Capital Group Private Client Services, Inc. (CGPCS) is a subsidiary of Capital Group International, Inc., which is owned by Capital Research and Management Company, wholly owned by The Capital Group Companies, Inc. CGPCS provides investment management services to high net-worth individuals and charitable organizations, including investments in separate securities and pooled funds such as mutual funds and ETFs.

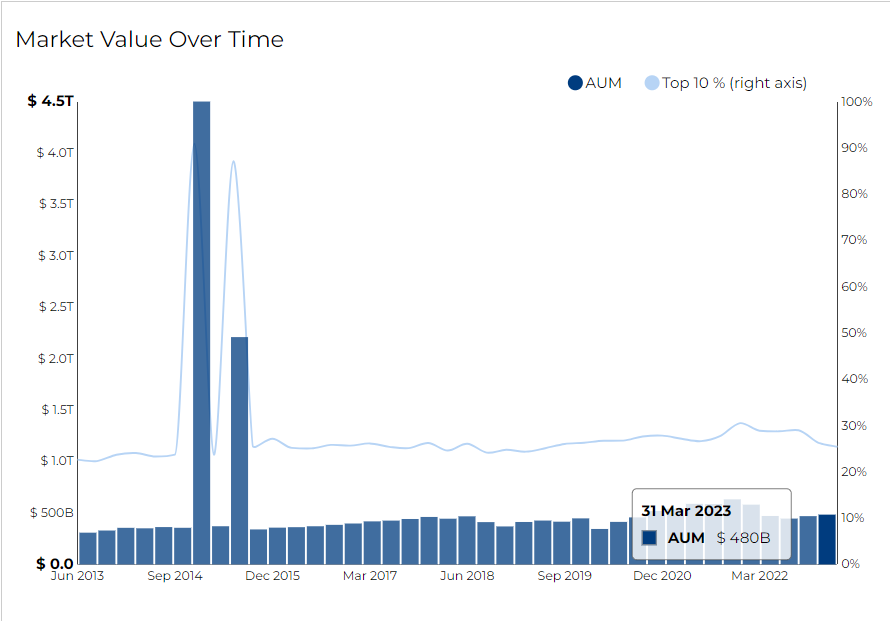

Capital World Investors filed its most recent 13F on 15 May 2023, for the quarter ended 31 Mar 2023.

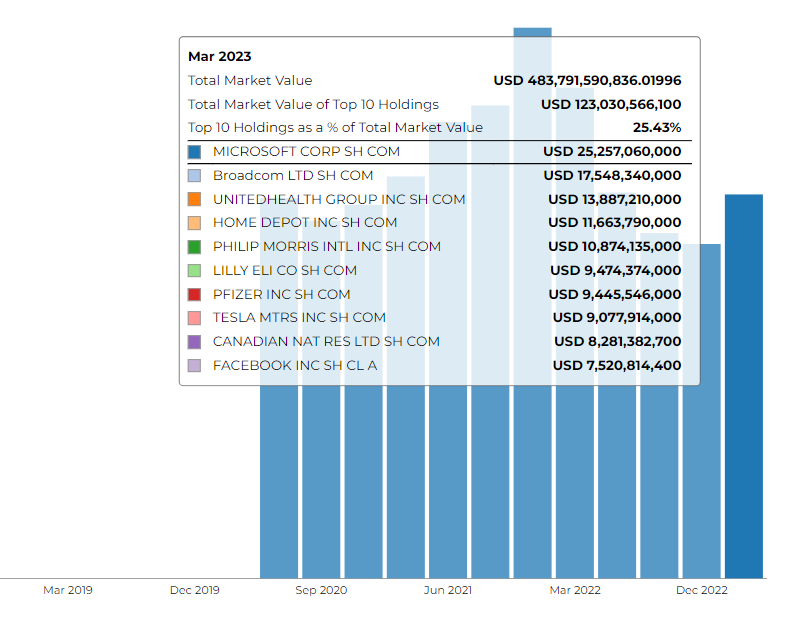

The firm disclosed 483.79 B in assets. It holds 513 securities in its 13F portfolio, and the top 10 holdings account for 25.4% of the portfolio.

Capital World Investors' top 3 holdings include Microsoft Corp ($25.25B), Broadcom Inc ($17.54B), and Unitedhealth Group Inc ($13.88B.

