The exchange traded fund industry is booming like no other – with returns closely tracking the index, low expense ratios, and high liquidity, it’s not hard to see why. However in 2018, ETFs fell along with the US markets– the median return of over 2,000 ETFs was a negative 9.70%!

There were some funds that delivered superior returns despite market events, and we thought it would be an interesting exercise to analyze the reasons behind their performance.

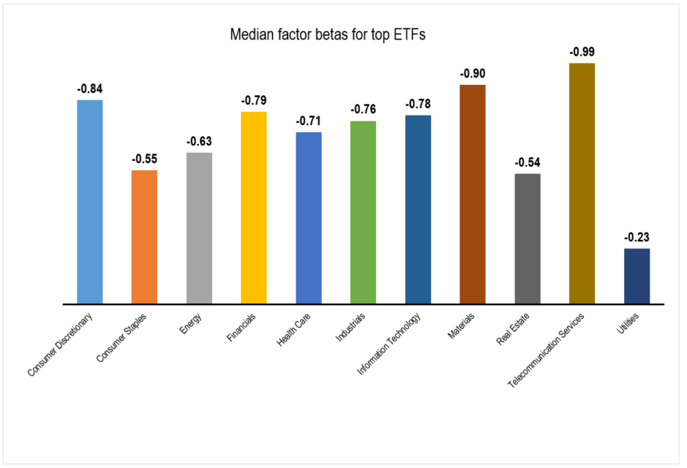

Beta NEGATIVE across ALL sectors in 2018

The median betas of these top ETFs with 11 S&P Sector indices (henceforth referred to as factors), were all negative ranging from -0.23 for Utilities to -0.99 for Telecommunication. 75% of top funds had negative betas for EVERY factor, despite some sectors like Healthcare and Utilities posting marginal positive returns.

9 out of the top 10 funds in the sample had negative betas against EVERY sector! We can infer that if you invested in 2018, you had a better chance of positive returns, if you selected funds negatively correlated with all indices!

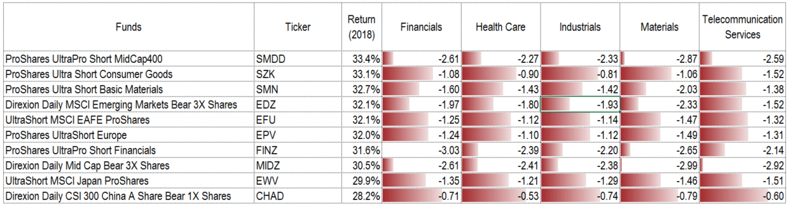

Short funds dominate 3:1

Among the top performing funds, “Short” and “Bear” funds were most prevalent (36 out of 56), delivering a median return of 20%! 31 out of 36 short funds had negative factor betas for every sector. The largest negative exposures were taken in Telecommunications, Materials and Financials.

A few of these short funds that did have positive betas preferred sectors such as Consumer Staples and Utilities.

Top 10 Short ETFs with Sector Betas

You can find all these funds on RADiENT here.

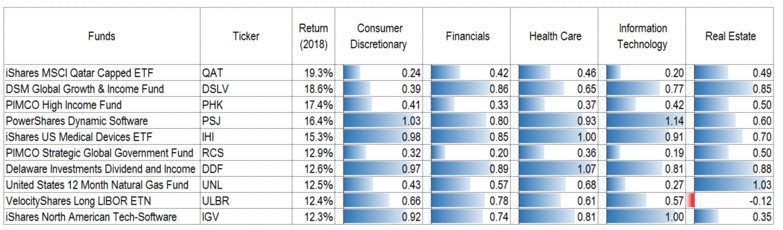

35% of top funds WERE long – so what did they get right?

Even though the S&P 500 ended on a negative note in 2018, 35% of the funds in our top funds sample were funds not explicitly termed “bear” or “short”. These funds generated median returns of 14.65%.

These funds preferred to take strong exposures in Financials, Utilities, Healthcare and Information Technology and combined them with negligible betas in other sectors as well.

Top 10 Long ETFs with Sector Betas

You can find all these funds on RADiENT here.

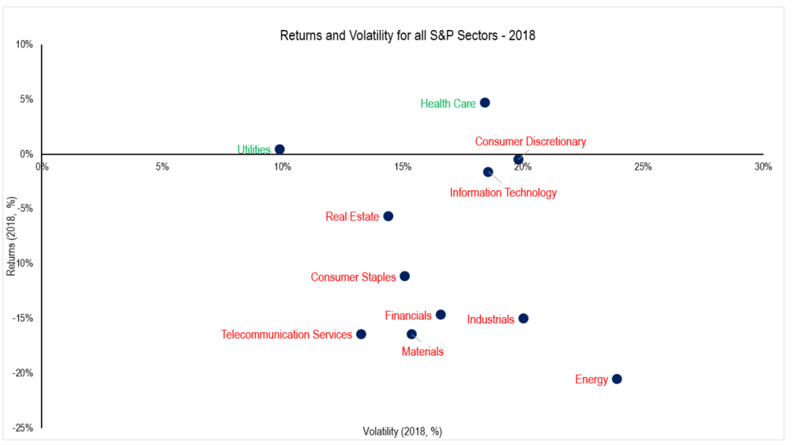

Review of sector performance and fund betas

A look at all 11 sectors reveals that it was a bleak year for most of them individually too – only 2 indices (Healthcare and Utilities) managed to post positive returns, and negligible ones at that!

Healthcare is a clear winner with a 4.69% return favorable for higher future earnings as it is not generally considered to be as cyclical as other sectors. Healthcare job growth outpaced other sectors as well, creating 346,000 jobs last year.

Utilities is considered another relatively inelastic sector, generally one of the low and stable performing ones, but last year, a lot of the top performing long ETFs were either natural gas or electricity focused.

Would you like to find more funds by factor drivers ? Try our fund explorer now!