AbbVie Inc., for the period from January 1, 2023, to June 1, 2023, reported a 13F Value of $98.88 billion for the last held period, which ended on March 31, 2023.

AbbVie Inc., a research-focused pharmaceutical company, operates with a workforce of 29,000 employees. The company's portfolio comprises a variety of adult and pediatric pharmaceuticals, including treatments for conditions such as rheumatoid arthritis, psoriasis, Crohn's disease, HIV, cystic fibrosis complications, low testosterone, thyroid disease, Parkinson's disease, and complications related to chronic kidney disease, among others. In 2012, AbbVie launched a comprehensive Phase III program for Hepatitis C Virus (HCV) genotype one.

The forthcoming report utilizes data sourced from Radient Analytics. Let's delve into key changes that happened for AbbVie Inc., breaking down the 13F filings of its top buyers and sellers.

Top Buyers of AbbVie Inc. (ABBV)

In the recent period, several prominent financial institutions have turned their attention towards AbbVie Inc. (ABBV), a global biopharmaceutical company. The company has seen an influx of new investment from top buyers.

Leading the pack is BlackRock Inc., the world's largest asset manager. They've significantly established their position in AbbVie by acquiring a new stake valued at $22.1 billion.

Geode Capital Management, LLC, another notable new entrant, invested $5.4 billion into AbbVie.

Royal Bank of Canada, one of North America's leading diversified financial services companies, also marked its new position in AbbVie with an investment reaching $1.55 billion.

Europe's Amundi has also appeared on the list of top buyers, with a new investment in AbbVie totaling $1.39 billion.

Likewise, Putnam Investments LLC and HighTower Advisors, LLC, showed their interest in AbbVie by making new investments amounting to $454 million and $211.5 million.

Ameriprise Financial Inc and Goldman Sachs Group Inc. too expanded their holdings.

- Ameriprise increased its shareholding by 11.04%, bringing its total investment value to $2.35 billion, marking a value change of 9.49%. Goldman Sachs, with a 14.51% increase in shares, now holds $1.61 billion in AbbVie, up by 12.92% in value.

Lastly, Zurcher Kantonalbank also made a new entry into AbbVie's list of top investors with an investment worth $197.6 million.

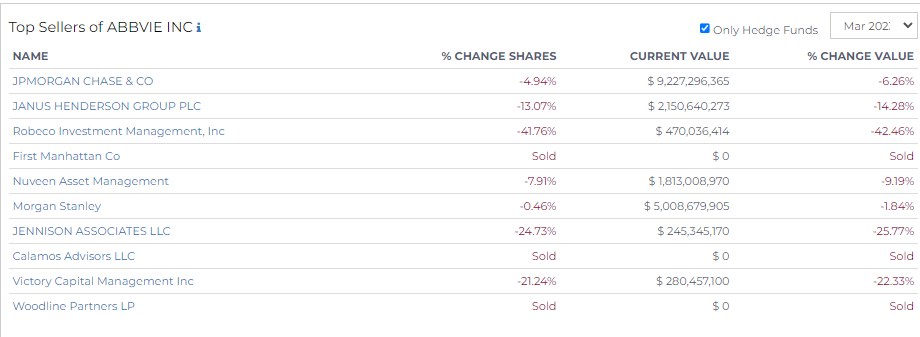

Top Sellers of AbbVie Inc (ABBV)

While new buyers have emerged, several longstanding investors have reduced their stakes or completely divested their positions.

JP Morgan Chase & Co, one of the leading global financial services firms, trimmed their position by 4.94%, with a value drop of 6.26%. Their remaining stake in AbbVie is currently worth $9.23 billion.

Janus Henderson Group PLC, a global active investment manager, reduced its shares by 13.07%. Correspondingly, the value of their holdings also decreased by 14.28% to $2.15 billion.

Robeco Investment Management, Inc., made one of the most significant sell-offs, reducing its stake by 41.76%. The value of their investment in AbbVie fell by 42.46% to $470 million.

Calamos Advisors LLC and Woodline Partners LP completely sold off its holdings in AbbVie.

Nuveen Asset Management cut its holdings by 7.91%. The firm's current investment value in AbbVie is $1.81 billion.

Morgan Stanley saw a minor reduction of 0.46% in its shares and a corresponding 1.84% decrease in value. Despite this sell-off, the firm still holds a substantial stake in AbbVie, valued at $5.01 billion.

Jennison Associates LLC and Victory Capital Management Inc. also decreased their holdings by 24.73% and 21.24% respectively, leading to value decreases of 25.77% and 22.33%. Their current holdings stand at $245.3 million and $280.4 million, respectively.

-png.png)