

- Number of positions entirely liquidated: 30

- Number of new positions added: 87

Top holdings include:

- MSFT ($5.5B)

- Apple ($3.3B)

- UnitedHealth Group ($3B)

- Amazon ($2.9B)

- VISA Inc ($2.5B)

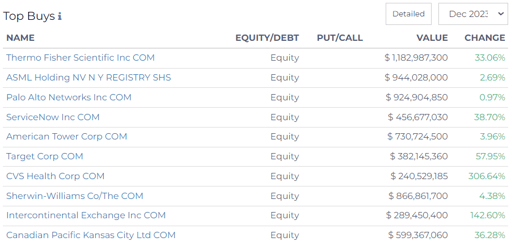

Some of the top buys of the hedge fund include:

- Value : $1.1B

- Change in shares %: + 33.06%

- Value : $944M

- Change in shares %: +2.69%

- Value : $456M

- Change in shares %: +38.7%

- Value : $382M

- Change in shares %: +58%

Securities completely sold out:

- Unity Software

- Activision Blizzard Inc

- New Relic Inc

- DexCom Inc

Fisher Asset Management

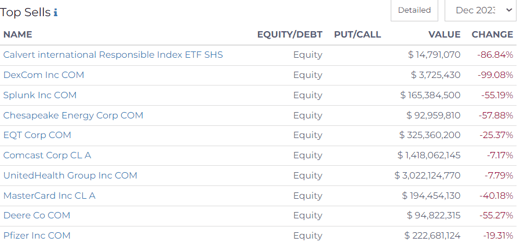

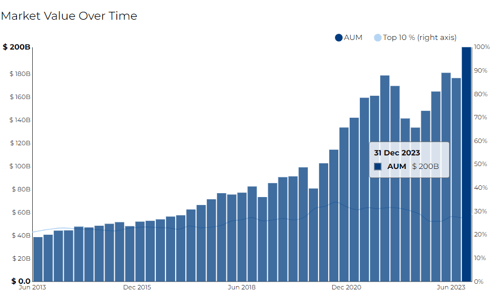

Fisher Asset Management is a hedge fund with 133K+ clients and with an AUM of $203B (As per the latest Form ADV).

The top 10 holdings concentration of 28.73%.

The firm's largest allocation is in Technology, Financial Services, Consumer Cyclical sectors.

More 13F activities

- Turnover: 21.79%

- Number of positions entirely liquidated: 130

- Number of new positions added: 123

Top holding include:

- Apple ($10.5B): AAPL is currently the top position at 5.20% of the portfolio.

- MSFT ($9.5B): MSFT is a top-three 4.71% of the portfolio position. It is a very long-term stake that has been in the portfolio for well over a decade.

- Alphabet Inc ($6.7B)

- Amazon ($6.4B)

- Vanguard Scottsdale ($6B)

Some of the top buys of the hedge fund include:

- Value : $9.5B

- Change in shares %: +1.84%

- Value : $1.9B

- Change in shares %: +8.22%

- Value : $4.4B

- Change in shares %: +7.12%

Securities completely sold out:

- Itau Unibanco Holdings

- Banco Bradesco SA SP ADR

- Lazard Ltd

Other insights:

- Fisher's 13F portfolio value increased by approximately 15% to $203 billion in Q4 2023 from Q3 2023.

- The number of holdings decreased from 1168 to 1161, with significantly large positions decreasing from 66 to 65.

Dimensional Fund Advisors LP

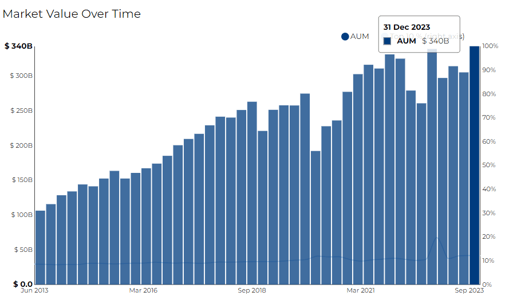

This Austin-based hedge fund, has 13F market value of $340B.

The top 10 holdings contribute 12.11% to the 13F market value.

The firm's largest allocation is in Technology, Financial Services, Industrials sectors.

More 13F activities

- Turnover: 4.95%

- Number of positions entirely liquidated: 112

- Number of new positions added: 57

Top holding include:

- Apple ($8.9B)

- MSFT ($8.5B)

- Amazon ($3.6B)

- JP Morgan Chase Co ($3.6B)

- Exxon Mobil ($3.2B)

Some of the top buys of the hedge fund include:

- Value : $3.1B

- Change in shares %: +44.05%

Amazon

- Value : $2.9B

- Change in shares %: +4.67%

- Value : $1.7B

- Change in shares %: +5.34%

Securities completely sold out:

- Activision Blizzard Inc

- Hostess Brands Inc

- Bunge Limited

- Veritiv Corp

To track more recent 13F filings visit our page, here.