The 13F filings for the third quarter of 2018 are in – and it’s time to take a look at what Wall Street’s high profile hedge fund managers are holding.

For those who are wondering what Form 13F is – it is a quarterly report mandated by the SEC for all asset managers with qualified assets of at least $100 Million.

Besides the highly publicized Facebook (NASDAQ: FB) and NXP Semiconductors (NASDAQ: NXPI) exits, and news that fund managers have maintained holdings in Apple (NASDAQ: APPL) and Microsoft (NASDAQ: MSFT), there were certain interesting transactions by a large majority of the filers which went unnoticed.

Here are some insights into 7 equities which stood out based on certain selection parameters:

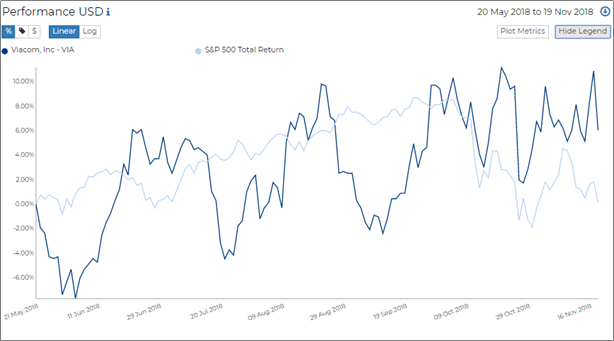

Active 13F filers invested almost $ 2.5 billion into VIA this quarter, doubling their existing holdings from the previous quarter. 43 filers increased their holdings, while 22 reduced their stake. The shares held in VIA by 13F filers after this quarter increased to 46 million from a mere 8 million!

A comparison of Viacom’s 6M performance with the S&P 500

Williams Companies, Inc (NASDAQ: WMB)

The Williams Companies have tanked in the last 3 months by more than -19%, but it looks like a lot of managers have spotted this as a good buying opportunity. Equity holdings of WMB among 13F filers increased by more than 50%. Over 400 filers increased their stake, while 180 trimmed down their holdings. The largest holder is now Blackrock, which holds shares worth $3 billion of WMB!

Dropbox share prices have dropped by more than 25% since it first listed in May, however that hasn’t stopped hedge funds and other asset managers from betting on this stock. Holdings in Dropbox increased by over 30 million shares among all 13F filers in the third quarter!

A look at the filers with the highest increases in holdings in DBX this quarter

iShares Exponential Technologies ETF (NASDAQ: XT)

The only fund to feature in this list - XT is held by over 60 firms. Holdings by 13F filers doubled this quarter as they bought over 40 million units between themselves!

This reaffirms asset managers’ continuing stand in the technology sector. The top holder of XT is Edelman Financial Services which holds units worth more than $ 1.5 billion. 8 out of the 10 top holders increased their holdings in the ETF last quarter

Fortive Corporation (NASDAQ: FTV)

Fortive Corp is an industrial conglomerate with technology businesses in wide variety of fields. It originated from the Danaher group in 2016 and has since delivered a cumulative return over 50%. In the last quarter, over 500 13F filers increased their stake in FTV by more ~75 million shares! 139 filers trimmed down their holdings. Fortive’s calculated ratios since the stock listed are given below.

Bayer AG (ADR) (NASDAQ: BAYRY)

BAYRY has tanked massively in the last 1 year, dropping by 42%! Last quarter, out of the top 10 holders, 8 slashed their holdings in the Bayer ADR. Bayer’s latest earnings were flat and investor concerns about the weed-killer ruling haven’t helped. Fund managers have dumped more than 20 million units of Bayer ADR in the last quarter.

Altaba (Yahoo!) Inc (NASDAQ: AABA)

13F filers slashed their holding by ~15.6 million shares of AABA in the last quarter, with more than 250 filers reducing their positions in the stock. The largest holder among 13F filers continues to be Elliot Management Corp followed by Farallon Capital. Despite the cut in holdings in aggregate among filers, both Elliot and Farallon increased their stakes in this security. Other notable holders who increased stakes include the Baupost Group, David Einhorn (Greenlight Capital) and Davidson Kempner.

Visit RADiENT to further analyze 13F filings today!