Every quarter, institutional investors are required to disclose their detailed holdings and security transactions to the SEC via Form 13F filings. These filings offer insight into the portfolios and asset allocation strategies of Wall Street’s top stock pickers, and are useful for individuals and other investors to research new securities, analyze manager performance and construct portfolios on their own.

Daniel Loeb's Third Point LLC, one of the largest activist firms with assets under management of $ 27 Billion , holds more than half of its AUM value 13F listed securities.

An analysis of these holdings on RADiENT Form 13F reveals-

Third Point's largest investments in Q2 were in technology and manufacturing

Some of Third Point's largest acquisitions were securities of NXP Semiconductors, Paypal, Deere, Dell and Microsoft Inc- companies primarily engaged in either manufacturing and technology. All of these are new additions to its portfolio. NXP Semiconductors tanked by almost 30% post acquisition , while Deere and Agilent posted positive returns .Other large buys were in the financial services, energy and food products space - with larger investments in Visa Inc, Energen, PVH Corp and Campbell Soup.

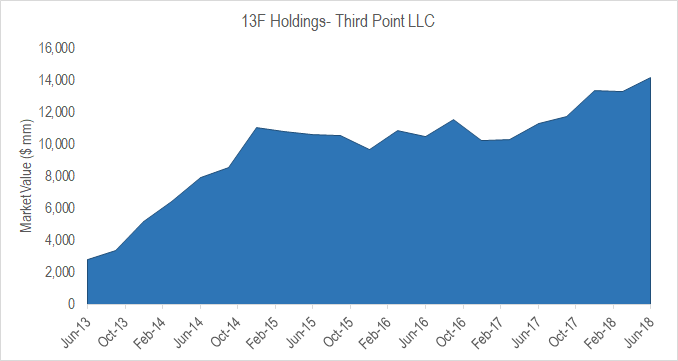

The market value of Third Point's investments in 13F listed securities increased by 7.5% (in Q2) and they slashed their entire position in 13 equities

A comparison of filings across different quarters from June 2013 reveals that Third Point has steadily increased its investments in market listed securities, and in the last quarter the market value of its 13F portfolio increased by almost $1 Billion . Its largest sale was Alphabet Inc where it closed positions of around $600 Mill. It holds around 70% of its total portfolio value in these 10 securities:

Argentina fell out of favor with Loeb

Third Point had substantial holdings in emerging markets during early 2018, with most of its investments in Argentinian corporations. However in the second quarter of 2018, it liquidated all its Investments in South America (around ~$410.1 Mill), due to mounting losses and a weakening Argentinian currency. In addition to these companies, Third Point also closed all its positions in Alphabet, Intercontinental Exchange, Mohawk and Monsanto

Share prices of EA and Campbell drop post acquisition

The legal tussle between the Campbell Board and Third Point is no secret. Campbell Soup lost more than 8% post acquisition, whilst EA dropped by more than 30 %! Other opposite moves were NXP Semiconductors, PVH Corp and DowDuPont. Find other such securities, where prices and holdings moved in the opposite direction, with the "Opposite Moves" feature on RADiENT.

Summary

Third point redefined its entire portfolio this quarter, making additional purchases for 9 existing securities (largest acquisition was Microsoft), entering into 12 new positions and fully liquidating 14 positions in 13F listed securities.

The market value of its holdings in public listed securities appreciated by ~$ 1 billion, out of which almost 63% can be attributed to movements in prices of the securities constituting the portfolio!

Conduct a thorough analysis of hundreds of other firms and construct your next portfolio on the basis of these findings, on RADiENT!