Q4 2018 was brutal – The S&P tanked by more than 14% resulting in investors pulling billions of dollars from top funds. While investors in sectors such as energy and materials were battered, those in healthcare fared better.

Amidst this global meltdown, some select securities were aggressively acquired by hedge fund managers at attractive valuations. In this blog, we take a look at these investments with data sourced from their latest 13F filings!

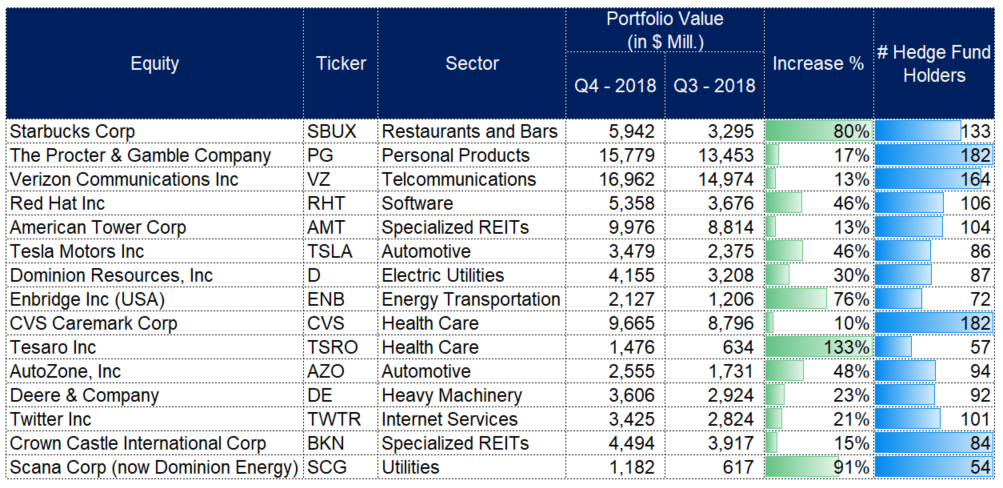

Equities in the limelight

Starbucks (SBUX), Tesaro (TSRO) and Scana Corp (SCG) recorded the highest increase on a % basis, with hedge funds increasing their holdings in these equities by more than 90%! The other equities which recorded substantial increases were Procter and Gamble (PG), Verizon (VZ) and Dominion Energy (D) . Hedge fund investors also reposed their faith in medical marijuana, increasing their stake in Aurora Cannabis (ACBFF) by over 2,000%!

Largest equity acquisitions by hedge fund investors

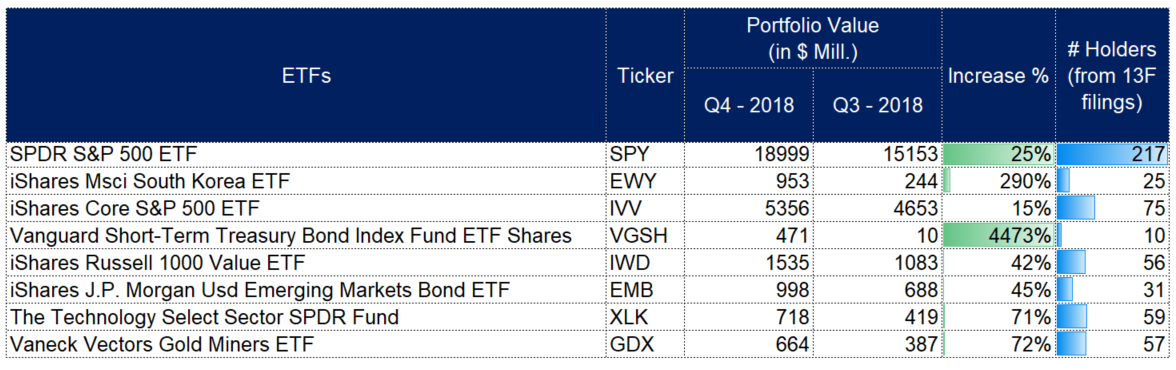

Treasury ETFs attract millions in sliding markets

Hedge fund managers invested large amounts in treasury and value factor funds, and the top 8 ETFs alone attracted more than $7 Billion.

Largest ETF acquisitions by hedge fund investors

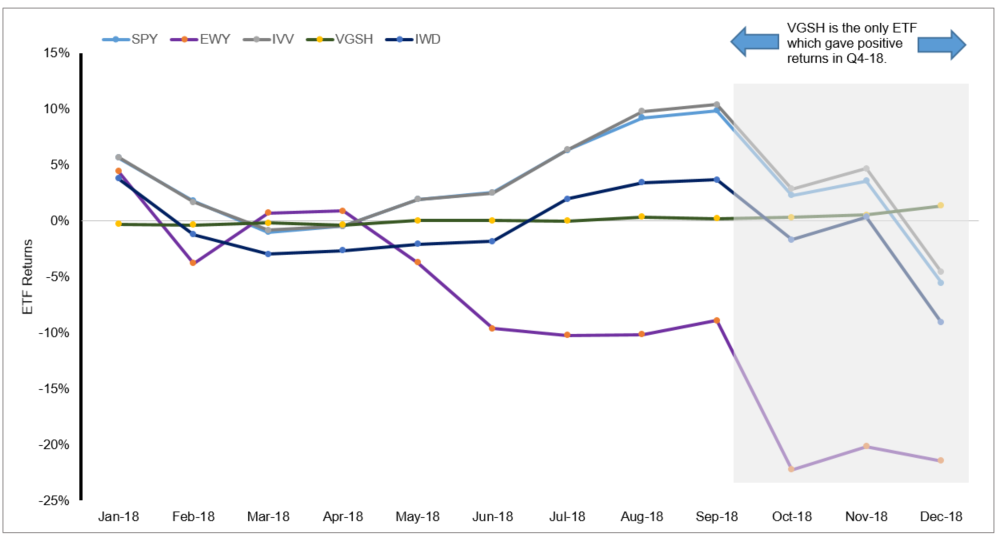

You can analyze the returns of all these ETFs on RADiENT here.

A comparison of the returns of top 5 held ETFS

Follow us on twitter for regular updates on 13F filings, and stay tuned for our blog on the activities of a top hedge fund manager later this week!