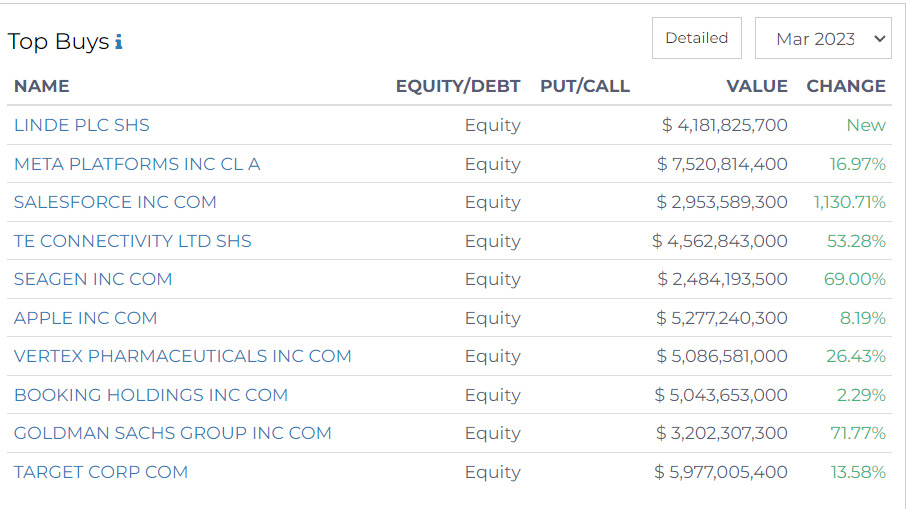

Top Buys Made by Capital World Investors

Technology Sector

Meta Platforms Inc, formerly Facebook, saw an increase in its equity value by 16.97%, now standing at $7.52 billion. The tech giant Apple Inc also had its stake increased by 8.19% to $5.28 billion.

Salesforce, another renowned name in the tech industry, experienced growth of 1,130.71%, boosting its equity value to $2.95 billion.

Industrial Sector

TE Connectivity Ltd, saw its equity value swell by 53.28% to $4.56 billion.

Healthcare Sector

The biotech company Seagen Inc witnessed a significant increase of 69.00% in its equity value to $2.48 billion. Vertex Pharmaceuticals also saw a rise, with its equity value growing by 26.43% to reach $5.09 billion.

Financial Services Sector

Goldman Sachs Group Inc saw a 71.77% increase in equity value, taking its total to $3.20 billion.

Consumer Discretionary Sector

Booking Holdings Inc, a leader in online travel and related services, experienced a modest growth of 2.29%, pushing its equity value to $5.04 billion. Meanwhile, Target Corp, a well-known retail corporation, saw its equity value rise by 13.58% to $5.98 billion.

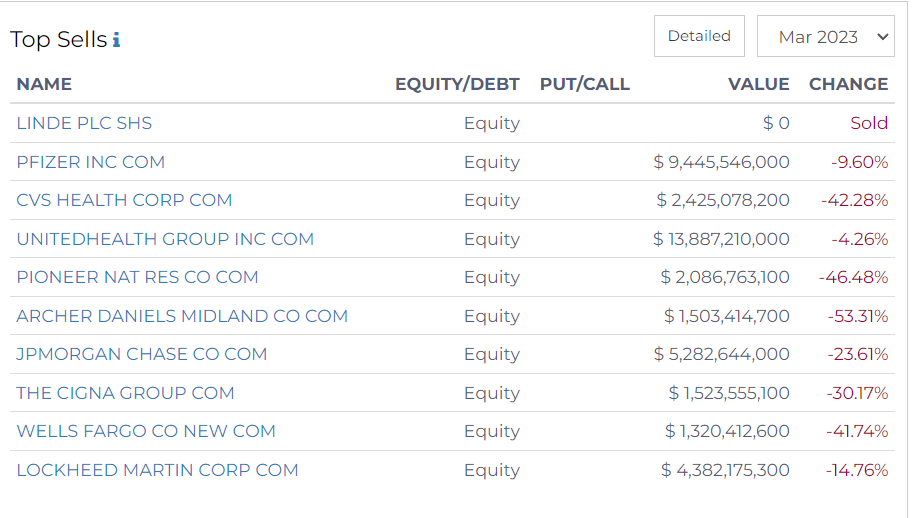

Top Sells made By Capital World Investors

In its latest portfolio adjustments, Capital World Investors has substantially trimmed positions across several sectors, according to the March 2023 report.

Healthcare Sector

In the healthcare sector, we saw significant divestment. Pfizer Inc witnessed a reduction in its equity value by 9.60% to $9.45 billion. CVS Health Corp experienced a considerable decrease of 42.28%, taking its equity value down to $2.43 billion.

UnitedHealth Group Inc also saw a reduction of 4.26% in its holdings, valued at $13.89 billion. Additionally, The Cigna Group's equity value dipped by 30.17% to $1.52 billion.

Energy Sector

Pioneer Natural Resources Company, an energy sector player, saw a decline of 46.48% in its equity value to $2.09 billion.

Consumer Staples Sector

Archer Daniels Midland Company, a significant player in the consumer staples sector, saw a significant reduction of 53.31% in its equity value, amounting to $1.50 billion.

Financial Services Sector

In the financial services sector, both JPMorgan Chase Co and Wells Fargo & Co experienced substantial cutbacks in equity value.

JPMorgan's equity value decreased by 23.61% to $5.28 billion, while Wells Fargo saw a sharp reduction of 41.74%, bringing its equity value down to $1.32 billion.

Industrial Sector

Lockheed Martin Corp, a significant defense and aerospace player, saw a reduction in equity value by 14.76% to $4.38 billion.